Need journal entries

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 3E: The following are independent events: a. A partnership is preparing to become a corporation and sell...

Related questions

Question

Need journal entries

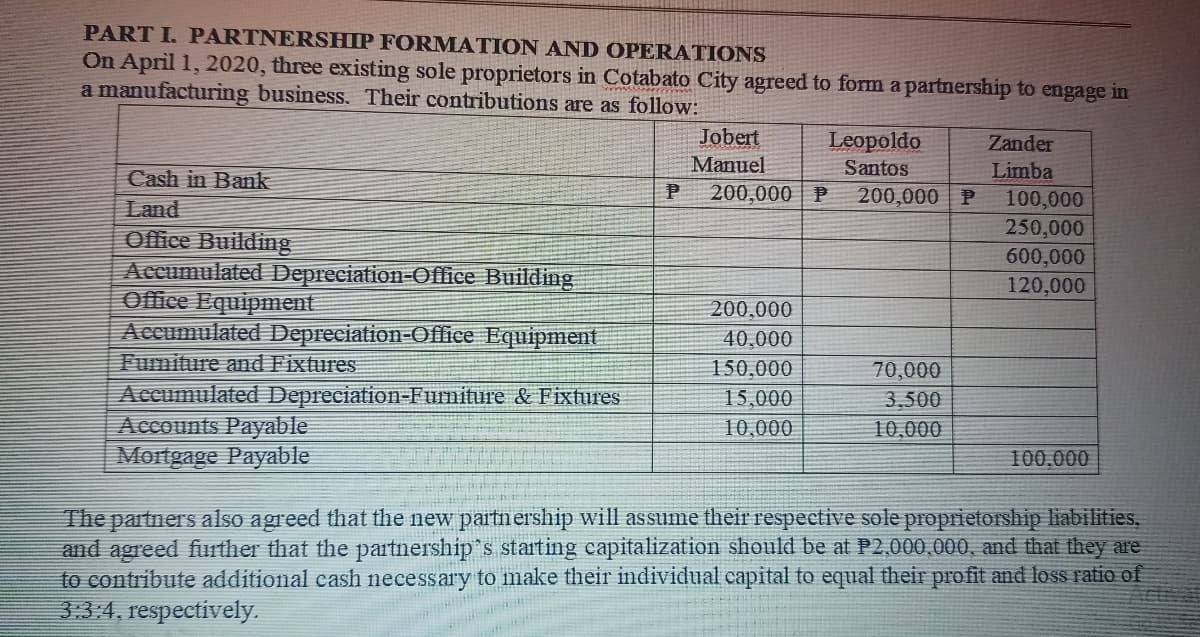

Transcribed Image Text:PART I. PARTNERSHIP FORMATION AND OPERATIONS

On April 1, 2020, three existing sole proprietors in Cotabato City agreed to form a partnership to engage in

a manufacturing business. Their contributions are as follow:

Jobert

Manuel

Leopoldo

Zander

Santos

Limba

100,000

Cash in Bank

200,000 | P

200,000 | P

Land

Office Building

Accumulated Depreciation-Office Building

Office Equipment.

Accumulated Depreciation-Office Equipment

Furniture and Fixtures

Accumulated Depreciation-Furniture & Fixtures

Accounts Payable

Mortgage Payable

250,000

600,000

120,000

200,000

40,000

150,000

70,000

3,500

15,000

10,000

10,000

100,000

The partners also agreed that the new partnership will assume their respective sole proprietorship liabilities,

and agreed further that the partnership's starting capitalization should be at P2,000,000, and that they are

to contribute additional cash necessary to make their individual capital to equal their profit and loss ratio of

3:3:4, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,