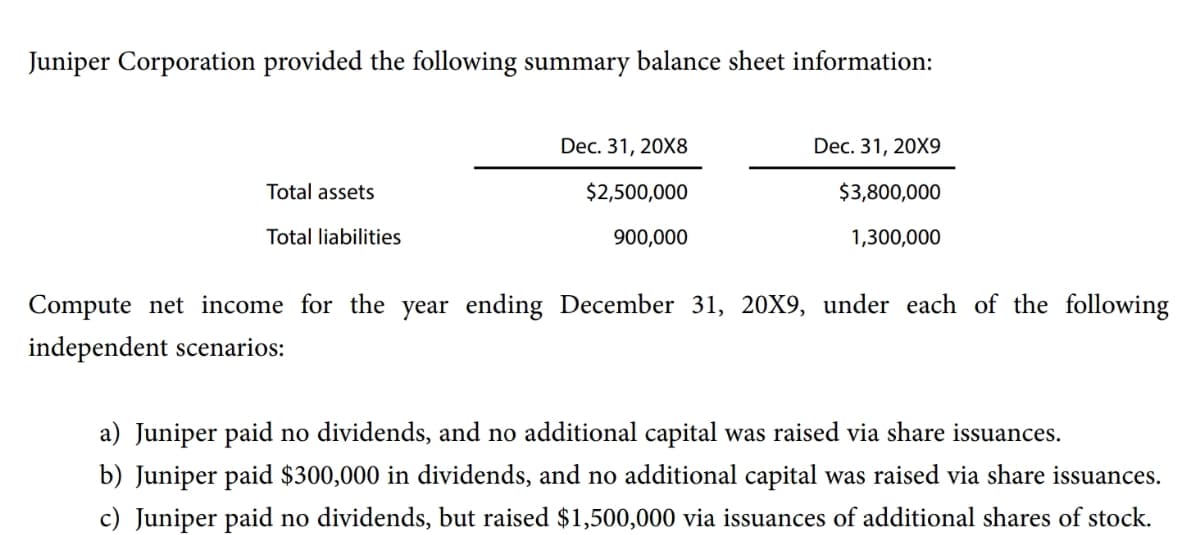

Juniper Corporation provided the following summary balance sheet information: Dec. 31, 20X8 Dec. 31, 20X9 Total assets $2,500,000 $3,800,000 Total liabilities 900,000 1,300,000 Compute net income for the year ending December 31, 20X9, under each of the following independent scenarios: a) Juniper paid no dividends, and no additional capital was raised via share issuances. b) Juniper paid $300,000 in dividends, and no additional capital was raised via share issuances. c) Juniper paid no dividends, but raised $1,500,000 via issuances of additional shares of stock.

Juniper Corporation provided the following summary balance sheet information: Dec. 31, 20X8 Dec. 31, 20X9 Total assets $2,500,000 $3,800,000 Total liabilities 900,000 1,300,000 Compute net income for the year ending December 31, 20X9, under each of the following independent scenarios: a) Juniper paid no dividends, and no additional capital was raised via share issuances. b) Juniper paid $300,000 in dividends, and no additional capital was raised via share issuances. c) Juniper paid no dividends, but raised $1,500,000 via issuances of additional shares of stock.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8RE

Related questions

Question

Transcribed Image Text:Juniper Corporation provided the following summary balance sheet information:

Dec. 31, 20X8

Dec. 31, 20X9

Total assets

$2,500,000

$3,800,000

Total liabilities

900,000

1,300,000

Compute net income for the year ending December 31, 20X9, under each of the following

independent scenarios:

a) Juniper paid no dividends, and no additional capital was raised via share issuances.

b) Juniper paid $300,000 in dividends, and no additional capital was raised via share issuances.

c) Juniper paid no dividends, but raised $1,500,000 via issuances of additional shares of stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,