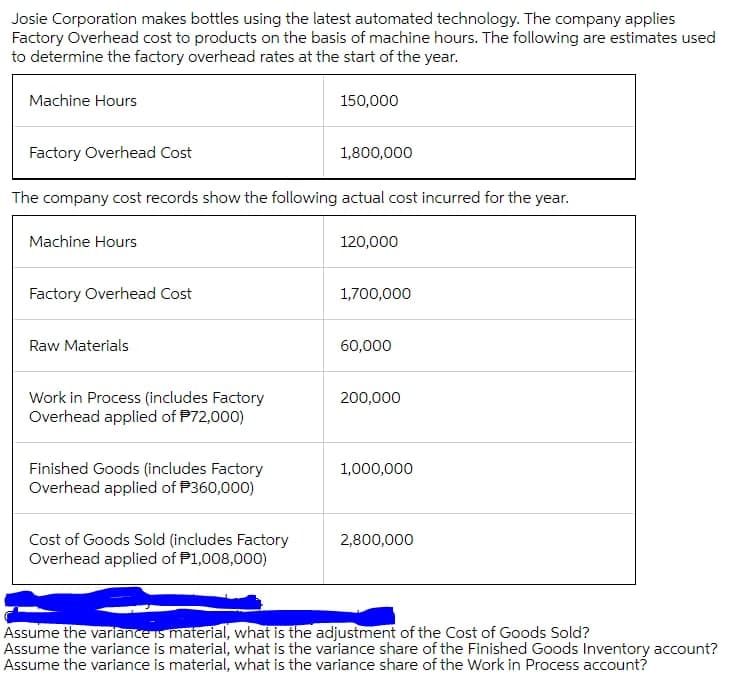

Josie Corporation makes bottles using the latest automated technology. The company applies Factory Overhead cost to products on the basis of machine hours. The following are estimates use to determine the factory overhead rates at the start of the year. Machine Hours 150,000 Factory Overhead Cost 1,800,000 The company cost records show the following actual cost incurred for the year. Machine Hours 120,000 Factory Overhead Cost 1,700,000 Raw Materials 60,000 Work in Process (includes Factory Overhead applied of P72,000) 200,000 Finished Goods (includes Factory Overhead applied of P360,000) 1,000,000 Cost of Goods Sold (includes Factory Overhead applied of P1,008,000) 2,800,000

Josie Corporation makes bottles using the latest automated technology. The company applies Factory Overhead cost to products on the basis of machine hours. The following are estimates use to determine the factory overhead rates at the start of the year. Machine Hours 150,000 Factory Overhead Cost 1,800,000 The company cost records show the following actual cost incurred for the year. Machine Hours 120,000 Factory Overhead Cost 1,700,000 Raw Materials 60,000 Work in Process (includes Factory Overhead applied of P72,000) 200,000 Finished Goods (includes Factory Overhead applied of P360,000) 1,000,000 Cost of Goods Sold (includes Factory Overhead applied of P1,008,000) 2,800,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 4E: The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the...

Related questions

Question

answer quickly

Transcribed Image Text:Josie Corporation makes bottles using the latest automated technology. The company applies

Factory Overhead cost to products on the basis of machine hours. The following are estimates used

to determine the factory overhead rates at the start of the year.

Machine Hours

150,000

Factory Overhead Cost

1,800,000

The company cost records show the following actual cost incurred for the year.

Machine Hours

120,000

Factory Overhead Cost

1,700,000

Raw Materials

60,000

Work in Process (includes Factory

Overhead applied of P72,000)

200,000

Finished Goods (includes Factory

Overhead applied of P360,000)

1,000,000

Cost of Goods Sold (includes Factory

Overhead applied of P1,008,000)

2,800,000

Assume the variance is material, what is the adjustment of the Cost of Goods Sold?

Assume the variance is material, what is the variance share of the Finished Goods Inventory account?

Assume the variance is material, what is the variance share of the Work in Process account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning