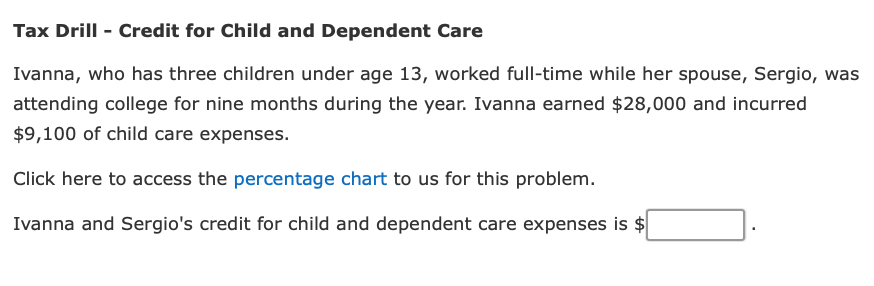

Tax Drill - Credit for Child and Dependent Care Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, wa attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care expenses. Click here to access the percentage chart to us for this problem. Ivanna and Sergio's credit for child and dependent care expenses is $

Tax Drill - Credit for Child and Dependent Care Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, wa attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care expenses. Click here to access the percentage chart to us for this problem. Ivanna and Sergio's credit for child and dependent care expenses is $

Chapter9: Deductions: Employee And Self-employed-related Expenses

Section: Chapter Questions

Problem 15CE

Related questions

Question

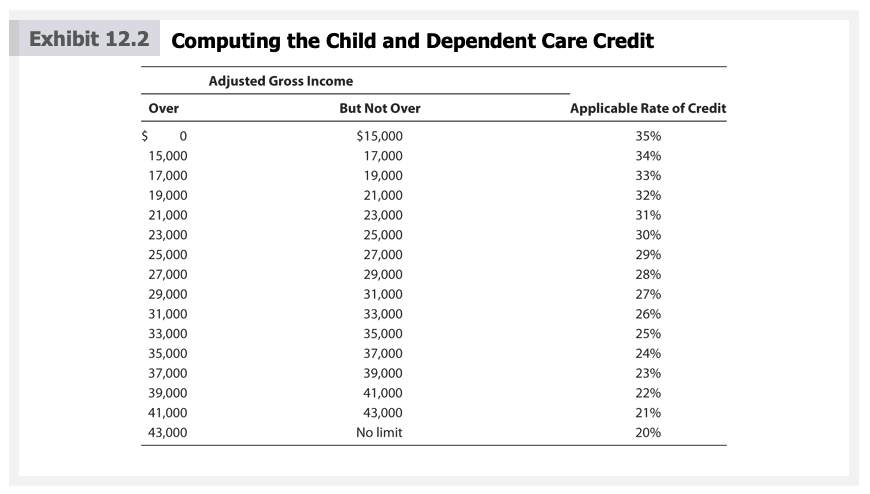

Transcribed Image Text:Exhibit 12.2 Computing the Child and Dependent Care Credit

Adjusted Gross Income

Over

But Not Over

Applicable Rate of Credit

$15,000

35%

15,000

17,000

34%

17,000

19,000

33%

19,000

21,000

32%

21,000

23,000

31%

23,000

25,000

30%

25,000

27,000

29%

27,000

29,000

28%

29,000

31,000

27%

31,000

33,000

26%

33,000

35,000

25%

35,000

37,000

24%

37,000

39,000

23%

39,000

41,000

22%

41,000

43,000

21%

43,000

No limit

20%

Transcribed Image Text:Tax Drill - Credit for Child and Dependent Care

Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was

attending college for nine months during the year. Ivanna earned $28,000 and incurred

$9,100 of child care expenses.

Click here to access the percentage chart to us for this problem.

Ivanna and Sergio's credit for child and dependent care expenses is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning