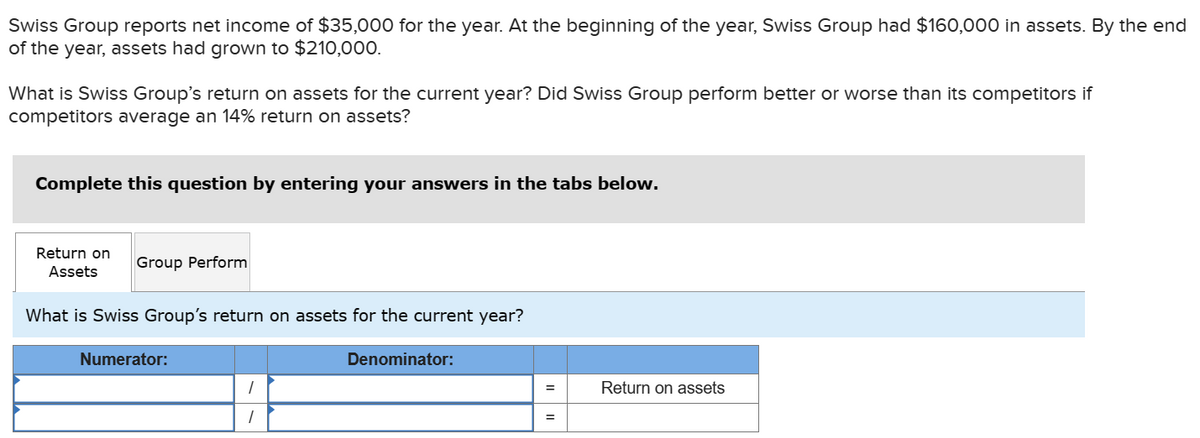

Swiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $160,000 in assets. By the end of the year, assets had grown to $210,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 14% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: Denominator:

Swiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $160,000 in assets. By the end of the year, assets had grown to $210,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 14% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: Denominator:

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Swiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $160,000 in assets. By the end

of the year, assets had grown to $210,000.

What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if

competitors average an 14% return on assets?

Complete this question by entering your answers in the tabs below.

Return on

Assets

Group Perform

What is Swiss Group's return on assets for the current year?

Numerator:

1

1

Denominator:

=

Return on assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning