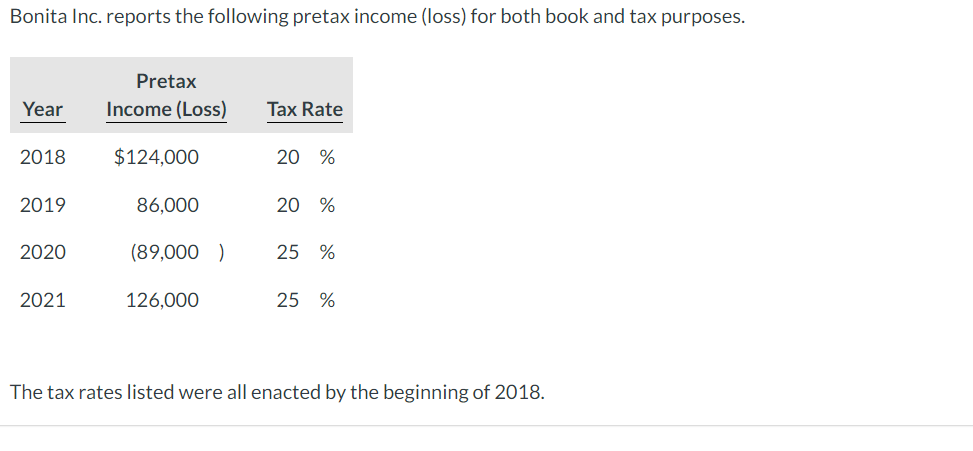

Bonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018.

Bonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 2MCQ: Tayla Corporation generated $400,000 of taxable income in the 2019. What is Tayla's corporate tax...

Related questions

Question

Transcribed Image Text:Bonita Inc. reports the following pretax income (loss) for both book and tax purposes.

Pretax

Year

Income (Loss)

Tax Rate

2018

$124,000

20 %

2019

86,000

20 %

2020

(89,000 )

25 %

2021

126,000

25 %

The tax rates listed were all enacted by the beginning of 2018.

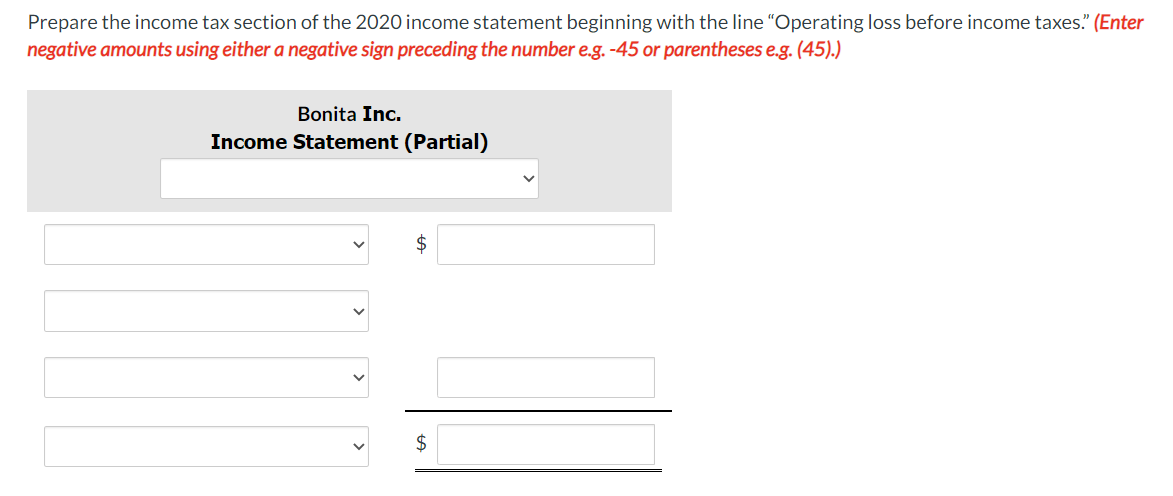

Transcribed Image Text:Prepare the income tax section of the 2020 income statement beginning with the line "Operating loss before income taxes." (Enter

negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Bonita Inc.

Income Statement (Partial)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you