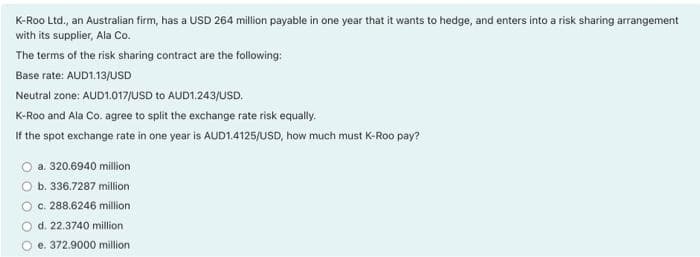

K-Roo Ltd., an Australian firm, has a USD 264 million payable in one year that it wants to hedge, and enters into a risk sharing arrangement with its supplier, Ala Co. The terms of the risk sharing contract are the following: Base rate: AUD1.13/USD Neutral zone: AUD1.017/USD to AUD1.243/USD. K-Roo and Ala Co. agree to split the exchange rate risk equally. If the spot exchange rate in one year is AUD1.4125/USD, how much must K-Roo pay? a. 320.6940 million b. 336.7287 million c. 288.6246 million d. 22.3740 million O e. 372.9000 million

K-Roo Ltd., an Australian firm, has a USD 264 million payable in one year that it wants to hedge, and enters into a risk sharing arrangement with its supplier, Ala Co. The terms of the risk sharing contract are the following: Base rate: AUD1.13/USD Neutral zone: AUD1.017/USD to AUD1.243/USD. K-Roo and Ala Co. agree to split the exchange rate risk equally. If the spot exchange rate in one year is AUD1.4125/USD, how much must K-Roo pay? a. 320.6940 million b. 336.7287 million c. 288.6246 million d. 22.3740 million O e. 372.9000 million

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 40QA

Related questions

Question

3

Transcribed Image Text:K-Roo Ltd., an Australian firm, has a USD 264 million payable in one year that it wants to hedge, and enters into a risk sharing arrangement

with its supplier, Ala Co.

The terms of the risk sharing contract are the following:

Base rate: AUD1.13/USD

Neutral zone: AUD1.017/USD to AUD1.243/USD.

K-Roo and Ala Co. agree to split the exchange rate risk equally.

If the spot exchange rate in one year is AUD1.4125/USD, how much must K-Roo pay?

O a. 320.6940 million

b. 336.7287 million

O c. 288.6246 million

O d. 22.3740 million

e. 372.9000 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning