Journalize

Q: Present entries to record the selected transactions described below.

A: Given: Issue of the bond = $ 2,750,000 Bond rate = 8 % Carried value = $ 2,692,250

Q: Write the journal entry for each transaction.

A: JOURNAL ENTRY RULE : ITEM INCREASE DECREASE ASSET DEBIT CREDIT LIABILITY CREDIT DEBIT…

Q: ournalize the transactions

A: Journal Entry The basic function of accounting is to enter the required transaction which are…

Q: Classify and fill which type of journal does the transaction matches.

A: Introductions: Journals: Recording of a business transactions in a chronological order. First step…

Q: Prepare the Journal Entries to the individual T-Account

A: Journal entries recording is the first step of accounting cycle. Under this, atleast one account is…

Q: You are reguired to prepare the journal entries to record all the transactione

A: Share capital refers to the capital which is raised by the issue of shares. it is an amount that is…

Q: journalize the transaction. do it nicely.

A: Journal Entry The basic process of accounting work is to provide required journal entries to the…

Q: Prepare Journal entries for all the transactions?

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: B. Journalize the following transactions using the Perpetual method:

A: The financial transactions are initially recorded in the form of journal entries. Every transaction…

Q: create t-accounts general ledger

A: T accounts preparation is the important step of accounting cycle process. These accounts are…

Q: Requirement: Prepare the journal entries.

A: Journal Entry The Purpose of providing the journal to enter the required transaction into debit and…

Q: Journalize the transactions

A: Journal entries forms the basic step for preparation any books of accounts. Dual accounting approach…

Q: Prepare the general journal for the above transactions. Narrations ares required.

A: Journal Entries for the month of July 2022 Date Particulars L.F Debit $ Credit $ 05-Jul Cash…

Q: Prepare journal entries and calculate net pa

A: Journal Entry: A journal entry is a systematic record of a financial transaction recorded in…

Q: Prepare journal entries to record the transactions.

A: Journal: It refers to an account which records all the financial transactions pertaining to a…

Q: Please prepare journal entries and T accounts.

A:

Q: Set c. Com.p.ute the General Journal

A: Journal Entry The purpose of preparing the journal entry to enter the required transaction which can…

Q: How to record General journal

A: General journal is the book of original entry in which the entities record the financial…

Q: JOURNALIZING TO T - ACCOUNT

A: Accounting is the process that is followed by a business in order to record all the transactions in…

Q: Statement Date ement Instructions arges We have

A: Bank Reconciliation statement is prepared at the end of the month to reconcile the balance as per…

Q: Describe the purpose of caash receipts journal.

A: The cash receipts journal is a special section of the general journal specifically used to record…

Q: Requirements: a. Journalize each transaction and prepare the necessary adjusting entries.

A: The transactions for the month of Dec 2021 for K-Dynamite company are given to us. The Company has…

Q: Journalize the entries f

A: Definition : Merchandise: Merchandise is unique to every business that sells goods which are in…

Q: Explain the Rules for Journalising Transactions

A: Solution A journal is a company's official book in which all business transaction are recorded in…

Q: Make a journal entry for each transaction

A: Journal entry records identified financial transactions in debit and credit side for different…

Q: Journalize the transactions.

A: A journal is a detailed account that records all the financial transactions of a business, to be…

Q: Journalize the entries to record

A: Common stock: These are the ordinary shares that a corporation issues to the investors in order to…

Q: Required a) Prepare joumal entries to record the preceding transactions.

A: Manufacturing business entity is defined as the legal form of business entity which is engaged in…

Q: journalise the transaction

A: Promissory notes are instruments designed where the maker of the note (payer) makes a promise to pay…

Q: Required: 1. Prepare the journal entries. 2. Post the journal entries to t-accounts.

A: Solution Concept Journal entry is the book where the transactions are initially recorded The entry…

Q: journal entries u

A: Prepaid Expense-:A Prepaid Expense is a variety of assets for the firm which is presented on the…

Q: calculations, journal entry and note notations

A: Workpapers-: Work papers are the packet of statements developed by an auditor while evaluating the…

Q: Explain General Journal, Ledger and trial balance.

A: Entries represent the transactions or events reported by the corporation from its day-to-day…

Q: source document of each transaction_

A: Source document is the document used for making a transaction into effect. t is used as a primary…

Q: On the printed "Worksheet" page, journalize the transactions the information from the "Transactions"…

A: Date Account Name Debit Credit Jan .15 Salaries Expense $1500 FICA Tax Expense ( 7.7%) $116…

Q: can u please make transaction summary table, general journal, general ledger and unadjusted trial…

A: Financial statements consists of the following:- Statement of Financial position; Income Statement;…

Q: Record the above summary transactions. (Record journal entries in the order presented in the…

A: The act of maintaining or making records of any transactions both monetary or non-monetary.…

Q: Activity 2 Use the information in the sum following General Ledger acco systems

A: Ledger Account The purpose of preparing the ledger account is to know the actual balance which are…

Q: Please prepare the following reports: 1.General Journal 2.General Ledger

A: General Ledger is the ledger in which the accounts of the transactions which are involved are…

Q: journal entry to record the transaction on

A: A transaction should be recognized in the correct period in which it has occurred.

Q: Explain the purpose of a journal and its relationship to the ledger.

A: Financial Accounting: It refers to the process of recording the financial transactions of the…

Q: Prepare journal entered for the attached transactions

A: Journal Entry for above Transaction are as follows.

Q: QUESTION 2 Posting: transfers journal entries to ledger accounts. O a. transfers ledger transaction…

A: Accounting process: A process that starts with identifying the transactions or events and ends with…

Q: Record each transaction in a journal entry.

A: For each transaction, while preparing journal entry some accounts to be debited and some needs to be…

Q: Determine the difference in the following terms: posting, closing, balancing, journalizing.

A: Posting transactions: The process of transferring the journalized transactions into the accounts of…

Q: transactions into ledger.

A: Meaning of Ledger All the transactions which are recorded on journal are posted into the ledger…

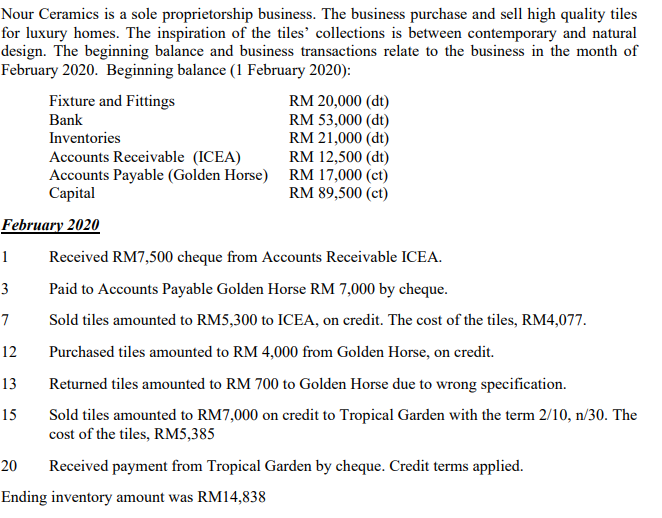

Journalize the transactions (Use periodic system)

Step by step

Solved in 2 steps with 1 images

- Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business sets up a line of credit with a supplier. The company purchases $10,000 worth of equipment on credit. Terms of purchase are 5/10, n/30. B. A customer purchases a watering hose for $25. The sales tax rate is 5%. C. Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $250 per season ticket. Each customer purchased two season tickets. D. A company issues 2,000 shares of its common stock with a price per share of $15.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Nathan owns the Kavanan Bakeshop that has the following post-closing trial balance on December 31 2021 Kavanah Bakeshop Post-Closing Trial Balance December 31, 2021Cash 38,000 Accounts Receivable 5.000 Baking Supplies 22,000 Baking Equipment 500,000 Acoumulated Depreciation 200,000 Accounts Payable 100,000 Nathan Capital 265.000 Totals 565000 565,000On January 2 2022. Nathan thought of expanding the business to include a cale. He needed additional investment so he invited his friend Dwayne to be his business partner Dwayneis to invest cash for a 50% equity in the partnership after alvind consideration to the following adjustments in the books of Nathan 1 Baking Equipment has an appraised value of 50% of its cost 2. Accounts Receivables are estimated to be 80% realizable. 3. Unused building rental amounts to P36.000 The journal entry to record revaluation includes.

- TA services were formed on May 1, 2020. The following transactions took place during the first month. May 1 Mr. Tarek Ahmed invested $80,000 in the business, as its sole owner.May 2 Hired two employees, who will be paid a salary $1,000 per month.May 3 Paid $20000 in advance for rent of a warehouse.May 4 Purchased furniture & equipment costing $30,000. $10,000 paid in cash and $20,000 payable in next 6 months.May 5 Paid $22,000 for 1-year insurance policy.May 7 Purchase basic office supplies for $500 on account.May 8 $1,500 received in advance for which services to be performed in June.May 10 Revenue earned in cash $20000 and on account $10000.May 12 Payment to creditor for May 7 transactions.May 16 Received from debtors for May 10 transaction.May 22 Withdraw by owner $ 700.May 27 Purchase of pick-up van $ 5000 on account. Instructions:(a) Pass the Journal Entry & Post to ledger.(b) Prepare Trial Balance.A. Jamal Textile Enterprise is a textile manufacturer operating in Selangor. The company was incorporated on 1June 2019 and closes its account annually on 31 December. All machinery purchased was imported from Taiwan and it was delivered on 1January2020, and the business commenced officially on 1February 2020. The following expenditure was incurred: (i) Purchased machinery that cost RM1,000,000 on 1June 2020 and paid deposit RM100,000 on the day of purchase, while the remaining RM900,000 was paid on 1November 2020. (ii) Purchased forklift on hire purchase term on 1January 2020. The total cost of the forklift is RM125,000, and Jamal Textile paid down payment of RM5,000. The total installment payment was RM48,000, excluding an interest amounting RM9,580. (iii) Purchased a new car (Proton X50) on 30December 2020 for the General Manager of the company costing RM120,000 . (iv) Purchased a computer with printer on 1April 2019 for RM5,500. This computer specification however was found to be…On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date, she paid P45,000 for six months rent on the store space, P10,000 for business licenses and permits, and P50,000 for various store furniture. She also bought P60,000 worth of office supplies on account with the intention to sell them at a higher price. However, the next day, the business received a P1,500 credit memo for allowance granted on the purchased merchandise. The supplies were bought from 123 Supplies Store on terms n/60. On July 6, the business bought from 45 Supplies Shop P5,000 worth of supplies to be used in the store on terms 50% downpayment, balance n/30. Francisco, a part time employee, was able to sell on July 12 some of the store's merchandise to Mr. Sam for P16,000 on terms 50% downpayment, balance 2/10, n/30. On July 24, the business sold to Mrs. Aslani merchandise for P12,000 on terms 2/10, n/30. On July 30, Mr. Boom paid the business P42,000 for merchandise bought…

- The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. [Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.] 2020 Sept 1 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3 Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad. 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Ltd worth RM470. 14 Returned some of damaged…The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. [Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.] 2020 Sept 1 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3 Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad. 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Ltd worth RM470. 14 Returned some of damaged…The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. [Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.] 2020 Sept 1 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3 Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad. 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Ltd worth RM470. 14 Returned some of damaged…

- The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. [Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.] 2020 Sept 1 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3 Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad. 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Ltd worth RM470. 14 Returned some of damaged…The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. [Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.] 2020 Sept 1 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3 Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad. 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Ltd worth RM470. 14 Returned some of damaged…On October 1, 2021, Santana Rey launched a computer services company, Business Solutions, that is organized as a corporation and provides consulting services, computer system installations, and custom program development. October 1 S. Rey invested $54,000 cash, a $28,000 computer system, and $9,500 of office equipment in the company in exchange for its common stock. October 3 The company purchased $1,510 of computer supplies on credit. October 6 The company billed Easy Leasing $5,700 for services performed in installing a new web server. October 8 The company paid $1,510 cash for the computer supplies purchased on credit on October 3. October 10 The company hired a part-time assistant. October 12 The company billed Easy Leasing another $1,800 for services performed. October 15 The company received $5,700 cash from Easy Leasing as partial payment toward its account. October 17 The company paid $735 cash to repair its computer equipment. October 20 The company paid…