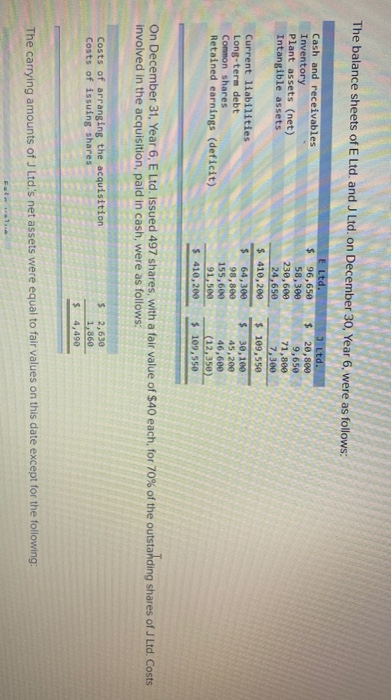

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: E Ltd. $ 96,650 58,300 230,600 24,650 410,200 $ 109,550 $ 30,100 45,200 46,600 (12,350) $ 410,200 $ 109,550 Cash and receivables Inventory Plant assets (net) Intangible assets Current liabilities Long-term debt Common shares Retained earnings (deficit) Costs of arranging the acquisition Costs of issuing shares $ $ 64,300 98,800 155,600 91,500 On December 31, Year 6, E Ltd. Issued 497 shares, with a fair value of $40 each, for 70% of the outstanding shares of J Ltd. Costs involved in the acquisition, paid in cash, were as follows: Falm S 3 Ltd. $ 20,800 9,650 71,800 7,300 $ 2,630 1,860 4,490 The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following:

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: E Ltd. $ 96,650 58,300 230,600 24,650 410,200 $ 109,550 $ 30,100 45,200 46,600 (12,350) $ 410,200 $ 109,550 Cash and receivables Inventory Plant assets (net) Intangible assets Current liabilities Long-term debt Common shares Retained earnings (deficit) Costs of arranging the acquisition Costs of issuing shares $ $ 64,300 98,800 155,600 91,500 On December 31, Year 6, E Ltd. Issued 497 shares, with a fair value of $40 each, for 70% of the outstanding shares of J Ltd. Costs involved in the acquisition, paid in cash, were as follows: Falm S 3 Ltd. $ 20,800 9,650 71,800 7,300 $ 2,630 1,860 4,490 The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

Hh1.

Account

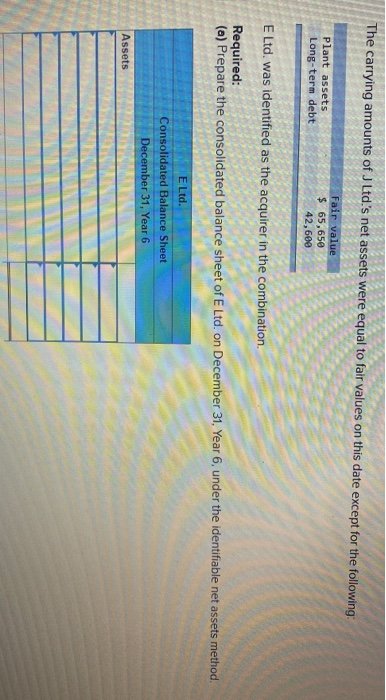

Transcribed Image Text:The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following:

Plant assets

Long-term debt

Fair value

$ 65,650

42,600

E Ltd. was identified as the acquirer in the combination.

Required:

(a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net assets method.

Assets

E Ltd.

Consolidated Balance Sheet

December 31, Year 6

Transcribed Image Text:The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows:

3 Ltd.

$ 20,800

E Ltd.

$ 96,650

58,300

230,600

24,650

9,650

Cash and receivables

Inventory

Plant assets (net)

Intangible assets

Current liabilities.

Long-term debt

Common shares

Retained earnings (deficit)

Costs of arranging the acquisition

Costs of issuing shares.

$

$

410,200

64,300

98,800

155,600

91,500

Fainal..

On December 31, Year 6, E Ltd. issued 497 shares, with a fair value of $40 each, for 70% of the outstanding shares of J Ltd. Costs

involved in the acquisition, paid in cash, were as follows:

71,800

7,300

$ 109,550

$ 30,100

45,200

46,600

(12,350)

$ 410,200 $ 109,550

S

2,630

1,860

$ 4,490

The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning