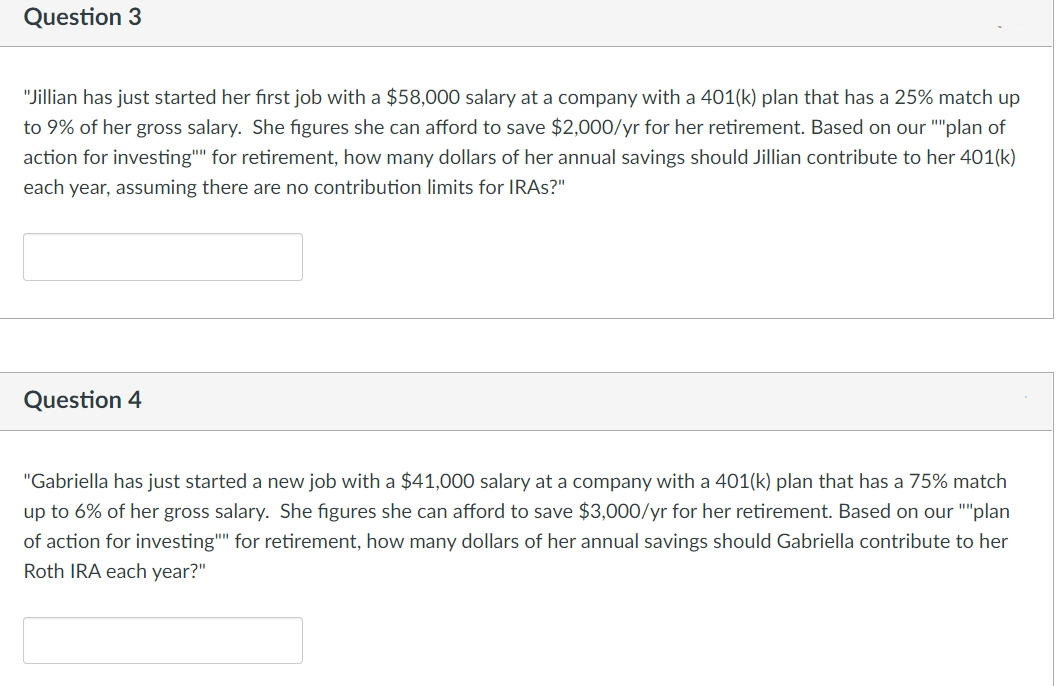

"Jillian has just started her first job with a $58,000 salary at a company with a 401(k) plan that has a 25% match up to 9% of her gross salary. She figures she can afford to save $2,000/yr for her retirement. Based on our ""plan of action for investing"" for retirement, how many dollars of her annual savings should Jillian contribute to her 401(k) each year, assuming there are no contribution limits for IRAS?"

"Jillian has just started her first job with a $58,000 salary at a company with a 401(k) plan that has a 25% match up to 9% of her gross salary. She figures she can afford to save $2,000/yr for her retirement. Based on our ""plan of action for investing"" for retirement, how many dollars of her annual savings should Jillian contribute to her 401(k) each year, assuming there are no contribution limits for IRAS?"

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 3FPE

Related questions

Question

1.

Transcribed Image Text:Question 3

"Jillian has just started her first job with a $58,000 salary at a company with a 401(k) plan that has a 25% match up

to 9% of her gross salary. She figures she can afford to save $2,000/yr for her retirement. Based on our ""plan of

action for investing"" for retirement, how many dollars of her annual savings should Jillian contribute to her 401(k)

each year, assuming there are no contribution limits for IRAS?"

Question 4

"Gabriella has just started a new job with a $41,000 salary at a company with a 401(k) plan that has a 75% match

up to 6% of her gross salary. She figures she can afford to save $3,000/yr for her retirement. Based on our ""plan

of action for investing"" for retirement, how many dollars of her annual savings should Gabriella contribute to her

Roth IRA each year?"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT