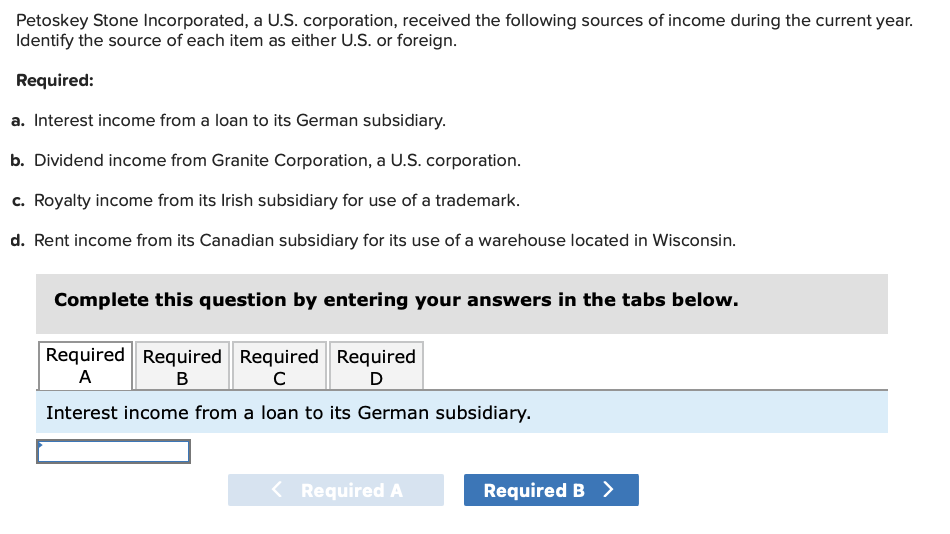

key Stone Incorporated, a U.S. corporation, received the following so fy the source of each item as either U.S. or foreign. red: rest income from a loan to its German subsidiary. dend income from Granite Corporation, a U.S. corporation. alty income from its Irish subsidiary for use of a trademark. t income from its Canadian subsidiary for its use of a warehouse loca

Q: During year 1, Yvo Corp. installed a production assembly line to manufacture furniture. In year 2,…

A: The expenditures are classified as revenue and capital expenditure. The revenue expenditures are…

Q: Sam Smith is a citizen and bona fide resident of Great Britain (United Kingdom). During the current…

A: NOTE- IN THIS CASE WE HAVE SAM SMITH IS THE CITIZEN AND RESIDENT OF GREAT BRETAIN U.K. BUT THE…

Q: V4. In the past five years, Eagle Burger has grown to over 200 stores. Two of the company-operated…

A: Return on investment - commonly referred to as ROI. It depicts the percentage of net profit to total…

Q: What is the company’s total contribution margin under variable costing? 3. What is the company’s net…

A: The income statement is prepared to record the revenues and expenses of the current period. It helps…

Q: An apprenticeship contract is one whereby a firm owner undertakes to provide full vocational…

A: The Answer is "False" Reason: The UAE Companies Law does not prescribe any minimum share capital but…

Q: Jellison Company had the following operating data for its first two years of operations: Variable…

A: Absorption costing: Absorption costing is also called traditional costing. This method of costing…

Q: Oak Canon produces and sells 13,900 units of Product X each month. The selling price of Product X is…

A: Income can be calculated by deducting the variable cost and fixed cost from the sales revenue. The…

Q: Statement 1: Goods displayed in the showroom are not part of the inventories. Statement 2: As…

A: Inventory refers to all goods that are produced and manufactured by a company. The inventory is sold…

Q: Required information Miami Solar manufactures solar panels for industrial use. The company budgets…

A: DIRECT LABOUT BUDGET Direct Labour Budget is the help to Determine the Requirement of Direct…

Q: Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $57,000. The computer was…

A: The practice of allocating the cost of a tangible or physical item over the course of that asset's…

Q: Predict future total costs when sales volume is (a) 378,000 units and (b) 418,000

A: Introduction: - High-low method is one of the techniques that is used to separate fixed and…

Q: The type of retirement income plan where the employer assumes the Investment risk is called Multiple…

A: Group RRSP (Registered Retirement savings plan) is a retirement saving plan in which contributions…

Q: Waco Leather Incorporated, a U.S. corporation, reported total taxable income of $5.05 million.…

A: The amount of foreign income taxes that the taxpayer has paid or is assumed to have paid is equal to…

Q: Keesha Company borrows $170,000 cash on November 1 of the current year by signing a 90-day, 8%,…

A: TIME VALUE OF MONEY Time Value of Money is help to determine the Value of Money in Present or…

Q: On September 1, 2021, Allied Moving Corp. borrows $100,000 cash from First National Bank. Alli…

A: Introduction:- Journal entry is the first stage of accounting process. Journal entry used to record…

Q: Budgeting items: • The principal's salary is fifty thousand dollars ($50,000.00) per month. THREE…

A: A budget is a tactical plan which transforms the overall strategic plan and implementation of an…

Q: The potential investment's profitability index is

A: Profitability index is an important capital budgeting tool and metric. This tool/metric is based on…

Q: Using the least aggregate deferral method, what year should the partnership adopt?

A: A least aggregate deferral method is the method which is used by the partnership so that the tax…

Q: For the accounting memo, Just explain THE CONCEPT of relevant cost. DON'T INCLUDE ANYTHING…

A: Introduction:- Relevant cost primarily used in managerial accounting. The relevant cost concept…

Q: Jane won 10M and has the option of taking all her winnings today, or taking 1.2M today and 1.2M for…

A: Net Present Value - It is the difference between the present value of cash outflow and present value…

Q: Anslo Fabricating, Inc. is authorized to issue 10,000,000 shares of $5 stated value common stock.…

A: ALSO FABRICATING INC…

Q: Required information Four years ago, Sierra Instruments of Monterey, California, spent $200,000 for…

A: The question has asked to compute the cash flow after tax. According to the IRS, the depreciation…

Q: Selected sales and operating data for three divisions of a multinational structural engineering firm…

A: Margin :— It is calculated by dividing net operating income by sales. Turnover :— It is…

Q: S the transactions. ank reconciliation and entries OBJ. 5 Ecount for Capstone Medical Co. at…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: Questions # 21-22 are based on the following: Clothing Emporium was organized on January 1, 2021.…

A: Stockholder's Equity -Stockholder's Equity includes the amount contributed by shareholders issued in…

Q: The management of Woznick Corporation has been concerned for some time with the financial…

A: Variable cost means the cost which vary with the level of output and fixed cost means the cost which…

Q: 2. Compute the July 31 balances of the inventory accounts. Materials Work in Process-Making…

A: Production cost includes direct materials, direct labor and overhead applied. Once the products are…

Q: Which statement is true? All of a company’s identifiable assets and liabilities appear on the…

A: Financial Statements: Official records of a person's, a company's, or another entity's financial…

Q: CreatGordon paid the $10,000 balance of his Federal income tax three months late. Determine the…

A: As per IRS, the Interest is charged when a taxpayer fails to pay tax, penalty, and any additions to…

Q: What are decisions where relevant cost analysis might be used effectively, along with a description…

A: What are decisions where relevant cost analysis might be used effectively, along with a description…

Q: There is a relationship between cost accounting, financial accounting, and management accounting.…

A: Financial and management accounting are two of the most important branches of accounting. They are…

Q: 8% has mature December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield…

A: Bonds are said to be issued at discount when the contract rate or stated interest rate is less than…

Q: Prominent Sdn Bhd produces furniture at several factories. Its Seberang Prai factory produces office…

A: PARTICULARS MACHINE A MACHINE B A SALE REVENUE OF CHAIR (RM) 96000 96000 ( 800 X RM120 ) ( 800…

Q: a. What EPS presentation is required-basic, diluted, or both? b. Compute the required EPS amount(s).…

A: Formula to Calculate EPS: = Earnings available to common stock holders (÷) Weighted Average no.of…

Q: Lars is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there…

A: A1) The correct one is meets the definition of a resident alien. 2020; .Lars meets the definition of…

Q: 1. A small business owner Borrowed Php8,500.00 at 9% for 18 months. How much interest will be repaid…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Service Department Graphics Production Accounting Personnel Cost $200,000 500,000 400,000 Direct…

A: Under Activity based costing method, the cost of each department is based on the consumption of that…

Q: During 2024, Farewell Incorporated had 511,000 shares of common stock and 55,500 shares of 4%…

A: Diluted earning per share = Net income - preferred dividend No.of common shares + Net increase in…

Q: Aliy, Bob, and Casily are parts with expital balance of $100,000, S60,000 and $80,000 and who share…

A: In Bonus method when new partner enters in the partnership than contribution made by the new partner…

Q: Jesse and Mason Fabricating, Inc. general ledger has the following account balances at the end of…

A: The capital of owners gets increased with additional investment and net income. The capital of…

Q: Diego Company manufactures one product that is sold for $78 per unit. The following information…

A: Unit product cost under Variable costing includes the product cost that is direct materials, direct…

Q: Shirley just bought a new car for $900,000 on installments with no downpayment, at 13% interest per…

A: TIME VALUE OF MONEY The time value of money is one of the Important basic financial principle…

Q: investments with low return variances usually: a. have a high return standard deviation b. have…

A: d. none of these options SINCE THE INVESTMENTS WITH LOW RETURN VARIANCE HAS LOW STANDARD…

Q: Riverbend Semiconductor Corporation (RSC) is an Arizona corporation engaged in the manufacture and…

A: Expense can be apportioned on a reasonable basis which can be location wise, product wise. We can…

Q: On Sept. 1, Paddington, Incorporated, issued 1,000 shares of $10 stated value common stock for cash…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Maria Landin is responsible for recording all of the transactions for Marshall’s Home Care, which…

A: These are two different option available to Maria Landin to rectify the accounting error. Option #1…

Q: VII. Polytech Inc. produces a laptop. The selling_price_per unit of the laptop is $500. Data for…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Using the following information: a. Beginning cash balance on March 1, $82,000. b. Cash receipts…

A: Cash Receipt :— It is the cash collection from customer against sale of goods. Cash Disbursement…

Q: Which member of the buying team helps determine the priorities to be addressed when making the…

A: Roles of Purchaser:- One of the responsibilities of the purchaser is to study possible goods,…

Q: Under AASB 119, leave entitlements that may be carried forward to a future financial period if…

A: Leave entitlement is the number of paid holidays allowed to an employee in that year. Accumulative…

please help solve a, b, c, thank you!

Step by step

Solved in 2 steps

- Valley View Inc., a U.S. corporation, formed a wholly owned Mexican corporation to conduct manufacturing and selling operations in Mexico. In its first year of operations, the Mexican corporation reported taxable income of Mex$5,000,000 and paid Mexican income tax of Mex$1,500,000 on its taxable income. In the second year of its operations, the Mexican subsidiary pays a dividend of Mex$2.000,000 to Valley View, Inc. The dividend is subject to a 10 percent withholding tax (Mex$200,000) under the U.S.-Mexico treaty. Assume the currency translation rate for both years is Mex$1:US$0.05.b-1. How much of the dividend from the Mexican subsidiary is subject to U.S. taxation?b-2. Are any of the Mexican taxes imposed on the income distributed creditable to the U.S.?P Corporation is the U.S.-based parent of F Company, a French-based branch. If P Corporation has U.S. taxable income of $100,000 and F Company has a $20,000 loss, what is P Corporation’s worldwide taxable income?Hughes Inc. has a wholly owned subsidiary in Canada that previously had been determined as having the Canadian dollar as its functional currency. Due to a recent restructuring, Hughes Inc.'s CFO believes that the functional currency of the Canadian company has changed to the U.S. dollar. A large cumulative translation adjustment related to the Canadian subsidiary is included in accumulated other comprehensive income on Hughes Inc.'s balance sheet. The CFO is unsure whether the cumulative translation adjustment should be removed from equity, and if so, to what other account it should be transferred. He also questions whether the change in functional currency qualifies as a change in accounting principle, which would require retrospective application of the temporal method in translating the Canadian subsidiary's financial statements. He wonders, for example, whether the Canadian subsidiary's nonmonetary assets need to be restated as if the temporal in applied in previous years.…

- Melissa Corporation is domiciled in Germany and is listed on both the Frankfurt and New York Stock Exchanges. Melissa has chosen to prepare consolidated financial statements in accordance with U.S. GAAP for filing with the U.S. Securities and Exchange Commission but must also prepare consolidated financial statements in accordance with IFRS in accordance with European Union regulations. On December 31, 20X0, Melissa Corporation purchased a small office building for $1,380,000. For tax and financial reporting purposes, Melissa estimates that the building has a useful life of 40 years with an estimated residual value of $100,000. Melissa uses straight-line depreciation for financial reporting. Assume that, for tax purposes, Melissa is permitted to deduct 5% of an asset’s depreciable base in 20X1. This is the only building that Melissa owns. At the end of 20X1, Melissa had the building appraised by a qualified real estate appraiser, who estimated the fair value of the building to be…Sean Regan Company formed a subsidiary in a foreign country on January 1, Year 1, through a combination of debt and equity financing. The foreign subsidiary acquired land on January 1, Year 1, which it rents to a local farmer. The foreign subsidiary’s financial statements for its first year of operations, in foreign currency units (FC), are presented in Exhibit 9.3 . All revenues and expenses were realized in cash during the year. Thus, the balance in the Cash account at December 31 (FC 1,750) is equal to the beginning balance in cash (FC 1,000) plus net income for the year (FC 750). The foreign country experienced significant inflation in Year 1, especially in the second half of the year. The general price index (GPI) during Year 1 was :January 1, Year 1 100Average, Year 1 125December 31, Year 1 200 The rate of inflation in Year 1 is 100 percent [(200 − 100)/100], and the foreign country clearly meets the definition of a hyperinflationary economy. (in FC) January 1…The controller of Pane Co. was preparing the company's financial statements. Pane had a wholly owned subsidiary in a foreign country that used the euro as its currency. At December 31, the exchange rate was $1 U.S. for 1.25 euro. The weighted-average exchange rate for the year was $1 U.S. for 1.50 euro. At December 31, the subsidiary had assets of 1 million euro and revenue for the year of 2 million euro. What amounts would assets and revenue translate for consolidation? Assets Revenue A. $666,666 $1,333,333 B. $666,666 $1,600,000 C. $800,000 $1,333,333 D. $800,000 $1,600,000

- Sendelbach Corporation is a U.S.-based organization with operations throughout the world. One of its subsidiaries is headquartered in Toronto. Although this wholly owned company operates primarily in Canada, it engages in some transactions through a branch in Mexico. Therefore, the subsidiary maintains a ledger denominated in Mexican pesos (Ps) and a general ledger in Canadian dollars (C$). As of December 31, 2020, the subsidiary is preparing financial statements in anticipation of consolidation with the U.S. parent corporation. Both ledgers for the subsidiary are as follows: Main Operation—Canada Debit Credit Accounts payable C$ 21,695 Accumulated depreciation 33,000 Buildings and equipment C$ 173,000 Cash 32,000 Common stock 56,000 Cost of goods sold 209,000 Depreciation expense 7,500 Dividends, 4/1/20 25,000 Gain on sale of equipment, 6/1/20 5,600 Inventory 85,000 Notes…Sendelbach Corporation is a U.S.-based organization with operations throughout the world. One of its subsidiaries is headquartered in Toronto. Although this wholly owned company operates primarily in Canada, it engages in some transactions through a branch in Mexico. Therefore, the subsidiary maintains a ledger denominated in Mexican pesos (Ps) and a general ledger in Canadian dollars (C$). As of December 31, 2020, the subsidiary is preparing financial statements in anticipation of consolidation with the U.S. parent corporation. Both ledgers for the subsidiary are as follows: Main Operation—Canada Debit Credit Accounts payable C$ 21,695 Accumulated depreciation 33,000 Buildings and equipment C$ 173,000 Cash 32,000 Common stock 56,000 Cost of goods sold 209,000 Depreciation expense 7,500 Dividends, 4/1/20 25,000 Gain on sale of equipment, 6/1/20 5,600 Inventory 85,000 Notes…Darwin Ltd, an Australian company, acquires a beneficial interest and becomes the Holding company of an overseas entity in New Zealand, Wellington Ltd. In which currency will Darwin Ltd report its consolidated accounts, which includes its interest in the New Zealand company, Wellington Ltd? Explain the process involved

- Meadows Limited, a foreign subsidiary of U.S. based Meadows Inc. operates primarily for the benefit of its parent company. When the exchange rate was $1.30 per one British Pound Sterling (£), Meadows Limited purchased Inventory for £2,100 pounds. Meadows resells one-third of the inventory for £900 when the exchange rate was $1.26 per Pound Sterling and another one-third for £900 when the exchange rate was $1.28 per Pound Sterling. The parent company applies the temporal method in its process of consolidating the financial results of its subsidiaries with its own financial results. Meadows Inc. reports sales revenue associated with its subsidiary in the amount of: Multiple Choice: $2,340 $2,304 $2,286 $2,268Assume Rosas Company is a resident foreign corporation using OSD, determine the amount of NCITA subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows: November 1, 2020 $ 0.21 = § 1 December 31, 2020 $ 0.22 = § 1 January 1, 2021 $ 0.24 = § 1 January 31, 2021 $ 0.25 = § 1 Average for 2021 $ 0.27 = § 1 What amount would have been reported for this inventory in Dunder’s consolidated balance sheet at December 31, 2020?