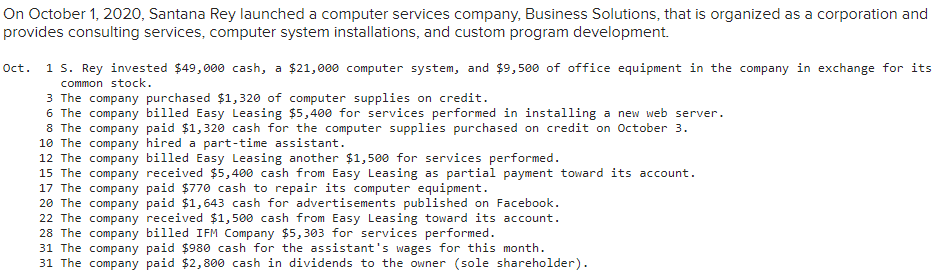

On October 1, 2020, Santana Rey launched a computer services company, Business Solutions, that is organized as a corporation and provides consulting services, computer system installations, and custom program development. Oct. 1 S. Rey invested $49,000 cash, a $21,000 computer system, and $9,500 of office equipment in the company in exchange for its common stock. 3 The company purchased $1,320 of computer supplies on credit. 6 The company billed Easy Leasing $5,400 for services performed in installing a new web server. 8 The company paid $1,320 cash for the computer supplies purchased on credit on October 3. 10 The company hired a part-time assistant. 12 The company billed Easy Leasing another $1,500 for services performed. 15 The company received $5,400 cash from Easy Leasing as partial payment toward its account. 17 The company paid $770 cash to repair its computer equipment. 20 The company paid $1,643 cash for advertisements published on Facebook. 22 The company received $1,500 cash from Easy Leasing toward its account. 28 The company billed IFM Company $5,303 for services performed. 31 The company paid $980 cash for the assistant's wages for this month. 31 The company paid $2,800 cash in dividends to the owner (sole shareholder).

On October 1, 2020, Santana Rey launched a computer services company, Business Solutions, that is organized as a corporation and provides consulting services, computer system installations, and custom program development. Oct. 1 S. Rey invested $49,000 cash, a $21,000 computer system, and $9,500 of office equipment in the company in exchange for its common stock. 3 The company purchased $1,320 of computer supplies on credit. 6 The company billed Easy Leasing $5,400 for services performed in installing a new web server. 8 The company paid $1,320 cash for the computer supplies purchased on credit on October 3. 10 The company hired a part-time assistant. 12 The company billed Easy Leasing another $1,500 for services performed. 15 The company received $5,400 cash from Easy Leasing as partial payment toward its account. 17 The company paid $770 cash to repair its computer equipment. 20 The company paid $1,643 cash for advertisements published on Facebook. 22 The company received $1,500 cash from Easy Leasing toward its account. 28 The company billed IFM Company $5,303 for services performed. 31 The company paid $980 cash for the assistant's wages for this month. 31 The company paid $2,800 cash in dividends to the owner (sole shareholder).

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5PA: Inner Resources Company started its business on April 1, 2019. The following transactions occurred...

Related questions

Question

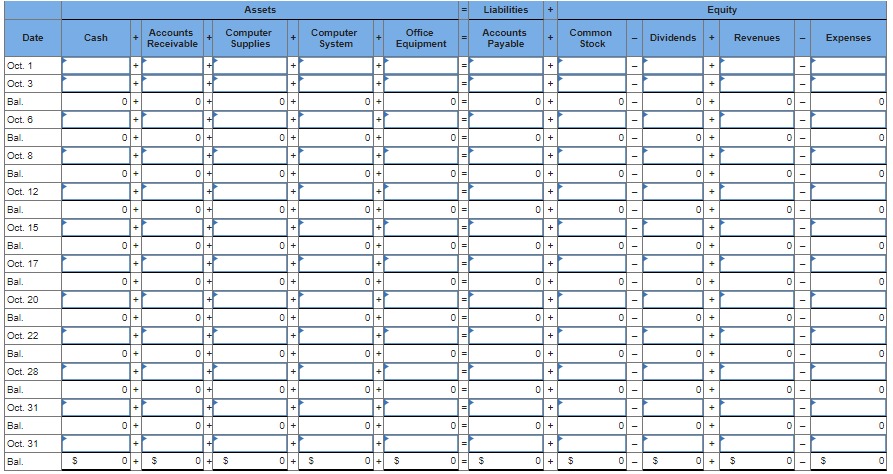

Required: Enter the amount of each transaction on individual items of the

Transcribed Image Text:Assets

Liabilities

Equity

Accounts

Computer

Supplies

Computer

System

Office

Accounts

Common

Date

Cash

Dividends

Revenues

Expenses

+

Receivable

Equipment

Payable

Stock

Oct. 1

+

Oct. 3

Bal.

01+

01 +

Oct. 6

+

+

Bal.

0l +

Ooct. 8

+

Bal.

01+

01 +

ol +

Oct. 12

+

+

Bal.

ol=

0l +

Oct. 15

+

+

Bal.

01+

Ol+

01 +

Oct. 17

+

+

Bal.

0l +

Oct. 20

+

Bal.

01+

Ol+

01 =

01 +

Oct. 22

+

+

Bal.

Oct. 28

Bal.

01+

Ol+

01 =

01 +

Oct. 31

+

+

Bal.

Oct. 31

Bal.

O1+

0 +

+++++++

+|++

+|++

++ + ++ + +

+

+ + +

+ + +

+ +

+++ + +

+++

++ + ++ +++ +++ +++ ++ +++ +++ +

Transcribed Image Text:On October 1, 2020, Santana Rey launched a computer services company, Business Solutions, that is organized as a corporation and

provides consulting services, computer system installations, and custom program development.

Oct. 1 s. Rey invested $49,000 cash, a $21,000 computer system, and $9,500 of office equipment in the company in exchange for its

common stock.

3 The company purchased $1, 320 of computer supplies on credit.

6 The company billed Easy Leasing $5,400 for services performed in installing a new web server.

8 The company paid $1,320 cash for the computer supplies purchased credit on October 3.

10 The company hired a part-time assistant.

12 The company billed Easy Leasing another $1,500 for services performed.

15 The company received $5,400 cash from Easy Leasing as partial payment toward its account.

17 The company paid $770 cash to repair its computer equipment.

20 The company paid $1,643 cash for advertisements published on Facebook.

22 The company received $1,500 cash from Easy Leasing toward its account.

28 The company billed IFM Company $5,303 for services performed.

31 The company paid $980 cash for the assistant's wages for this month.

31 The company paid $2,800 cash in dividends to the owner (sole shareholder).

on

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT