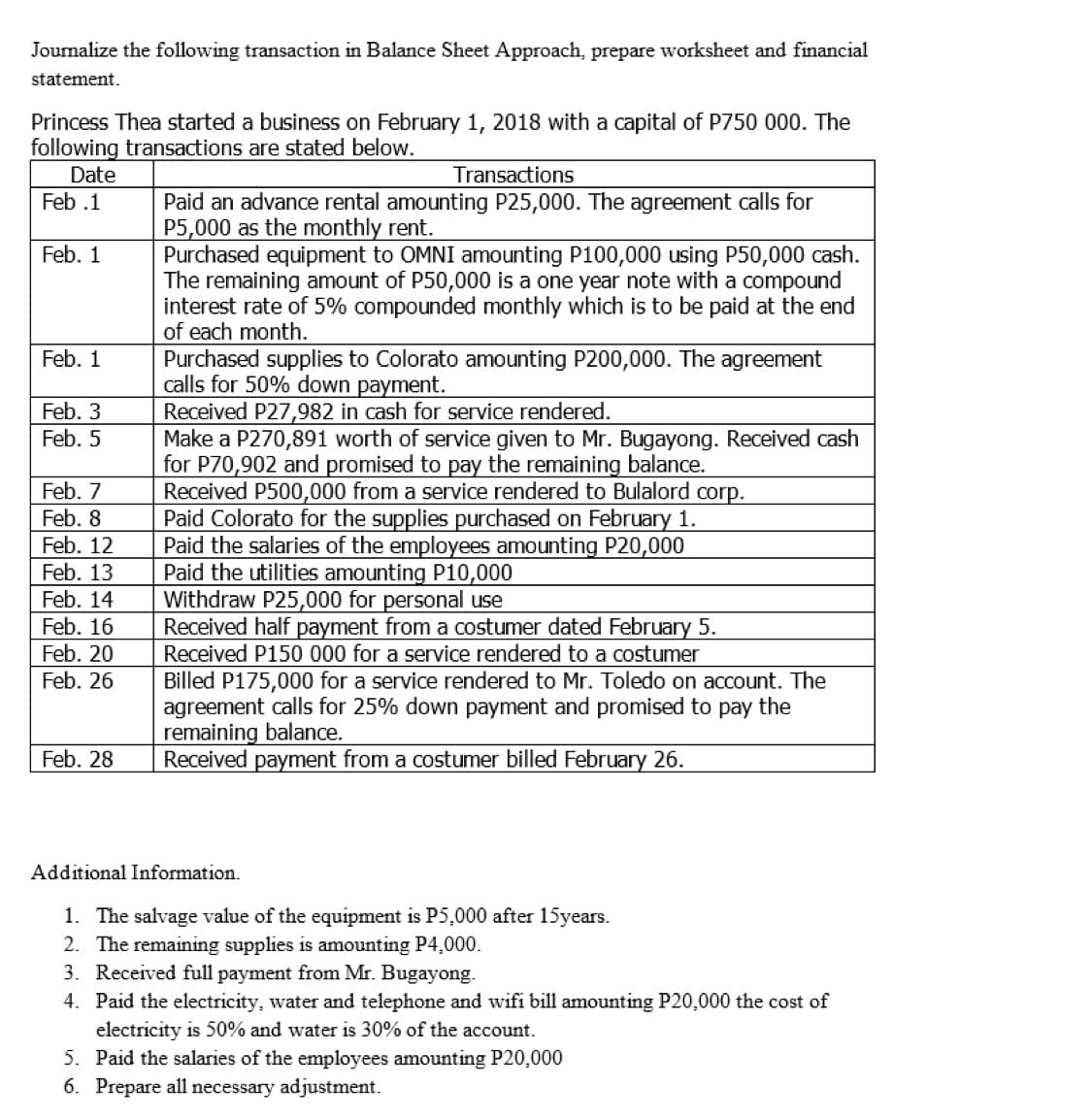

Journalize the following transaction in Balance Sheet Approach, prepare worksheet and financial statement. Princess Thea started a business on February 1, 2018 with a capital of P750 000. The following transactions are stated below. Date Transactions Feb.1 Paid an advance rental amounting P25,000. The agreement calls for P5,000 as the monthly rent. Feb. 1 Purchased equipment to OMNI amounting P100,000 using P50,000 cash. The remaining amount of P50,000 is a one year note with a compound interest rate of 5% compounded monthly which is to be paid at the end of each month. Feb. 1 Purchased supplies to Colorato amounting P200,000. The agreement calls for 50% down payment. Feb. 3 Received P27,982 in cash for service rendered. Feb. 5 Feb. 7 Feb. 8 Make a P270,891 worth of service given to Mr. Bugayong. Received cash for P70,902 and promised to pay the remaining balance. Received P500,000 from a service rendered to Bulalord corp. Paid Colorato for the supplies purchased on February 1. Paid the salaries of the employees amounting P20,000 Paid the utilities amounting P10,000 Withdraw P25,000 for personal use Feb. 12 Feb. 13 Feb. 14 Feb. 16 Received half payment from a costumer dated February 5. Received P150 000 for a service rendered to a costumer Feb. 20 Feb. 26 Billed P175,000 for a service rendered to Mr. Toledo on account. The agreement calls for 25% down payment and promised to pay the remaining balance. Feb. 28 Received payment from a costumer billed February 26. Additional Information. 1. The salvage value of the equipment is P5,000 after 15years. 2. The remaining supplies is amounting P4,000. 3. Received full payment from Mr. Bugayong. 4. Paid the electricity, water and telephone and wifi bill amounting P20,000 the cost of electricity is 50% and water is 30% of the account. 5. Paid the salaries of the employees amounting P20,000 6. Prepare all necessary adjustment.

Journalize the following transaction in Balance Sheet Approach, prepare worksheet and financial statement. Princess Thea started a business on February 1, 2018 with a capital of P750 000. The following transactions are stated below. Date Transactions Feb.1 Paid an advance rental amounting P25,000. The agreement calls for P5,000 as the monthly rent. Feb. 1 Purchased equipment to OMNI amounting P100,000 using P50,000 cash. The remaining amount of P50,000 is a one year note with a compound interest rate of 5% compounded monthly which is to be paid at the end of each month. Feb. 1 Purchased supplies to Colorato amounting P200,000. The agreement calls for 50% down payment. Feb. 3 Received P27,982 in cash for service rendered. Feb. 5 Feb. 7 Feb. 8 Make a P270,891 worth of service given to Mr. Bugayong. Received cash for P70,902 and promised to pay the remaining balance. Received P500,000 from a service rendered to Bulalord corp. Paid Colorato for the supplies purchased on February 1. Paid the salaries of the employees amounting P20,000 Paid the utilities amounting P10,000 Withdraw P25,000 for personal use Feb. 12 Feb. 13 Feb. 14 Feb. 16 Received half payment from a costumer dated February 5. Received P150 000 for a service rendered to a costumer Feb. 20 Feb. 26 Billed P175,000 for a service rendered to Mr. Toledo on account. The agreement calls for 25% down payment and promised to pay the remaining balance. Feb. 28 Received payment from a costumer billed February 26. Additional Information. 1. The salvage value of the equipment is P5,000 after 15years. 2. The remaining supplies is amounting P4,000. 3. Received full payment from Mr. Bugayong. 4. Paid the electricity, water and telephone and wifi bill amounting P20,000 the cost of electricity is 50% and water is 30% of the account. 5. Paid the salaries of the employees amounting P20,000 6. Prepare all necessary adjustment.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

Journalize the following transaction in Balance Sheet Approach, prepare worksheet and financial statement.

Transcribed Image Text:Journalize the following transaction in Balance Sheet Approach, prepare worksheet and financial

statement.

Princess Thea started a business on February 1, 2018 with a capital of P750 000. The

following transactions are stated below.

Date

Transactions

Feb.1

Paid an advance rental amounting P25,000. The agreement calls for

P5,000 as the monthly rent.

Feb. 1

Purchased equipment to OMNI amounting P100,000 using P50,000 cash.

The remaining amount of P50,000 is a one year note with a compound

interest rate of 5% compounded monthly which is to be paid at the end

of each month.

Feb. 1

Purchased supplies to Colorato amounting P200,000. The agreement

calls for 50% down payment.

Feb. 3

Received P27,982 in cash for service rendered.

Feb. 5

Feb. 7

Make a P270,891 worth of service given to Mr. Bugayong. Received cash

for P70,902 and promised to pay the remaining balance.

Received P500,000 from a service rendered to Bulalord corp.

Paid Colorato for the supplies purchased on February 1.

Paid the salaries of the employees amounting P20,000

Paid the utilities amounting P10,000

Feb. 8

Feb. 12

Feb. 13

Feb. 14

Withdraw P25,000 for personal use

Feb. 16

Received half payment from a costumer dated February 5.

Received P150 000 for a service rendered to a costumer

Feb. 20

Feb. 26

Billed P175,000 for a service rendered to Mr. Toledo on account. The

agreement calls for 25% down payment and promised to pay the

remaining balance.

Feb. 28

Received payment from a costumer billed February 26.

Additional Information.

1. The salvage value of the equipment is P5,000 after 15years.

2. The remaining supplies is amounting P4,000.

3. Received full payment from Mr. Bugayong.

4. Paid the electricity, water and telephone and wifi bill amounting P20,000 the cost of

electricity is 50% and water is 30% of the account.

5. Paid the salaries of the employees amounting P20,000

6. Prepare all necessary adjustment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage