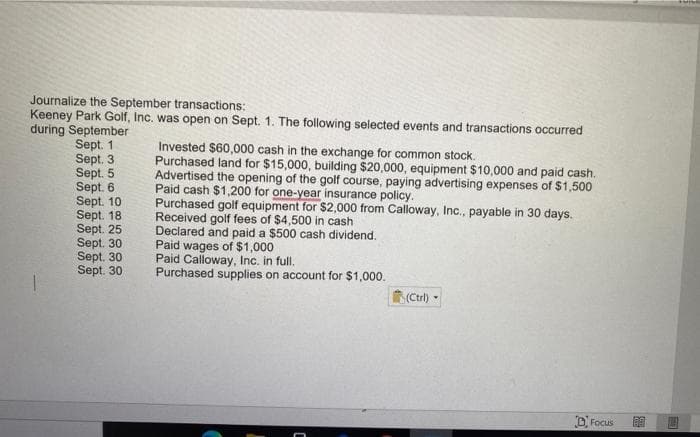

Journalize the September transactions: Keeney Park Golf, Inc. was open on Sept. 1. The following selected events and transactions occurred during September Sept. 1 Sept. 3 Sept. 5 Sept. 6 Sept. 10 Sept. 18 Sept. 25 Sept. 30 Sept. 30 Sept. 30 Invested $60,000 cash in the exchange for common stock. Purchased land for $15,000, building $20,000, equipment $10,000 and paid cash. Advertised the opening of the golf course, paying advertising expenses of $1,500 Paid cash $1,200 for one-year insurance policy. Purchased golf equipment for $2,000 from Calloway, Inc., payable in 30 days. Received golf fees of $4,500 in cash Declared and paid a $500 cash dividend. Paid wages of $1,000 Paid Calloway, Inc. in full. Purchased supplies on account for $1,000.

Journalize the September transactions: Keeney Park Golf, Inc. was open on Sept. 1. The following selected events and transactions occurred during September Sept. 1 Sept. 3 Sept. 5 Sept. 6 Sept. 10 Sept. 18 Sept. 25 Sept. 30 Sept. 30 Sept. 30 Invested $60,000 cash in the exchange for common stock. Purchased land for $15,000, building $20,000, equipment $10,000 and paid cash. Advertised the opening of the golf course, paying advertising expenses of $1,500 Paid cash $1,200 for one-year insurance policy. Purchased golf equipment for $2,000 from Calloway, Inc., payable in 30 days. Received golf fees of $4,500 in cash Declared and paid a $500 cash dividend. Paid wages of $1,000 Paid Calloway, Inc. in full. Purchased supplies on account for $1,000.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.9MCP: Journal Entries Atkins Advertising Agency began business on January 2. The transactions entered into...

Related questions

Question

Transcribed Image Text:Journalize the September transactions:

Keeney Park Golf, Inc. was open on Sept. 1. The following selected events and transactions occurred

during September

Sept. 1

Sept. 3

Sept. 5

Sept. 6

Sept. 10

Sept. 18

Sept. 25

Sept. 30

Sept. 30

Sept. 30

Invested $60,000 cash in the exchange for common stock.

Purchased land for $15,000, building $20,000, equipment $10,000 and paid cash.

Advertised the opening of the golf course, paying advertising expenses of $1,500

Paid cash $1,200 for one-year insurance policy.

Purchased golf equipment for $2,000 from Calloway, Inc., payable in 30 days.

Received golf fees of $4,500 in cash

Declared and paid a $500 cash dividend.

Paid wages of $1,000

Paid Calloway, Inc. in full.

Purchased supplies on account for $1,000.

(Ctrl) -

D Focus

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,