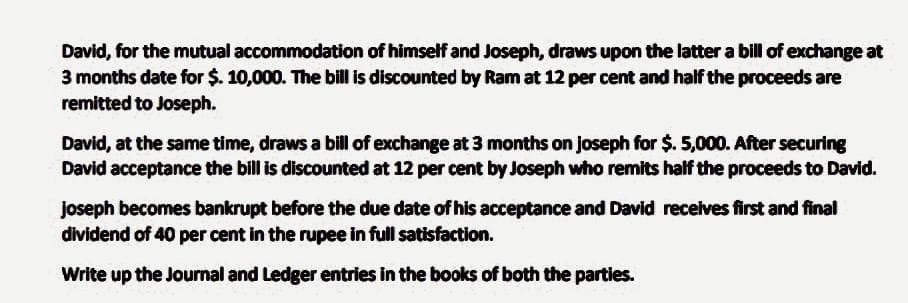

joseph becomes bankrupt before the due date of his acceptance and David rece dividend of 40 per cent in the rupee in full satisfaction. Write up the lournal and Ledger entries in the books of both the parties

Q: Last month, Laredo Company sold 450 units for $25 each. During the month, fixed costs were $2,520…

A: Lets understand the basics. Break even point is a point at which no profit no loss condition arise.…

Q: Ared Company showed the following shareholders’ equity on January 1, 2020: Share capital 1,000,000…

A: A property dividend is a dividend in kind. In this kind of dividend instead of cash or shares, an…

Q: Return on Sales Coca Cola Company Pepsi Co Return on Assets Coca Cola Company Pepsi Co Return on…

A: The financial ratio is used to calculate the financial status or production of a company compared to…

Q: Imagine you have taken a once-prized and valuable possession to a consignment store. You tell the…

A: A retail store that specialized in a particular product or service in the retail consumer market…

Q: b) A trader buys a set of accessories that is listed at RM8000 with trade discounts of 15% and 5%.…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: Firm Tezla produces the product QuickCar. Annual demand for QuickCar is 600600 units per year on a…

A: Correct option is b. 110 units .

Q: Calculate the gross margin (markup rate) for a

A: Gross margin is calculated by deducting the cost of goods sold from the revenues and dividing it by…

Q: Christian and Dior are partners, who share profits equally, were incapacitated due to a car…

A: Cash available after liabilities payment and liquidation expenses = P35,000 - P19,000 - P10,000 =…

Q: Define transfer pricing and elaborate on FOUR (4) of its purposes. B. In deciding a transfer…

A: There are some transactions that take place within different divisions of an enterprise. Sometimes,…

Q: elected accounts with some amounts omitted are as follows Work in Process Oct. 1 Balance 23,400…

A: The total amount of expenses added to a cost item is referred to as applicable overhead. Some…

Q: Sharif and Huda were partners sharing profit and loss in the ratio of 3:2. They decided to admit…

A: Introduction:- Journal entry is the first stage of accounting process. Journal entry used to record…

Q: PROBLEM 4: MULTIPLE CHOICE-COMPUTATIONAL 1. In preparing its August 31, 2004 bank reconciliation,…

A: >Bank reconciliation statement, is a statement prepared on a particular date, to reconcile the…

Q: A payment of $2,450 is due in 2 years and $3,300 is due in 4 years. These two original payments are…

A: A payment of $2450 is due in 2 years and $3300 is due in 4 years. These two original payments are to…

Q: During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a…

A: Form 1040 is a form that is used by the US citizens and NRIs to file their annual income tax…

Q: Imperial Jewelers manufactures and sells a gold bracelet for $409.00. The company's accounting…

A: Note: In the special order question, firstly relevant cost for the special order is calculated. To…

Q: urgent in one hour

A: All cargo owners sign a General Average Bond early to ensure that if the general average happens,…

Q: Shoemaker Perkins Company uses a standard cost system and had 500 pounds of raw material X15 on hand…

A: Formula: Material purchase price variance = (Actual price per pound - Standard price per…

Q: 18) Salaries of $675 were paid in cash. The journal entry A) debit to Accounts Payable and a credit…

A:

Q: A manufacturing company applies factory overhead based on direct labor hours. At the beginning of…

A: Variance is the result of the amount of expected value and actual results. It can be calculated by…

Q: Advise on what you consider would be the appropriate business structure, and why, for Peter…

A: The answer for the practical question on advising Peter and Melina an appropriate business structure…

Q: The following information is available for Grace Company for 2020: Disbursements for purchases…

A: Every business purchases goods and services for use in its business or operations. These can be cash…

Q: 2. Aside from being a manager Pepe also deposited in a Bank to earn an extra income through passive…

A: As per our protocol we provide solution to the one question only but as you have asked three…

Q: APPLICATION The following adjusted trial balance accounts were taken from the records of Jaunty…

A: All nominal nature accounts are closed by Income Statement or Income summary. The personal nature…

Q: Bergo Bay's accounting system generated the following account balances on December 31. The company's…

A: If the actual overhead incurred is more than the applied overhead the overhead is said to be under…

Q: Items 7 - 9: On January 2, 2022, Phillips Corporation purchase 80% of Signage Company's outstanding…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Boo Company has just completed the first month of producing a new product but has not yet shipped…

A: Break even point means a situation where the is neither profit nor loss. Sales revenue is sufficient…

Q: Plz solve i ,and j part only and plz solve handwritten not on excel plz (only by hand) and solve…

A: The answer is stated below:

Q: QUESTION 1 Khaled has developed a new technology device that is so exciting he is considering…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: B. In deciding a transfer pricing method, advise management on: i. negotiated transfer pricing ii.…

A: Transfer pricing is the price which is to be calculated if there is any transaction between related…

Q: Cash Accounts Receivable Inventory Long-term Assets Accounts Payable Wages Payable Long-term…

A: Working capital helps to know the net liquidity position of the company. It is a difference of…

Q: Partners Nina, Ricci, and Guess, who share profit and losses in the ratio of 2:2:1, respectively,…

A: The Partnership is a relationship between two or more partners who have agreed to share the profit/…

Q: Compute the net profit if, Service Revenue OMR 110,000; Other income OMR12,000; salary Expenses OMR…

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: Using WORKSHEET that is provided, indicate for each of the statements whether it is True (T) or…

A: When a company buys another company for more than the fair market worth of its assets, goodwill is…

Q: The Ludel Company acquired the net assets of the Girl Conrad Company on January 1, 2018, and made…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: artmann Company, operating at full capacity, sold 1,000,000 units at a price of $190 pe atement is…

A: Contribution means the difference between the sale and variable cost. Net operating income means the…

Q: A recent statement of cash flows for Colgate-Palmolive reported the following information (dollars…

A: Cash Flow Statement is one of the financial statement which shows the movement of cash during the…

Q: B. In deciding a transfer pricing method, advise management on: i. negotiated transfer pricing ii.…

A: Transfer price can be defined as the price charged for products exchanged in internal transactions…

Q: ILLUSTRATE THE CASHFLOW DIAGRAM FOR PLAN R AND PLAN S A utility company is considering the…

A: Capital budgeting is a method to select either the most profitable or the least cost alternatives…

Q: Calculate the markdown rate for the Kleenex.

A: The markdown rate is calculated by deducting the selling price from the original price and dividing…

Q: The demand for a product is 200 units per week, and the items are withdrawn at a constant rate. The…

A:

Q: RADOMZO SECURITY SERVICES LTD. is a professional security company in Ghana. The company has a high…

A: Staff turnover or employee turnover is the term used to denote the tenure of the employees in which…

Q: Cap Incorporated manufactures ball point pens that sell at wholesale for $0.80 per unit. Budgeted…

A: Full costing is nothing but absorption costing. In absorption costing method, the unit product…

Q: Rock Solid concrete manufacturers supply cement mixture directly to both the construction industry…

A: Product cost Period cost No,…

Q: Activity 2 Directions/Instructions: Journalize the business transactions of Coco Repair Shop and…

A: Advantages of use of ledger : It determines the result of each account. It shows the financial…

Q: The FernRod Motorcycle Company invested $150,000 at 4.5% compounded monthly to be used for the…

A: The value of the investment (made in the current period) after a certain period of time would be…

Q: PB13. LO 4.3 Prepare adjusting journal entries, as needed, considering the account balances…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: Mixing Company manufactured 2,200 units of its only product during 2022. The inputs for this…

A: Partial operation productivity is a measure where the output of the production unit is to a single…

Q: Financial Statements of a Manufacturing Firm The following events took place for Rushmore Biking…

A: The material to be used in the production during the period becomes part of work-in-process besides…

Q: Given the provided 5 year cash inflows below calculate the project NPV. The discount rate will be…

A: Net Present value is calculated by taking out the difference of the present values of all the…

Q: Alliance Corporation purchased inventory with an invoice price of $22,000 and credit terms of 1/10,…

A: Discount policies are given by the company in order to get the payments timely from the debtors. The…

Step by step

Solved in 4 steps with 4 images

- For their mutual accommodation a draws A bill for RS. 5,000 on B for three months. B accepts it and return it to A. the proceeds of the bill are to be shared by A and B in the ratio of 3/5 and 2/5 respectively. The bill is discounted by A for Rs 4975 and he remits 2/5 of the proceeds to B. Before the due date B draws another bill for 10 000 on A at three months with the help of these proceeds the first bill is met by B and the remaining proceeds are shared by A and B in the ratio 2/5 and 3/5 respectively the bill is discounted for Rs 9 950 before the due date of the second bill A becomes insolvent and his estate pays only 25% of debts Pass the entries in the book of both the parties?George and Peggy Fulwider bought a house from Sally Sinclair for $225,500. In lieu of a 10% down payment, Ms. Sinclair accepted 5% down at the time of the sale and a promissory note from the Fulwiders for the remaining 5%, due in four years. The Fulwiders also agreed to make monthly interest payments to Ms. Sinclair at 10% interest until the note expires. The Fulwiders obtained a loan from their bank for the remaining 90% of the purchase price. The bank in turn paid the sellers the remaining 90% of the purchase price, less a sales commission of 6% of the purchase price, paid to the sellers' and the buyers' real estate agents. (d) Find the Fulwiders' monthly interest-only payment to Ms. Sinclair. (Round your answer to the nearest cent.)$ (e) Find Ms. Sinclair's total income from all aspects of the down payment (including the down payment, the amount borrowed under the promissory note, and the monthly payments required by the promissory note).$ (f) Find Ms. Sinclair's net income from the…George and Peggy Fulwider bought a house from Sally Sinclair for $225,500. In lieu of a 10% down payment, Ms. Sinclair accepted 5% down at the time of the sale and a promissory note from the Fulwiders for the remaining 5%, due in four years. The Fulwiders also agreed to make monthly interest payments to Ms. Sinclair at 10% interest until the note expires. The Fulwiders obtained a loan from their bank for the remaining 90% of the purchase price. The bank in turn paid the sellers the remaining 90% of the purchase price, less a sales commission of 6% of the purchase price, paid to the sellers' and the buyers' real estate agents. (a) Find the Fulwiders' down payment.$ (b) Find the amount that the Fulwiders borrowed from their bank.$ (c) Find the amount that the Fulwiders borrowed from Ms. Sinclair.$

- Chuck Ponzi has talked an elderly woman into loaning him $50,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $50,000 with an annual interest rate of 11% over the next 15 years. Determine the cash flow to the woman under a discount loan, in which Ponzi will have a lump-sum payment at the end of the contract. What is the amount of payment that the woman will receive at the end of years 1 through 14?Lorissa owes Waterbury State Bank $200,000. During the current year, she isunable to make the required payments on the loan and negotiates the followingterms to extinguish the debt. Lorissa transfers to Waterbury ownership ofinvestment property with a value of $90,000 and a basis of $55,000, and commonstock with a value of $50,000 and a basis of $70,000. Lorissa also pays Waterbury$5,000 cash, and Waterbury forgives the remaining amount of debt. Before theagreement, Lorissa's assets are $290,000, and her liabilities are $440,000.Determine how much gross income Lorissa has from the extinguishment of the debt.Mario has agreed to purchase his partner’s share in the business by making payments of $1200 every three months. The agreed transfer value is $17 850, and interest is 9.5% compounded annually. If the first payment is due at the date of the agreement, what is the size of the final payment?

- Aki offered to sell her house and lot to Jannie for P2,000,000 who was interested in buying the same. In her letter, Aki stated that she was giving Jannie a period of one month within which to raise the amount. A week before the expiration of the period, Aki told Jannie that she is no longer willing to sell the property unless the price is increased to P3,000,000. May Jannie compel Aki to accept the P2,000,000 first offered? No, because the increase in the price is 50% and is deemed iniquitous and unconscionable. Yes, the period is deemed for the benefit of Darleane as it was Tin who voluntarily offered the period to her No, because the promise to sell had no cause or consideration distinct from the selling price Yes, because this is an obligation with a period intended for the benefit of both partiesEight months ago, Louise agreed to pay Thelma $750 and $950, 6 and 12 months, respectively, from the date of the agreement. With each payment, Louise agreed to pay interest on the respective principal amounts at the rate of 6.5% from the date of the agree-ment. Louise failed to make the first payment and now wishes to settle her obligations with a single payment four months from now. What payment should Thelma be willing to accept if money can earn 4.75%? r= rate of interest p= present value s= future value t= timeRobert Provider purchases a joint and survivor annuity providing for payments of $200 per month for his life and upon his death for his wife, Robin, for the remainder of her life. As of the annuity starting date Robert is 68 and Robin is 66. The annuity cost Robert $36,000. Determine the exclusion ratio for the annuity.

- Edward borrowed an amount to his friend and promised to pay the principal amount and accumulated interest within 8 years at a simple interest rate of 15.118%. As what was agreed upon, Edward must pay two separate payments, one at the end of 3 years with an amount equivalent to half of the loan and the interest accumulated for the first 3 years, and a final payment at the end of 8 years. If he paid a total amount of P15.855 on his first payment, determine the following: Determine the total principal amount borrowed. Amount paid at the end of 8 years. Accumulated interest at the end of 3 years.Chuck Ponzi has talked an elderly woman into loaning him $35,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $35,000 with an annual interest rate of 11% over the next 15 years. Determine the cash flow to the woman under an interest-only loan, in which Ponzi will pay the annual interest expense each year and pay the principal back at the end of the contract. What is the amount of payment that the woman will receive at the end of the loan in year 15?Wally is employed as an executive with Pay More Incorporated. To entice Wally to work for Pay More, the corporation loaned him $20,000 at the beginning of the year at a simple interest rate of 1 percent. Wally would have paid interest of $2,400 this year if the interest rate on the loan had been set at the prevailing federal interest rate. Required: Wally used the funds as a down payment on a speedboat and repaid the $20,000 loan (including $200 of interest) at year-end. a-1. Does this loan result in any income to either party? a-2. Indicate the amount below. Assume instead that Pay More forgave the loan and interest on December 31. What amount of gross income does Wally recognize this year?