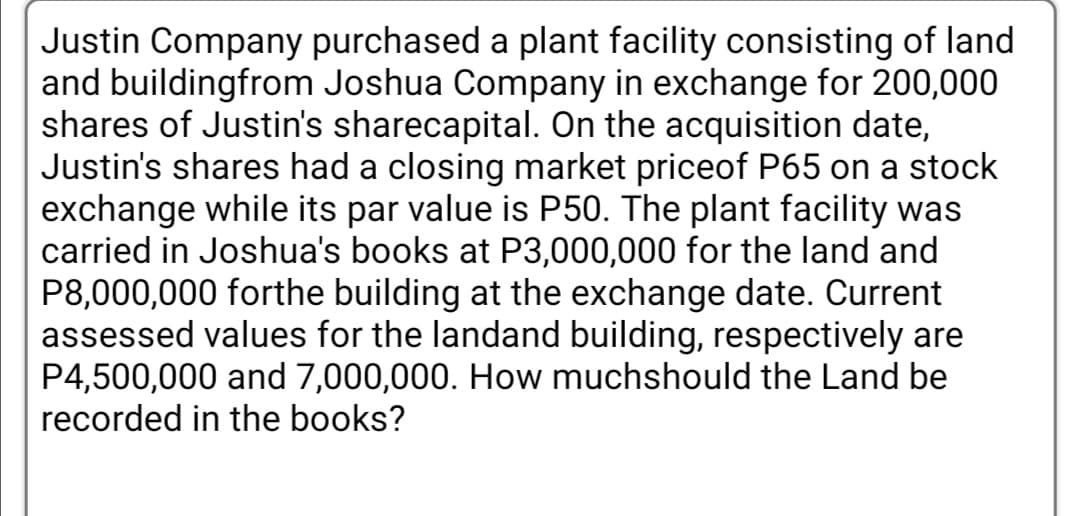

Justin Company purchased a plant facility consisting of land and buildingfrom Joshua Company in exchange for 200,000 shares of Justin's sharecapital. On the acquisition date, Justin's shares had a closing market priceof P65 on a stock exchange while its par value is P50. The plant facility was carried in Joshua's books at P3,000,000 for the land and P8,000,000 forthe building at the exchange date. Current assessed values for the landand building, respectively are P4,500,000 and 7,000,000. How muchshould the Land be recorded in the books?

Justin Company purchased a plant facility consisting of land and buildingfrom Joshua Company in exchange for 200,000 shares of Justin's sharecapital. On the acquisition date, Justin's shares had a closing market priceof P65 on a stock exchange while its par value is P50. The plant facility was carried in Joshua's books at P3,000,000 for the land and P8,000,000 forthe building at the exchange date. Current assessed values for the landand building, respectively are P4,500,000 and 7,000,000. How muchshould the Land be recorded in the books?

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 44P

Related questions

Question

Show the solution in good accounting form

Transcribed Image Text:Justin Company purchased a plant facility consisting of land

and buildingfrom Joshua Company in exchange for 200,000

shares of Justin's sharecapital. On the acquisition date,

Justin's shares had a closing market priceof P65 on a stock

exchange while its par value is P50. The plant facility was

carried in Joshua's books at P3,000,000 for the land and

P8,000,000 forthe building at the exchange date. Current

assessed values for the landand building, respectively are

P4,500,000 and 7,000,000. How muchshould the Land be

recorded in the books?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning