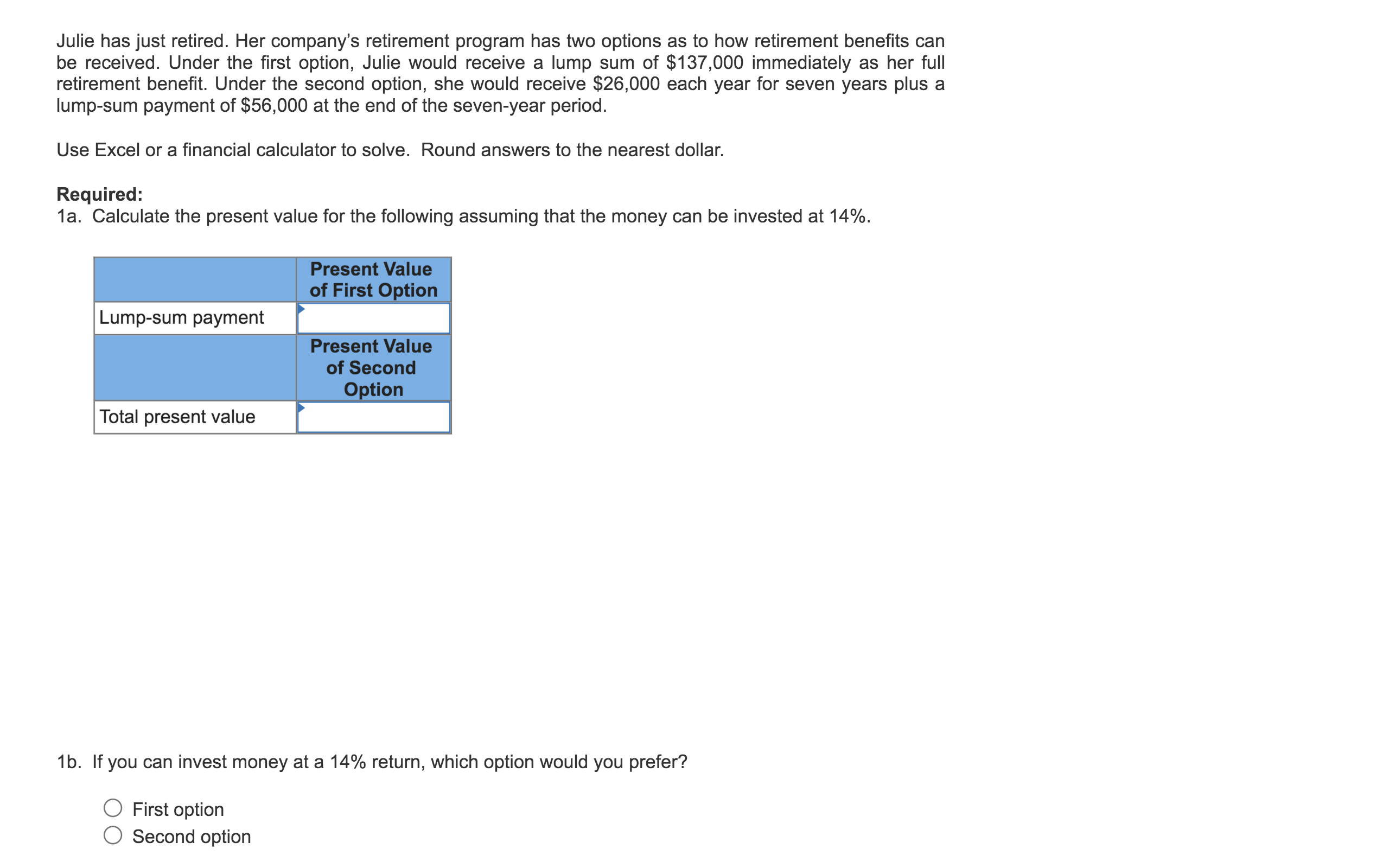

Julie has just retired. Her company's retirement program has two options as to how retirement benefits can be received. Under the first option, Julie would receive a lump sum of $137,000 immediately as her full retirement benefit. Under the second option, she would receive $26,000 each year for seven years plus a lump-sum payment of $56,000 at the end of the seven-year period. Use Excel or a financial calculator to solve. Round answers to the nearest dollar. Required: 1a. Calculate the present value for the following assuming that the money can be invested at 14%. Present Value of First Option Lump-sum payment Present Value of Second Option Total present value 1b. If you can invest money at a 14% return, which option would you prefer? First option Second option

Julie has just retired. Her company's retirement program has two options as to how retirement benefits can be received. Under the first option, Julie would receive a lump sum of $137,000 immediately as her full retirement benefit. Under the second option, she would receive $26,000 each year for seven years plus a lump-sum payment of $56,000 at the end of the seven-year period. Use Excel or a financial calculator to solve. Round answers to the nearest dollar. Required: 1a. Calculate the present value for the following assuming that the money can be invested at 14%. Present Value of First Option Lump-sum payment Present Value of Second Option Total present value 1b. If you can invest money at a 14% return, which option would you prefer? First option Second option

Chapter3: Income Sources

Section: Chapter Questions

Problem 51P

Related questions

Question

I need help with this probelm. Thank you

Transcribed Image Text:Julie has just retired. Her company's retirement program has two options as to how retirement benefits can

be received. Under the first option, Julie would receive a lump sum of $137,000 immediately as her full

retirement benefit. Under the second option, she would receive $26,000 each year for seven years plus a

lump-sum payment of $56,000 at the end of the seven-year period.

Use Excel or a financial calculator to solve. Round answers to the nearest dollar.

Required:

1a. Calculate the present value for the following assuming that the money can be invested at 14%.

Present Value

of First Option

Lump-sum payment

Present Value

of Second

Option

Total present value

1b. If you can invest money at a 14% return, which option would you prefer?

First option

Second option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT