Make a journal entry for each transaction

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 1P: Indicate whether each of the items listed below would be included (I) in or excluded (E) from gross...

Related questions

Question

Make a

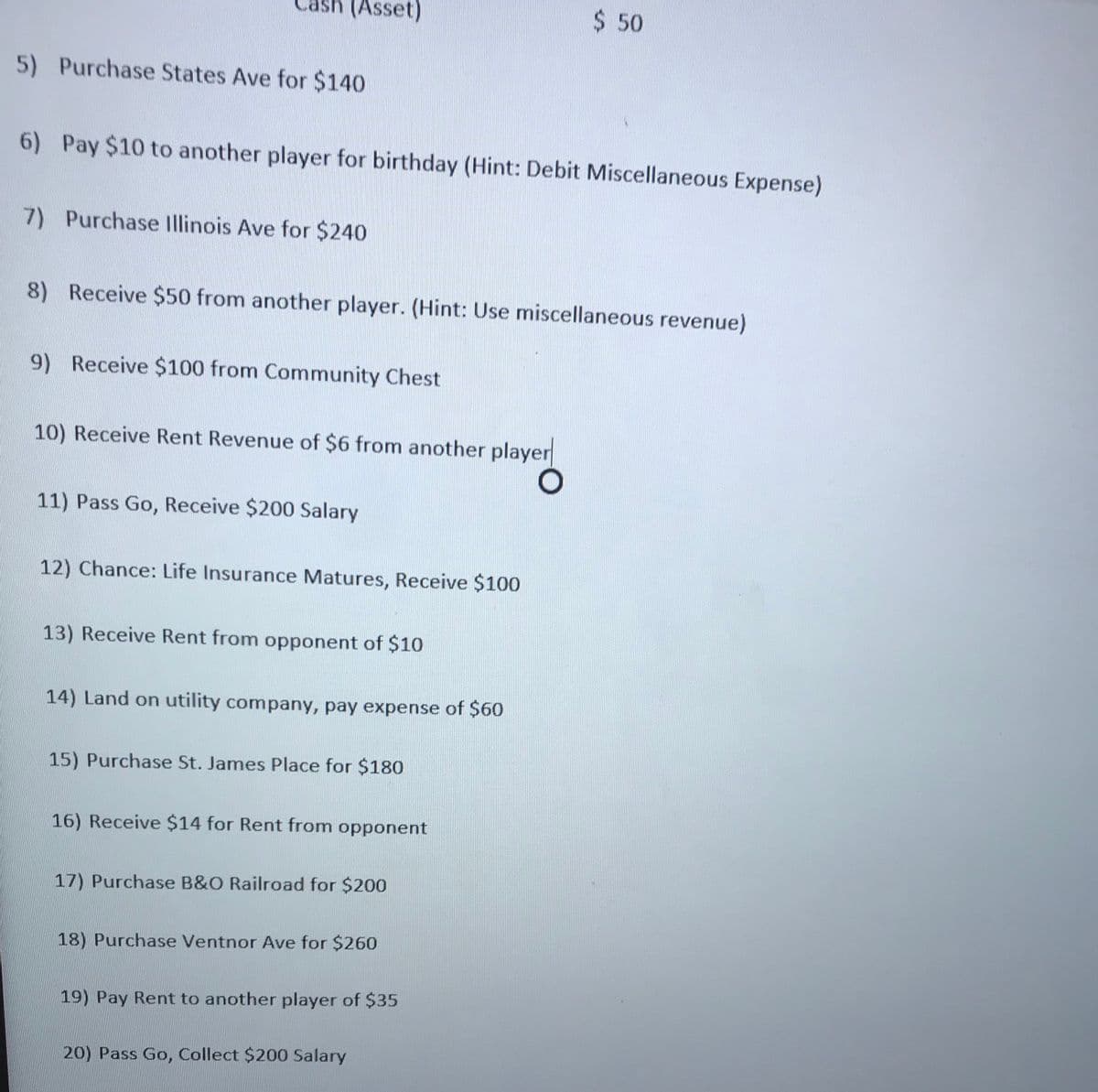

Transcribed Image Text:(Asset)

$ 50

5) Purchase States Ave for $140

6) Pay $10 to another player for birthday (Hint: Debit Miscellaneous Expense)

7) Purchase Illinois Ave for $240

8) Receive $50 from another player. (Hint: Use miscellaneous revenue)

9) Receive $100 from Community Chest

10) Receive Rent Revenue of $6 from another player

11) Pass Go, Receive $200 Salary

12) Chance: Life Insurance Matures, Receive $100

13) Receive Rent from opponent of $10

14) Land on utility company, pay expense of $60

15) Purchase St. James Place for $180

16) Receive $14 for Rent from opponent

17) Purchase B&O Railroad for $200

18) Purchase Ventnor Ave for $260

19) Pay Rent to another player of $35

20) Pass Go, Collect $200 Salary

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you