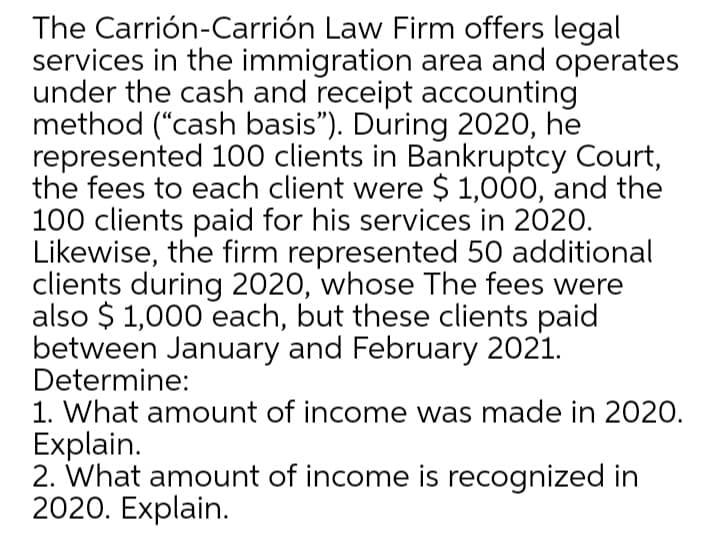

The Carrión-Carrión Law Firm offers legal services in the immigration area and operates under the cash and receipt accounting method ("cash basis"). During 2020, he represented 100 clients in Bankruptcy Court, the fees to each client were $ 1,000, and the 100 clients paid for his services in 2020. Likewise, the firm represented 50 additional clients during 2020, whose The fees were also $ 1,000 each, but these clients paid between January and February 2021. Determine: 1. What amount of income was made in 2020. Explain. 2. What amount of income is recognized in 2020. Explain.

The Carrión-Carrión Law Firm offers legal services in the immigration area and operates under the cash and receipt accounting method ("cash basis"). During 2020, he represented 100 clients in Bankruptcy Court, the fees to each client were $ 1,000, and the 100 clients paid for his services in 2020. Likewise, the firm represented 50 additional clients during 2020, whose The fees were also $ 1,000 each, but these clients paid between January and February 2021. Determine: 1. What amount of income was made in 2020. Explain. 2. What amount of income is recognized in 2020. Explain.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 30CE

Related questions

Question

Transcribed Image Text:The Carrión-Carrión Law Firm offers legal

services in the immigration area and operates

under the cash and receipt accounting

method ("cash basis"). During 2020, he

represented 100 clients in Bankruptcy Court,

the fees to each client were $ 1,000, and the

100 clients paid for his services in 2020.

Likewise, the firm represented 50 additional

clients during 2020, whose The fees were

also $ 1,000 each, but these clients paid

between January and February 2021.

Determine:

1. What amount of income was made in 2020.

Explain.

2. What amount of income is recognized in

2020. Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT