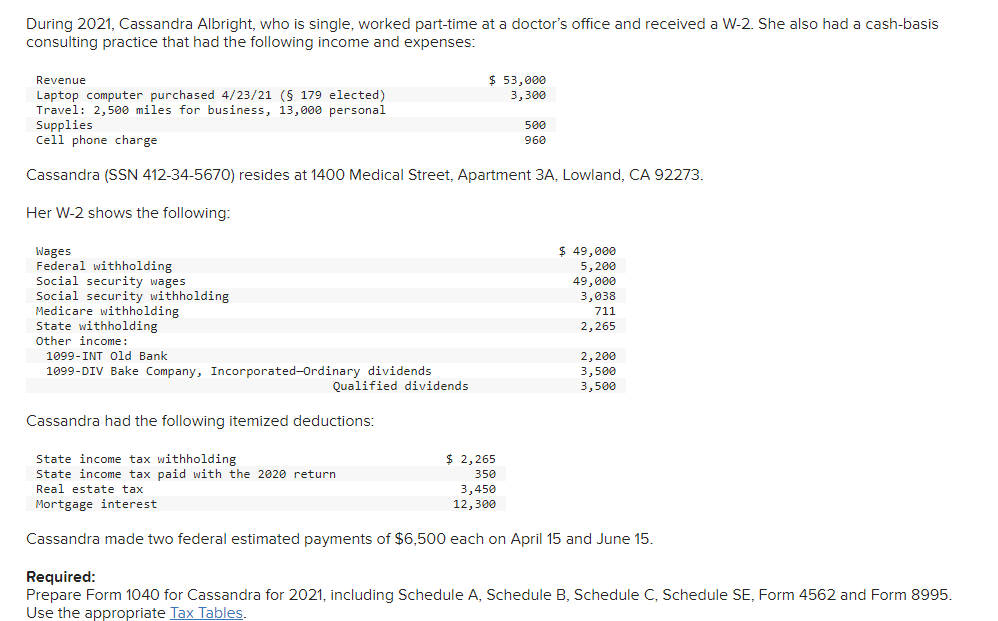

During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis consulting practice that had the following income and expenses: Revenue $ 53,000 3,300 Laptop computer purchased 4/23/21 (§ 179 elected) Travel: 2,500 miles for business, 13,000 personal Supplies 500 Cell phone charge 960 Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowland, CA 92273. Her W-2 shows the following: Wages $ 49,000 Federal withholding Social security wages Social security withholding 5,200 49,000 3,038 711 2,265 Medicare withholding State withholding Other income: 1099-INT Old Bank 2,200 1099-DIV Bake Company, Incorporated-Ordinary dividends 3,500 Qualified dividends 3,500 Cassandra had the following itemized deductions: State income tax withholding $ 2,265 State income tax paid with the 2020 return 350 Real estate tax 3,450 Mortgage interest 12,300 Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15. Required: Prepare Form 1040 for Cassandra for 2021, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995. Use the appropriate Tax Tables.

During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis consulting practice that had the following income and expenses: Revenue $ 53,000 3,300 Laptop computer purchased 4/23/21 (§ 179 elected) Travel: 2,500 miles for business, 13,000 personal Supplies 500 Cell phone charge 960 Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowland, CA 92273. Her W-2 shows the following: Wages $ 49,000 Federal withholding Social security wages Social security withholding 5,200 49,000 3,038 711 2,265 Medicare withholding State withholding Other income: 1099-INT Old Bank 2,200 1099-DIV Bake Company, Incorporated-Ordinary dividends 3,500 Qualified dividends 3,500 Cassandra had the following itemized deductions: State income tax withholding $ 2,265 State income tax paid with the 2020 return 350 Real estate tax 3,450 Mortgage interest 12,300 Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15. Required: Prepare Form 1040 for Cassandra for 2021, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995. Use the appropriate Tax Tables.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 42CP

Related questions

Question

Transcribed Image Text:During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis

consulting practice that had the following income and expenses:

Revenue

$ 53,000

Laptop computer purchased 4/23/21 (§ 179 elected)

3,300

Travel: 2,500 miles for business, 13,000 personal

Supplies

500

Cell phone charge

960

Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowland, CA 92273.

Her W-2 shows the following:

Wages

$ 49,000

Federal withholding

5,200

Social security wages

49,000

3,038

Social security withholding

Medicare withholding

711

2,265

State withholding

Other income:

1099-INT Old Bank

2,200

1099-DIV Bake Company, Incorporated-Ordinary dividends

3,500

Qualified dividends

3,500

Cassandra had the following itemized deductions:

State income tax withholding

$ 2,265

State income tax paid with the 2020 return

350

Real estate tax

3,450

Mortgage interest

12,300

Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15.

Required:

Prepare Form 1040 for Cassandra for 2021, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995.

Use the appropriate Tax Tables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Expert Answers to Latest Homework Questions

Q: Please answer in typing format

Q: Polynomial - Addition & Subtraction

Simplify each expression.

1) (6v4 + 3v) + (7v4+2+5v)

3) (4x² -…

Q: what does it mean if a ratio is 1.5

Q: please give me answer relatable

Q: 1

An increase in Real GDP:

a. is absolute economic growth

b.

C.

always results in a higher standard…

Q: Radium-223 nuclei usually decay by alpha emission. Once in every billion decays, a radium-223…

Q: In the figure, two satellites, A and B, both of mass m = 36.1 kg, move in the same circular orbit of…

Q: A radionuclide undergoes alpha emission, and radon-222 is produced. What was the original…

Q: In 1932, James Chadwick discovered a new subatomic particle when he bombarded beryllium-9 with alpha…

Q: In 1932, James Chadwick discovered a new subatomic particle when he bombarded beryllium-9 with alpha…

Q: A 45.0 mL solution of 0.18 M nitrous acid (HNO2, K₂ = 4.5x104) is being titrated with a 0.34 M…

Q: How I can answer that?

Q: The radioactivity of a substance can be neutralized by?

Q: A substance (A) reacts to form another substance (B):

3A(g) →2B(g)

The reaction is run at a…

Q: please answer in text form with proper workings and explanation for each and every part and steps…

Q: William Beville's computer training school, in Richmond, stocks workbooks with the following…

Q: Classify each of the following characteristics as related to fusion, fission, or both

Q: Target Corporation (TGT) is considering a new delivery system that costs $194,875. Assume a required…

Q: The fixed costs of Shanita, nv are $471,000 and the total variable costs for its only

product are…

Q: in addition to being the pioneers of economic growth, Adam Smith and David Ricardo also established…

Q: Problem 4

A carousel at a park has a total mass of M = 3 × 103 kg and a radius

R=4 m. It can be…