Journalize the following transactions. Thank you!

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Topic Video

Question

Journalize the following transactions. Thank you!

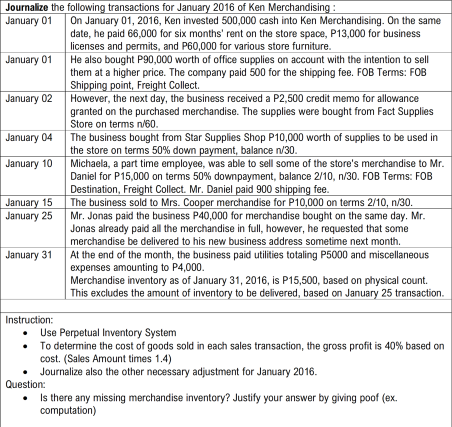

Transcribed Image Text:Journalize the following transactions for January 2016 of Ken Merchandising :

January 01

On January 01, 2016, Ken invested 500,000 cash into Ken Merchandising. On the same

date, he paid 66,000 for six months' rent on the store space, P13,000 for business

licenses and permits, and P60,000 for various store furniture.

He also bought P90,000 worth of office supplies on account with the intention to sell

them at a higher price. The company paid 500 for the shipping fee. FOB Terms: FOB

Shipping point, Freight Collect.

However, the next day, the business received a P2,500 credit memo for allowance

granted on the purchased merchandise. The supplies were bought from Fact Supplies

Store on terms n/60.

January 01

January 02

January 04

The business bought from Star Supplies Shop P10,000 worth of supplies to be used in

the store on terms 50% down payment, balance n/30.

Michaela, a part time employee, was able to sell some of the store's merchandise to Mr.

Daniel for P15,000 on terms 50% downpayment, balance 2/10, n/30. FOB Terms: FOB

Destination, Freight Collect. Mr. Daniel paid 900 shipping fee.

The business sold to Mrs. Cooper merchandise for P10,000 on terms 2/10, n/30.

Mr. Jonas paid the business P40,000 for merchandise bought on the same day. Mr.

Jonas already paid all the merchandise in full, however, he requested that some

merchandise be delivered to his new business address sometime next month.

January 10

January 15

January 25

At the end of the month, the business paid utilities totaling P5000 and miscellaneous

expenses amounting to P4,000.

Merchandise inventory as of January 31, 2016, is P15,500, based on physical count.

| This excludes the amount of inventory to be delivered, based on January 25 transaction.

January 31

Instruction:

• Use Perpetual Inventory System

• To determine the cost of goods sold in each sales transaction, the gross profit is 40% based on

cost. (Sales Amount times 1.4)

Journalize also the other necessary adjustment for January 2016.

Question:

• Is there any missing merchandise inventory? Justify your answer by giving poof (ex.

computation)

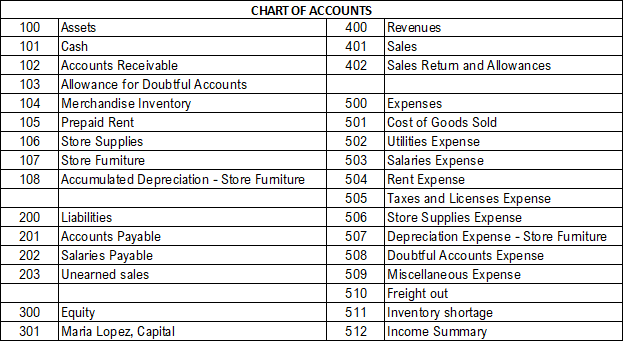

Transcribed Image Text:CHART OF ACCOUNTS

100

Assets

400

Revenues

101

Cash

401

Sales

Accounts Receivable

Allowance for Doubtful Accounts

Merchandise Inventory

Prepaid Rent

Store Supplies

107

102

402

Sales Retum and Allowances

103

Expenses

501 Cost of Goods Sold

104

500

105

106

502

Utilities Expense

Store Fumiture

Accumulated Depreciation - Store Fumiture

Salaries Expense

Rent Expense

Taxes and Licenses Expense

Store Supplies Expense

Depreciation Expense - Store Fumiture

Doubtful Accounts Expense

Miscellane ous Expense

Freight out

Inventory shortage

Income Summary

503

108

504

505

200

Liabilities

506

Accounts Payable

Salaries Payable

Unearned sales

201

507

202

508

203

509

510

Equity

Maria Lopez, Capital

300

511

301

512

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education