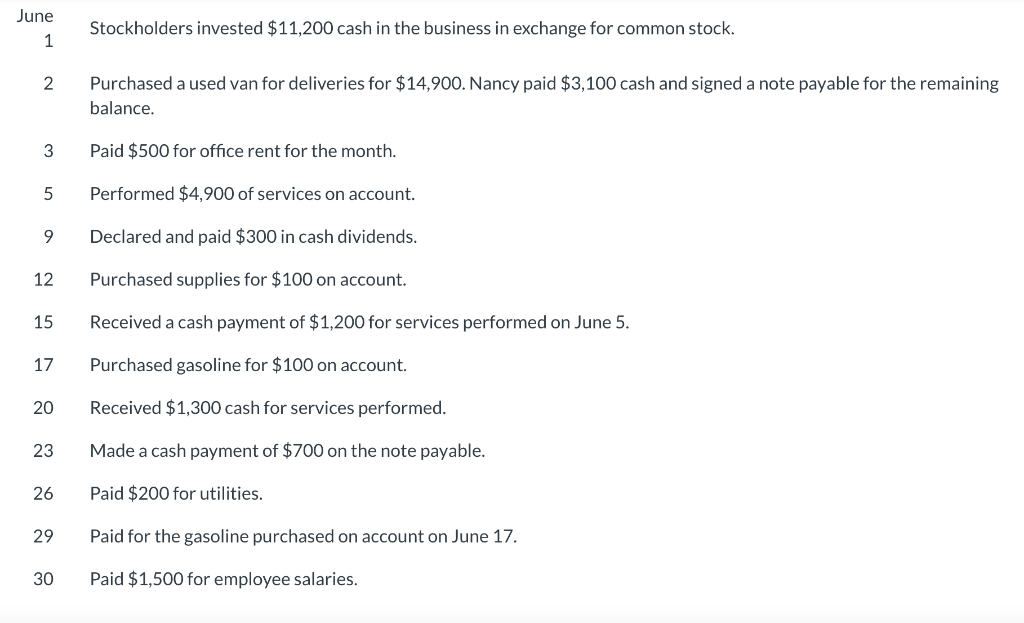

June 1 2 3 5 9 12 15 17 20 23 26 29 30 Stockholders invested $11,200 cash in the business in exchange for common stock. Purchased a used van for deliveries for $14,900. Nancy paid $3,100 cash and signed a note payable for the remaining balance. Paid $500 for office rent for the month. Performed $4,900 of services on account. Declared and paid $300 in cash dividends. Purchased supplies for $100 on account. Received a cash payment of $1,200 for services performed on June 5. Purchased gasoline for $100 on account. Received $1,300 cash for services performed. Made a cash payment of $700 on the note payable. Paid $200 for utilities. Paid for the gasoline purchased on account on June 17. Paid $1,500 for employee salaries.

June 1 2 3 5 9 12 15 17 20 23 26 29 30 Stockholders invested $11,200 cash in the business in exchange for common stock. Purchased a used van for deliveries for $14,900. Nancy paid $3,100 cash and signed a note payable for the remaining balance. Paid $500 for office rent for the month. Performed $4,900 of services on account. Declared and paid $300 in cash dividends. Purchased supplies for $100 on account. Received a cash payment of $1,200 for services performed on June 5. Purchased gasoline for $100 on account. Received $1,300 cash for services performed. Made a cash payment of $700 on the note payable. Paid $200 for utilities. Paid for the gasoline purchased on account on June 17. Paid $1,500 for employee salaries.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5PB: Lavender Company started its business on April 1, 2019. The following are the transactions that...

Related questions

Topic Video

Question

Transcribed Image Text:June

1

2

3

5

9

12

15

17

20

23

26

29

30

Stockholders invested $11,200 cash in the business in exchange for common stock.

Purchased a used van for deliveries for $14,900. Nancy paid $3,100 cash and signed a note payable for the remaining

balance.

Paid $500 for office rent for the month.

Performed $4,900 of services on account.

Declared and paid $300 in cash dividends.

Purchased supplies for $100 on account.

Received a cash payment of $1,200 for services performed on June 5.

Purchased gasoline for $100 on account.

Received $1,300 cash for services performed.

Made a cash payment of $700 on the note payable.

Paid $200 for utilities.

Paid for the gasoline purchased on account on June 17.

Paid $1,500 for employee salaries.

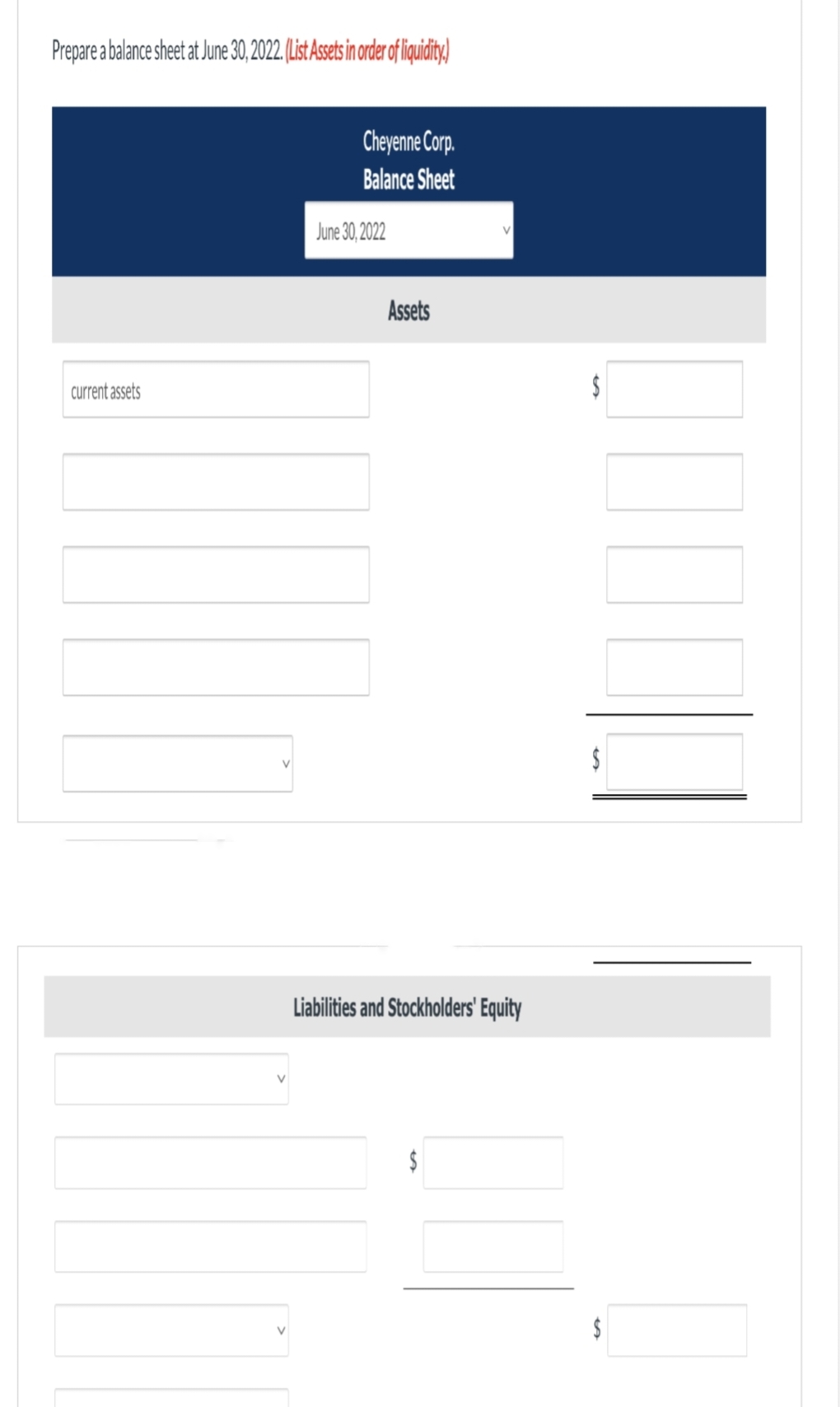

Transcribed Image Text:Prepare a balance sheet at June 30, 2022. (List Assets in order of liquidity.)

current assets

V

Cheyenne Corp.

Balance Sheet

June 30, 2022

Assets

Liabilities and Stockholders' Equity

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning