Julle pald a day care center to watch ner two-year-old son wnile sne wOrked as a computer program up company. What amount of child and dependent care credit can Julie claim in 2021 in each of the following alternative scenarios? Use Exhibit 8-10 ............ a. Julie paid $2,260 to the day care center and her AGI is $52,600 (all salary). Child and dependent care credit

Julle pald a day care center to watch ner two-year-old son wnile sne wOrked as a computer program up company. What amount of child and dependent care credit can Julie claim in 2021 in each of the following alternative scenarios? Use Exhibit 8-10 ............ a. Julie paid $2,260 to the day care center and her AGI is $52,600 (all salary). Child and dependent care credit

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 10P

Related questions

Question

100%

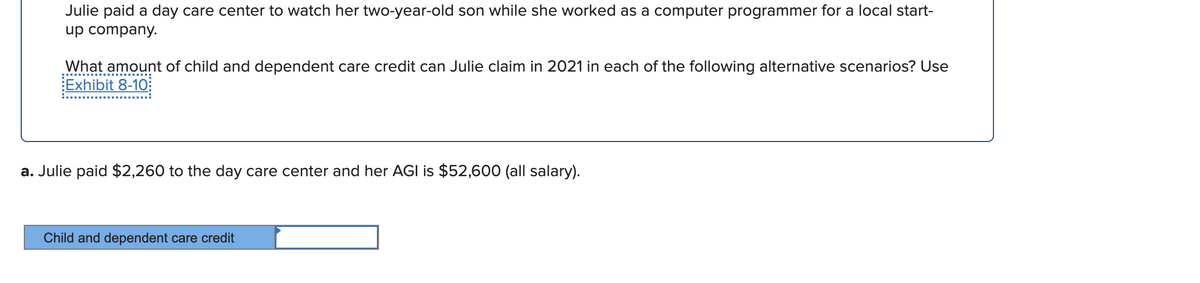

Transcribed Image Text:Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-

up company.

What amount of child and dependent care credit can Julie claim in 2021 in each of the following alternative scenarios? Use

Exhibit 8-10:

a. Julie paid $2,260 to the day care center and her AGI is $52,600 (all salary).

Child and dependent care credit

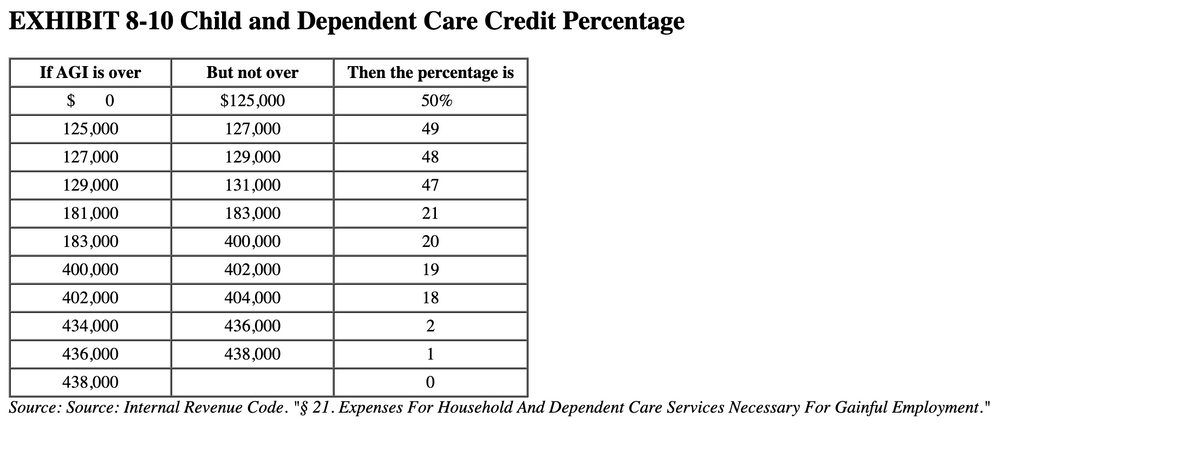

Transcribed Image Text:EXHIBIT 8-10 Child and Dependent Care Credit Percentage

If AGI is over

But not over

Then the percentage is

$ 0

$125,000

50%

125,000

127,000

49

127,000

129,000

48

129,000

131,000

47

181,000

183,000

21

183,000

400,000

20

400,000

402,000

19

402,000

404,000

18

434,000

436,000

2

436,000

438,000

1

438,000

Source: Source: Internal Revenue Code. "§ 21. Expenses For Household And Dependent Care Services Necessary For Gainful Employment."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT