transactions into ledger.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 3E: Dr. L. M. Patton is an ophthalmologist. As of December 31, Dr. Patton owned the following property...

Related questions

Question

100%

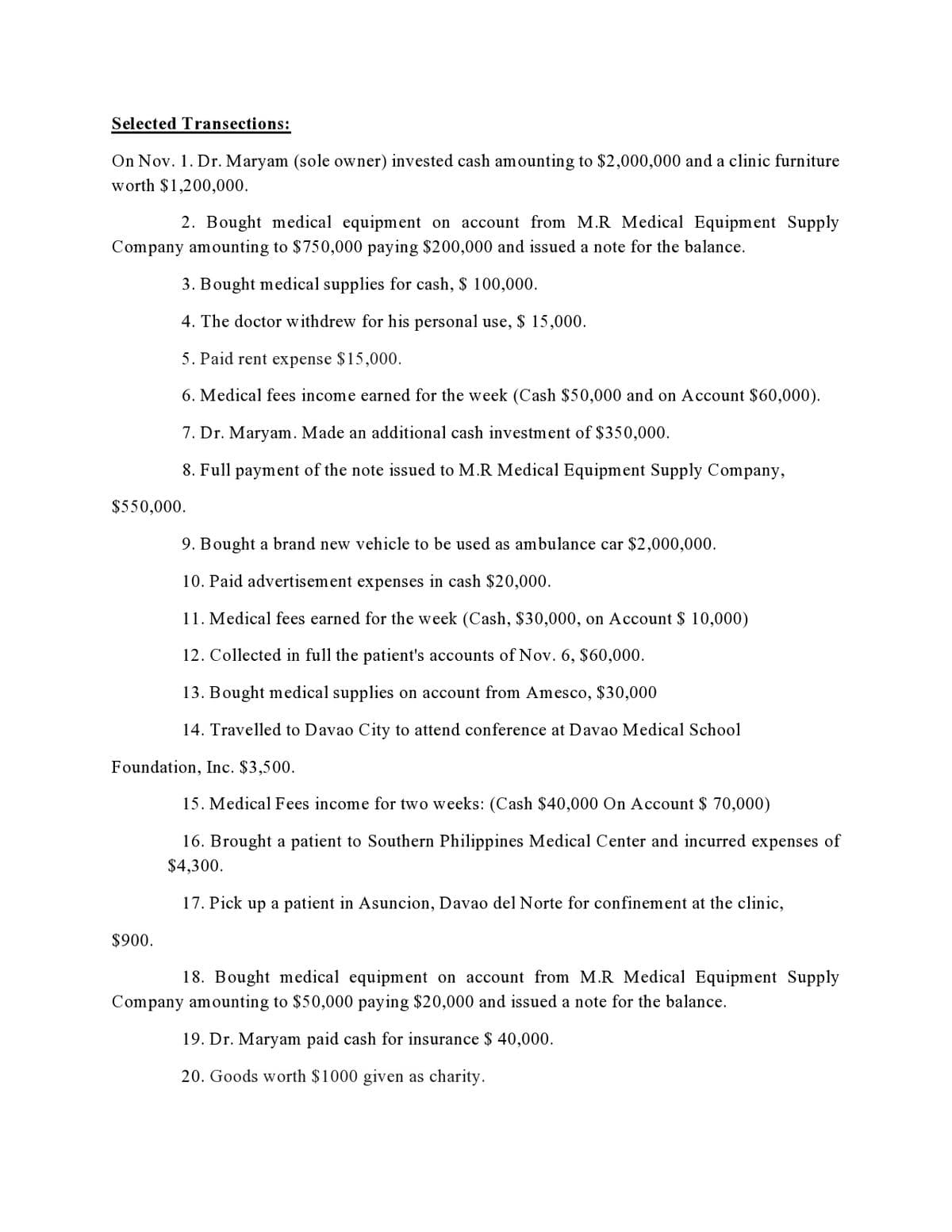

Transcribed Image Text:Selected Transections:

On Nov. 1. Dr. Maryam (sole owner) invested cash amounting to $2,000,000 and a clinic furniture

worth $1,200,000.

2. Bought medical equipment on account from M.R Medical Equipment Supply

Company amounting to $750,000 paying $200,000 and issued a note for the balance.

3. Bought medical supplies for cash, $ 100,000.

4. The doctor withdrew for his personal use, $ 15,000.

5. Paid rent expense $15,000.

6. Medical fees income earned for the week (Cash $50,000 and on Account $60,000).

7. Dr. Maryam. Made an additional cash investment of $350,000.

8. Full payment of the note issued to M.R Medical Equipment Supply Company,

$550,000.

9. Bought a brand new vehicle to be used as ambulance car $2,000,000.

10. Paid advertisement expenses in cash $20,000.

11. Medical fees earned for the week (Cash, $30,000, on Account $ 10,000)

12. Collected in full the patient's accounts of Nov. 6, $60,000.

13.

medical suppli

on account from Amesco, $30,000

14. Travelled to Davao City to attend conference at Davao Medical School

Foundation, Inc. $3,500.

15. Medical Fees income for two weeks: (Cash $40,000 On Account $ 70,000)

16. Brought a patient to Southern Philippines Medical Center and incurred expenses of

$4,300.

17. Pick up a patient in Asuncion, Davao del Norte for confinement at the clinic,

$900.

18. Bought medical equipment on account from M.R Medical Equipment Supply

Company amounting to $50,000 paying $20,000 and issued a note for the balance.

19. Dr. Maryam paid cash for insurance $ 40,000.

20. Goods worth $1000 given as charity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage