Karla Tanner opens a Web consulting business called Linkworks and con operations. April 1 Tanner invested $128,0ee cash along with office equipment val 2 The company prepaid $7, 200 cash for 12 months' rent for offie 3 The company made credit purchases for $14,400 in office equip days. 6 The company completed services for a client and immediately m 9 The company completed a $9,6e0 project for a client, who must 13 The company paid $17,280 cash to settle the account payable 19 The company paid $6,e00 cash for the premium on a 12-month in 22 The company received $7,680 cash as partial payment for the w 25 The company completed work for another client for $2,640 on 28 Tanner withdrew $6,200 cash from the company for personal use 29 The company purchased $960 of additional office supplies on 30 The company paid $700 cash for this month's utility bill.

Karla Tanner opens a Web consulting business called Linkworks and con operations. April 1 Tanner invested $128,0ee cash along with office equipment val 2 The company prepaid $7, 200 cash for 12 months' rent for offie 3 The company made credit purchases for $14,400 in office equip days. 6 The company completed services for a client and immediately m 9 The company completed a $9,6e0 project for a client, who must 13 The company paid $17,280 cash to settle the account payable 19 The company paid $6,e00 cash for the premium on a 12-month in 22 The company received $7,680 cash as partial payment for the w 25 The company completed work for another client for $2,640 on 28 Tanner withdrew $6,200 cash from the company for personal use 29 The company purchased $960 of additional office supplies on 30 The company paid $700 cash for this month's utility bill.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 3R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

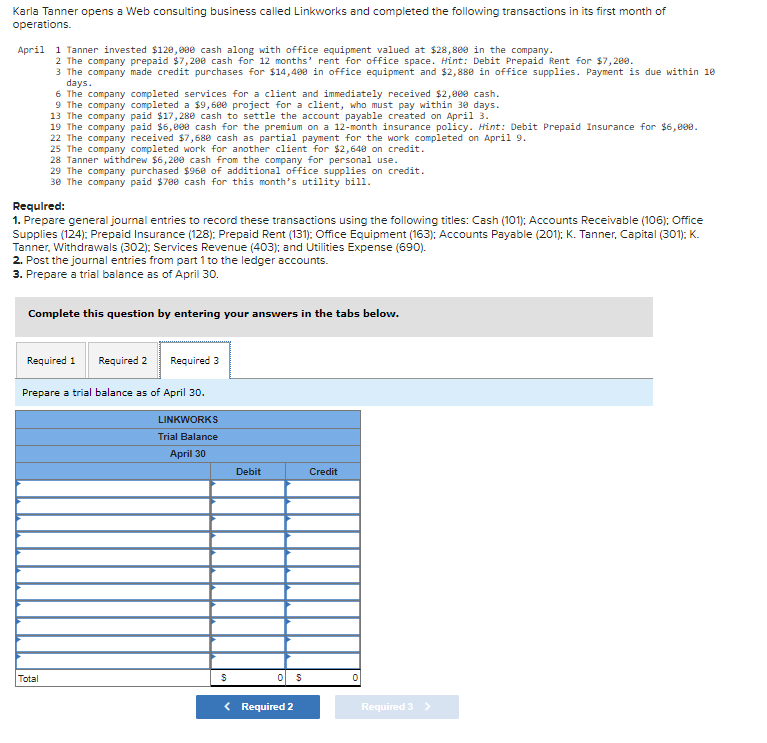

Transcribed Image Text:Karla Tanner opens a Web consulting business called Linkworks and completed the following transactions in its first month of

operations.

April 1 Tanner invested $128,090 cash along with office equipment valued at $28,8ee in the company.

2 The company prepaid $7,20e cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200.

3 The company made credit purchases for $14,400 in office equipment and $2,880 in office supplies. Payment is due within 10

days.

6 The company completed services for a client and immediately received $2,eee cash.

9 The company completed a $9, 680 project for a client, who must pay within 30 days.

13 The company paid $17,280 cash to settle the account payable created on April 3.

19 The company paid $6,800 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $6,00e.

22 The company received $7, 680 cash as partial payment for the work completed on April 9.

25 The company completed work for another client for $2,648 on credit.

28 Tanner withdrew $6,200 cash from the company for personal use.

29 The company purchased $960 of additional office supplies on credit.

30 The company paid $780 cash for this month's utility bill.

Requlred:

1. Prepare general journal entries to record these transactions using the following titles: Cash (101): Accounts Receivable (106): Office

Supplies (124): Prepaid Insurance (128): Prepaid Rent (131): Office Equipment (163): Accounts Payable (201): K. Tanner, Capital (301): K.

Tanner, Withdrawals (302): Services Revenue (403); and Utilities Expense (690).

2. Post the journal entries from part 1 to the ledger accounts.

3. Prepare a trial balance as of April 30.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Prepare a trial balance as of April 30.

LINKWORKS

Trial Balance

April 30

Debit

Credit

Total

< Required 2

Required 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning