What amount of gain should be reported as a result of the modification of terms under ifrs?

What amount of gain should be reported as a result of the modification of terms under ifrs?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 28E: On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First...

Related questions

Question

What amount of gain should be reported as a result of the modification of terms under ifrs?

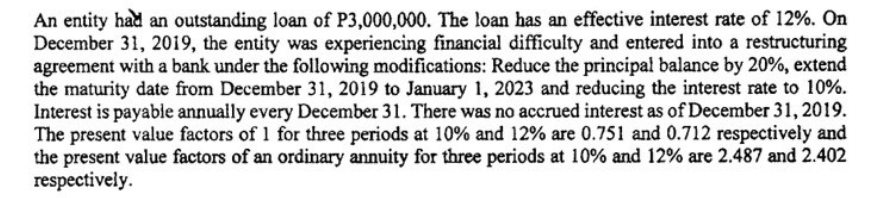

Transcribed Image Text:An entity had an outstanding loan of P3,000,000. The loan has an effective interest rate of 12%. On

December 31, 2019, the entity was experiencing financial difficulty and entered into a restructuring

agreement with a bank under the following modifications: Reduce the principal balance by 20%, extend

the maturity date from December 31, 2019 to January 1, 2023 and reducing the interest rate to 10%.

Interest is payable annually every December 31. There was no accrued interest as of December 31, 2019.

The present value factors of 1 for three periods at 10% and 12% are 0.751 and 0.712 respectively and

the present value factors of an ordinary annuity for three periods at 10% and 12% are 2.487 and 2.402

respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning