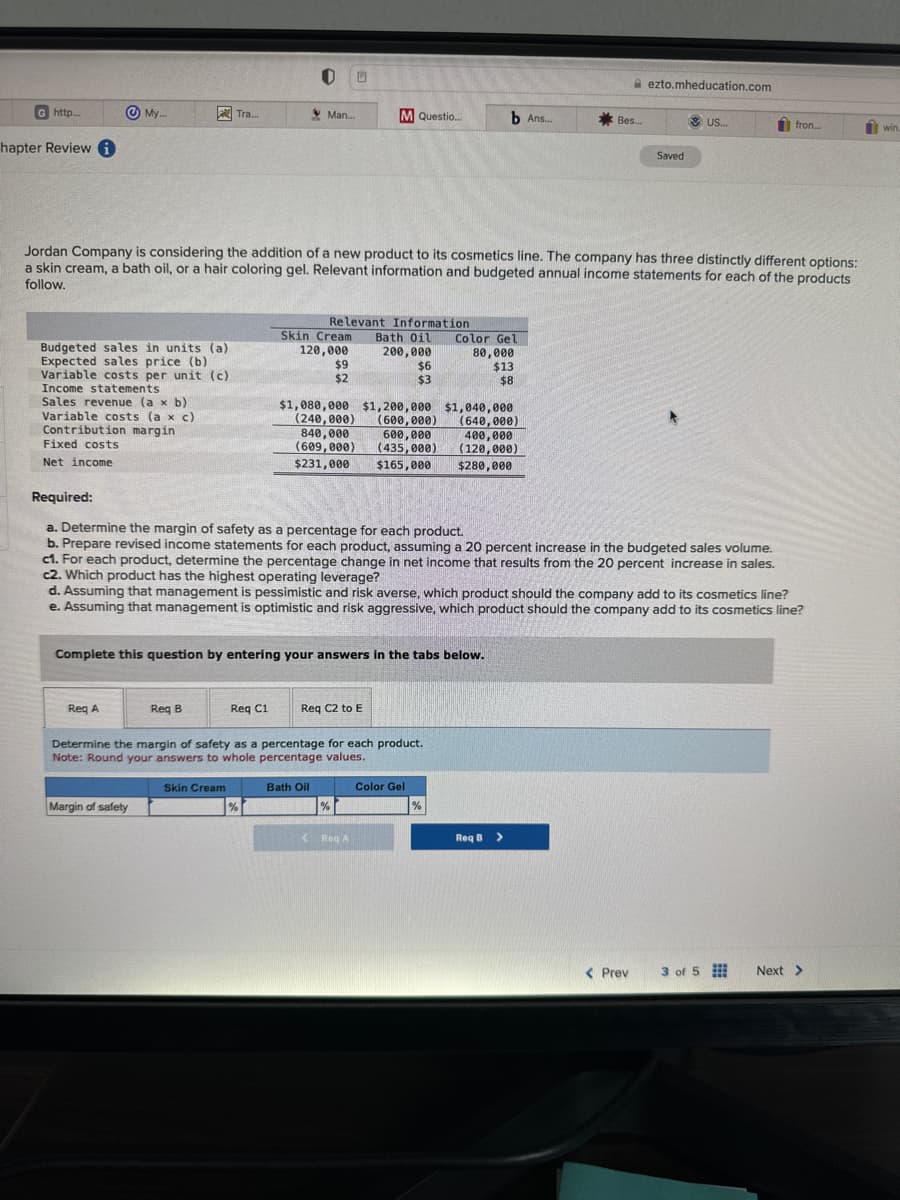

Jordan Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products follow. Budgeted sales in units (a) Expected sales price (b) Variable costs per unit (c) Income statements Sales revenue (a x b) Variable costs (a x c) Contribution margin Fixed costs Net income Req A Req B Margin of safety Relevant Information Skin Cream Bath Oil 120,000 200,000 Required: a. Determine the margin of safety as a percentage for each product. b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. c1. For each product, determine the percentage change in net income that results from the 20 percent increase in sales. c2. Which product has the highest operating leverage? d. Assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? e. Assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line? Req C1 Skin Cream Complete this question by entering your answers in the tabs below. $1,080,000 % $9 $2 $1,200,000 $1,040,000 (240,000) (600,000) (640,000) 840,000 600,000 400,000 (609,000) (435,000) (120,000) $231,000 $165,000 $280,000 Determine the margin of safety as a percentage for each product. Note: Round your answers to whole percentage values. Req C2 to E Bath Oil < $6 $3 % Req A Color Gel 80,000 $13 $8 Color Gel % Req B >

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps