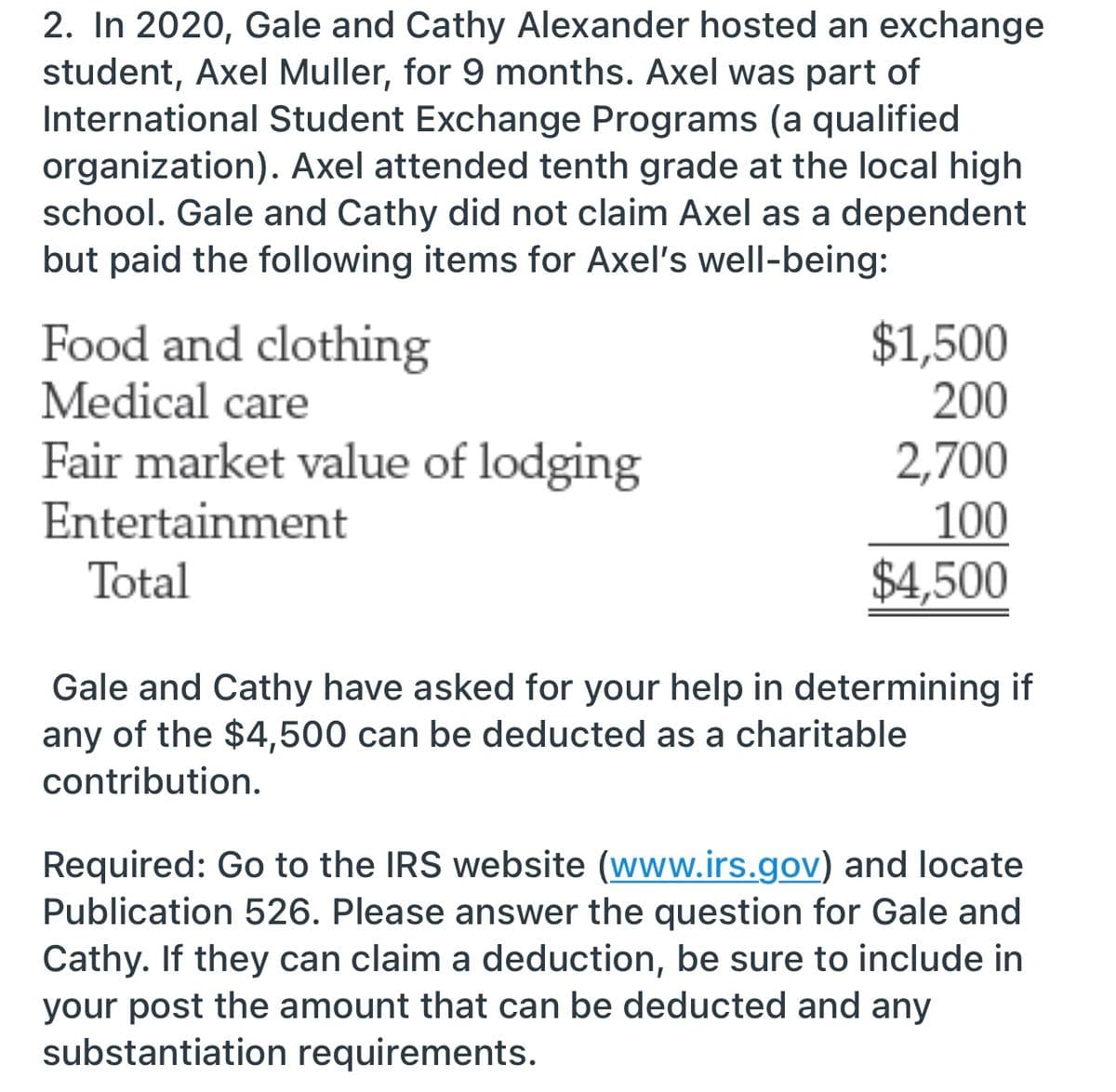

2. In 2020, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim Axel as a dependent but paid the following items for Axel's well-being: Food and clothing Medical care Fair market value of lodging $1,500 200 2,700 100 $4,500 Entertainment Total Gale and Cathy have asked for your help in determining if any of the $4,500 can be deducted as a charitable contribution.

2. In 2020, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim Axel as a dependent but paid the following items for Axel's well-being: Food and clothing Medical care Fair market value of lodging $1,500 200 2,700 100 $4,500 Entertainment Total Gale and Cathy have asked for your help in determining if any of the $4,500 can be deducted as a charitable contribution.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:2. In 2020, Gale and Cathy Alexander hosted an exchange

student, Axel Muller, for 9 months. Axel was part of

International Student Exchange Programs (a qualified

organization). Axel attended tenth grade at the local high

school. Gale and Cathy did not claim Axel as a dependent

but paid the following items for Axel's well-being:

Food and clothing

Medical care

$1,500

200

Fair market value of lodging

2,700

100

$4,500

Entertainment

Total

Gale and Cathy have asked for your help in determining if

any of the $4,500 can be deducted as a charitable

contribution.

Required: Go to the IRS website (www.irs.gov) and locate

Publication 526. Please answer the question for Gale and

Cathy. If they can claim a deduction, be sure to include in

your post the amount that can be deducted and any

substantiation requirements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT