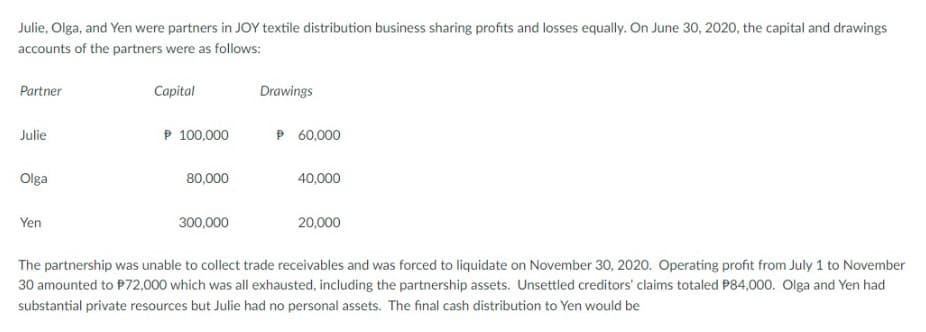

Julie, Olga, and Yen were partners in JOY textile distribution business sharing profits and losses equally. On June 30, 2020, the capital and drawings accounts of the partners were as follows: Partner Capital Drawings Julie P 100,000 P 60,000 Olga 80,000 40,000 Yen 300,000 20,000 The partnership was unable to collect trade receivables and was forced to liquidate on November 30, 2020. Operating profit from July 1 to November 30 amounted to $72,000 which was all exhausted, including the partnership assets. Unsettled creditors' claims totaled P84,000. Olga and Yen had substantial private resources but Julie had no personal assets. The final cash distribution to Yen would be

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps with 1 images