Required: a. Complete the income statements for both divisions and the corporation as a whole. (Enter all values as positive value. Round your answers to 1 decimal place.) Mountain Division Valley Division Corporate Sales Cost of sales Gross margin SG&A Allocated corporate costs Operating income Tax expense (@25%) After-tax income 18.0 72.0 134.4 Gross margin percentage Operating margin Profit margin 66.00 % 26.00 % 52.50 % 21.20 % 56.00 % 22.40 % 16.80 % 19.50 % 15.90 %

Required: a. Complete the income statements for both divisions and the corporation as a whole. (Enter all values as positive value. Round your answers to 1 decimal place.) Mountain Division Valley Division Corporate Sales Cost of sales Gross margin SG&A Allocated corporate costs Operating income Tax expense (@25%) After-tax income 18.0 72.0 134.4 Gross margin percentage Operating margin Profit margin 66.00 % 26.00 % 52.50 % 21.20 % 56.00 % 22.40 % 16.80 % 19.50 % 15.90 %

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter25: Departmental Accounting

Section: Chapter Questions

Problem 9SPA: INCOME STATEMENT WITH DEPART MENTAL DIRECT OPERATING MARGIN AND TOTAL OPERATING INCOME Durwood...

Related questions

Question

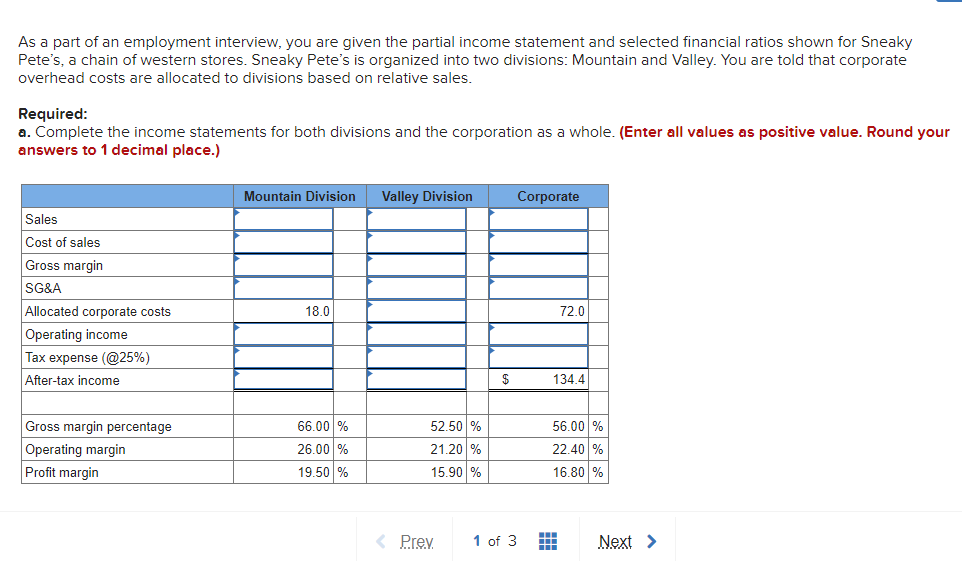

Transcribed Image Text:As a part of an employment interview, you are given the partial income statement and selected financial ratios shown for Sneaky

Pete's, a chain of western stores. Sneaky Pete's is organized into two divisions: Mountain and Valley. You are told that corporate

overhead costs are allocated to divisions based on relative sales.

Required:

a. Complete the income statements for both divisions and the corporation as a whole. (Enter all values as positive value. Round your

answers to 1 decimal place.)

Mountain Division

Valley Division

Сoгporate

Sales

Cost of sales

Gross margin

SG&A

Allocated corporate costs

18.0

72.0

Operating income

Tax expense (@25%)

After-tax income

134.4

52.50 %

Gross margin percentage

Operating margin

Profit margin

66.00 %

56.00 %

26.00 %

21.20 %

22.40 %

19.50 %

15.90 %

16.80 %

< Prey

1 of 3

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning