Kelvin owns and lives in a duplex. He rents the other unit for $720 per month. He incurs the following expenses during the current year for the entire property: Mortgage interest $ 7,350 Property taxes 1,880 Utilities 1,420 Fixed light fixture in rental unit 85 Fixed dishwasher in personal unit 220 Painted entire exterior 1,010 Insurance 1,700 Depreciation (entire structure) 6,200

Kelvin owns and lives in a duplex. He rents the other unit for $720 per month. He incurs the following expenses during the current year for the entire property: Mortgage interest $ 7,350 Property taxes 1,880 Utilities 1,420 Fixed light fixture in rental unit 85 Fixed dishwasher in personal unit 220 Painted entire exterior 1,010 Insurance 1,700 Depreciation (entire structure) 6,200

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 4RP

Related questions

Question

Kelvin owns and lives in a duplex. He rents the other unit for $720 per month. He incurs the following expenses during the current year for the entire property:

Mortgage interest $ 7,350

Property taxes 1,880

Utilities 1,420 Fixed light fixture in rental unit 85

Fixed dishwasher in personal unit 220

Painted entire exterior 1,010

Insurance 1,700

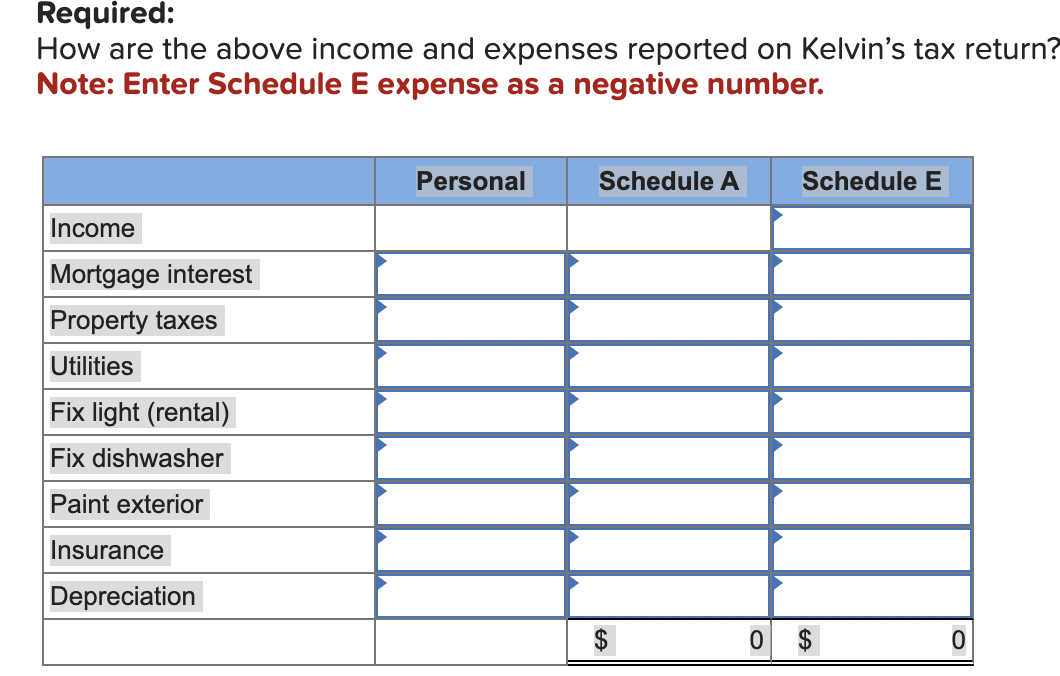

Transcribed Image Text:Required:

How are the above income and expenses reported on Kelvin's tax return?

Note: Enter Schedule E expense as a negative number.

Income

Mortgage interest

Property taxes

Utilities

Fix light (rental)

Fix dishwasher

Paint exterior

Insurance

Depreciation

Personal

Schedule A

0

Schedule E

SA

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning