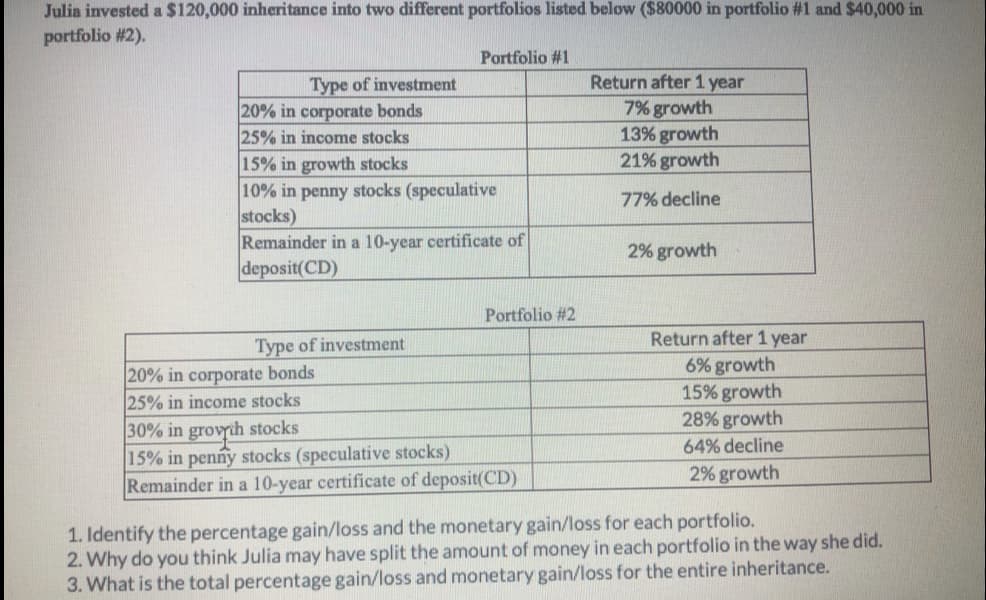

Julia invested a $120,000 inheritance into two different portfolios listed below ($80000 in portfolio #1 and $40,000 in portfolio #2). Portfolio #1 Type of investment Return after 1 year 7% growth 13% growth 21% growth 20% in corporate bonds 25% in income stocks 15% in growth stocks 10% in penny stocks (speculative stocks) Remainder in a 10-year certificate of deposit(CD) 77% decline 2% growth Portfolio #2 Return after 1 year 6% growth 15% growth 28% growth Type of investment 20% in corporate bonds 25% in income stocks 30% in grovrih stocks 15% in penny stocks (speculative stocks) Remainder in a 10-year certificate of deposit(CD) 64% decline 2% growth 1. Identify the percentage gain/loss and the monetary gain/loss for each portfolio. 2. Why do you think Julia may have split the amount of money in each portfolio in the way she did. 3. What is the total percentage gain/loss and monetary gain/loss for the entire inheritance.

Julia invested a $120,000 inheritance into two different portfolios listed below ($80000 in portfolio #1 and $40,000 in portfolio #2). Portfolio #1 Type of investment Return after 1 year 7% growth 13% growth 21% growth 20% in corporate bonds 25% in income stocks 15% in growth stocks 10% in penny stocks (speculative stocks) Remainder in a 10-year certificate of deposit(CD) 77% decline 2% growth Portfolio #2 Return after 1 year 6% growth 15% growth 28% growth Type of investment 20% in corporate bonds 25% in income stocks 30% in grovrih stocks 15% in penny stocks (speculative stocks) Remainder in a 10-year certificate of deposit(CD) 64% decline 2% growth 1. Identify the percentage gain/loss and the monetary gain/loss for each portfolio. 2. Why do you think Julia may have split the amount of money in each portfolio in the way she did. 3. What is the total percentage gain/loss and monetary gain/loss for the entire inheritance.

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 23CE

Related questions

Question

I need help

Transcribed Image Text:Julia invested a $120,000 inheritance into two different portfolios listed below ($80000 in portfolio #1 and $40,000 in

portfolio #2).

Portfolio #1

Return after 1 year

Type of investment

20% in corporate bonds

25% in income stocks

7% growth

13% growth

21% growth

15% in growth stocks

10% in penny stocks (speculative

stocks)

Remainder in a 10-year certificate of

deposit(CD)

77% decline

2% growth

Portfolio #2

Return after 1 year

6% growth

15% growth

28% growth

Type of investment

20% in corporate bonds

25% in income stocks

30% in grovrih stocks

15% in penny stocks (speculative stocks)

Remainder in a 10-year certificate of deposit(CD)

64% decline

2% growth

1. Identify the percentage gain/loss and the monetary gain/loss for each portfolio.

2. Why do you think Julia may have split the amount of money in each portfolio in the way she did.

3. What is the total percentage gain/loss and monetary gain/loss for the entire inheritance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you