key parties who can influence, or will be affected by, your decision?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

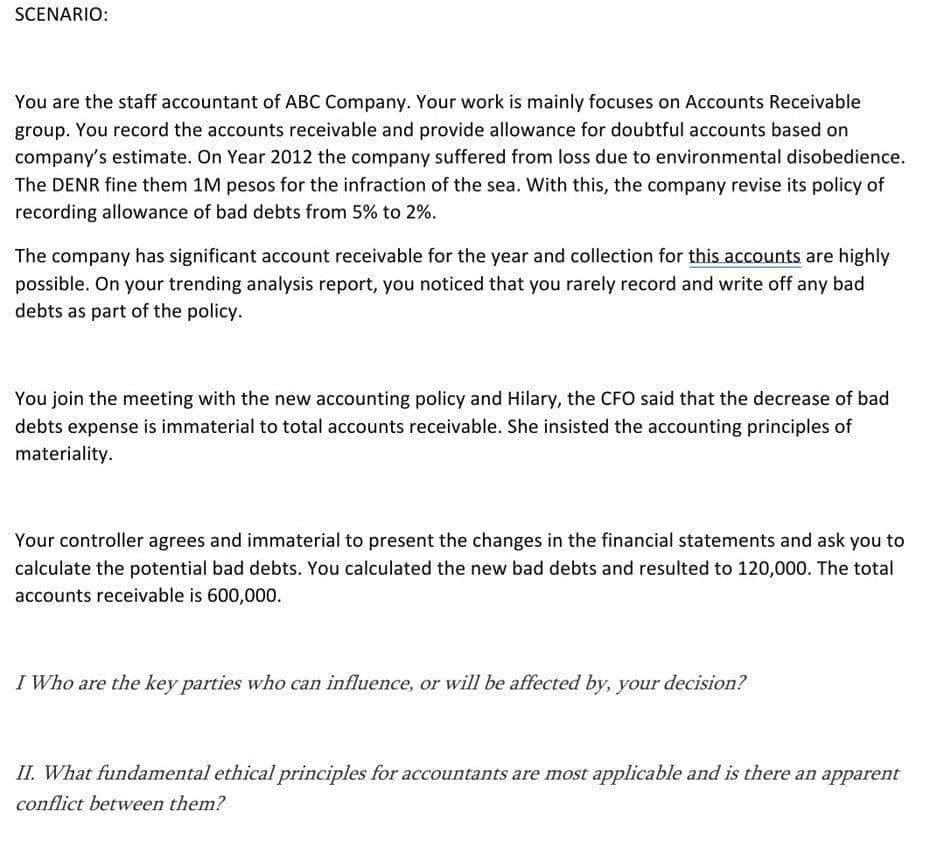

Transcribed Image Text:SCENARIO:

You are the staff accountant of ABC Company. Your work is mainly focuses on Accounts Receivable

group. You record the accounts receivable and provide allowance for doubtful accounts based on

company's estimate. On Year 2012 the company suffered from loss due to environmental disobedience.

The DENR fine them 1M pesos for the infraction of the sea. With this, the company revise its policy of

recording allowance of bad debts from 5% to 2%.

The company has significant account receivable for the year and collection for this accounts are highly

possible. On your trending analysis report, you noticed that you rarely record and write off any bad

debts as part of the policy.

You join the meeting with the new accounting policy and Hilary, the CFO said that the decrease of bad

debts expense is immaterial to total accounts receivable. She insisted the accounting principles of

materiality.

Your controller agrees and immaterial to present the changes in the financial statements and ask you to

calculate the potential bad debts. You calculated the new bad debts and resulted to 120,000. The total

accounts receivable is 600,000.

I Who are the key parties who can influence, or will be affected by, your decision?

II. What fundamental ethical principles for accountants are most applicable and is there an apparent

conflict between them?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning