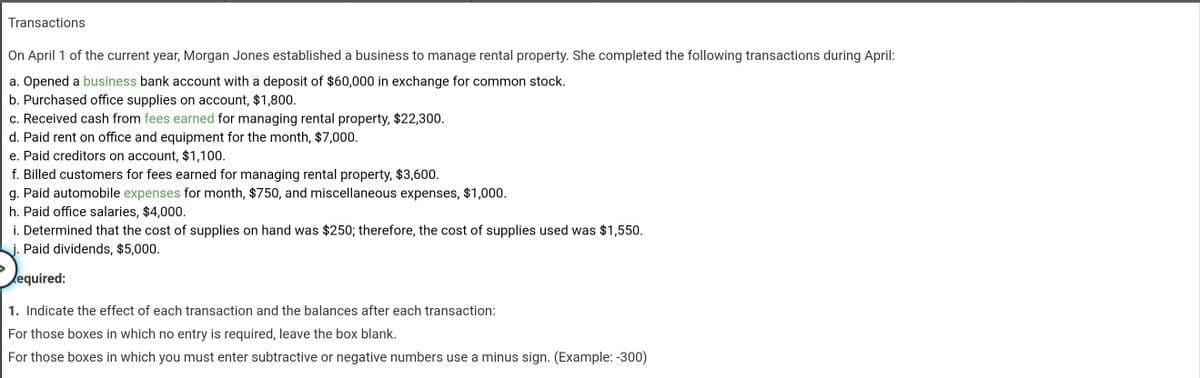

Transactions On April 1 of the current year, Morgan Jones established a business to manage rental property. She completed the following transactions during April: a. Opened a business bank account with a deposit of $60,000 in exchange for common stock. b. Purchased office supplies on account, $1,800. c. Received cash from fees earned for managing rental property, $22,300. d. Paid rent on office and equipment for the month, $7,000. e. Paid creditors on account, $1,100. f. Billed customers for fees earned for managing rental property, $3,600. g. Paid automobile expenses for month, $750, and miscellaneous expenses, $1,000. h. Paid office salaries, $4,000. i. Determined that the cost of supplies on hand was $250; therefore, the cost of supplies used was $1,550. J. Paid dividends, $5,000. Jequired: 1. Indicate the effect of each transaction and the balances after each transaction: For those boxes in which no entry is required, leave the box blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300)

Transactions On April 1 of the current year, Morgan Jones established a business to manage rental property. She completed the following transactions during April: a. Opened a business bank account with a deposit of $60,000 in exchange for common stock. b. Purchased office supplies on account, $1,800. c. Received cash from fees earned for managing rental property, $22,300. d. Paid rent on office and equipment for the month, $7,000. e. Paid creditors on account, $1,100. f. Billed customers for fees earned for managing rental property, $3,600. g. Paid automobile expenses for month, $750, and miscellaneous expenses, $1,000. h. Paid office salaries, $4,000. i. Determined that the cost of supplies on hand was $250; therefore, the cost of supplies used was $1,550. J. Paid dividends, $5,000. Jequired: 1. Indicate the effect of each transaction and the balances after each transaction: For those boxes in which no entry is required, leave the box blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300)

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 3R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

100%

attached files

Transcribed Image Text:Transactions

On April 1 of the current year, Morgan Jones established a business to manage rental property. She completed the following transactions during April:

a. Opened a business bank account with a deposit of $60,000 in exchange for common stock.

b. Purchased office supplies on account, $1,800.

c. Received cash from fees earned for managing rental property, $22,300.

d. Paid rent on office and equipment for the month, $7,000.

e. Paid creditors on account, $1,100.

f. Billed customers for fees earned for managing rental property, $3,600.

g. Paid automobile expenses for month, $750, and miscellaneous expenses, $1,000.

h. Paid office salaries, $4,000.

i. Determined that the cost of supplies on hand was $250; therefore, the cost of supplies used was $1,550.

j. Paid dividends, $5,000.

lequired:

1. Indicate the effect of each transaction and the balances after each transaction:

For those boxes in which no entry is required, leave the box blank.

For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300)

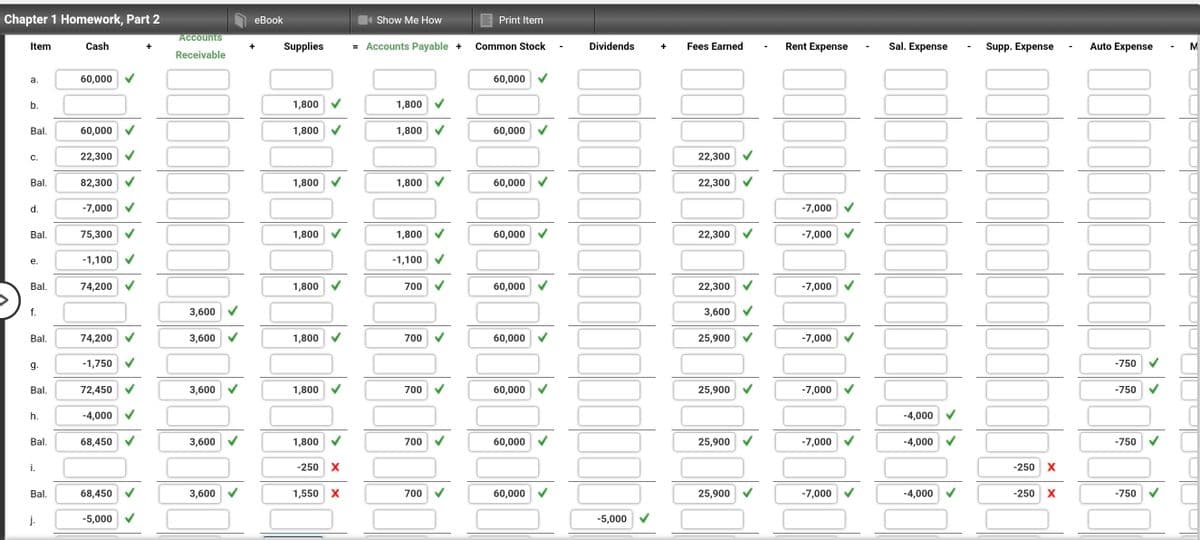

Transcribed Image Text:Chapter 1 Homework, Part 2

eВook

Show Me How

E Print Item

Accounts

Item

Cash

Supplies

= Accounts Payable +

Common Stock

Dividends

Fees Earned

Rent Expense

Sal. Expense

Supp. Expense

Auto Expense

M

+

+

+

Receivable

а.

60,000

60,000 V

b.

1,800

1,800

Bal.

60,000

1,800

1,800 V

60,000 V

C.

22,300

22,300

Bal.

82,300

1,800

1,800

60,000 V

22,300

d.

-7,000

-7,000 V

Bal.

75,300

1,800

1,800

60,000

22,300

-7,000

е.

-1,100

-1,100

Bal.

74,200

1,800

700

60,000

22,300

-7,000

f.

3,600

3,600

Bal.

74,200 V

3,600 V

1,800

700 V

60,000 V

25,900 V

-7,000

g.

-1,750

-750

Bal.

72,450

3,600 V

1,800

700

60,000 V

25,900

-7,000

-750

h.

-4,000

-4,000 V

Bal.

68,450

3,600

1,800

700

60,000 V

25,900

-7,000

-4,000

-750

i.

-250

X

-250

Bal.

68,450

3,600

1,550 X

700

60,000

25,900

-7,000

-4,000

-250

-750

j.

-5,000

-5,000

>

->

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,