Keynesians believe that the multiplier effect of an increase in government spending will be that of a tax cut of the same amount. True or False: A government spending increase can generally begin to impact the economy more rapidly than a tax cut. False True

Keynesians believe that the multiplier effect of an increase in government spending will be that of a tax cut of the same amount. True or False: A government spending increase can generally begin to impact the economy more rapidly than a tax cut. False True

Chapter24: Fiscal Policy

Section: Chapter Questions

Problem 5P

Related questions

Question

I asked this question and was told to resubmit for the other 2 parts. Thank you

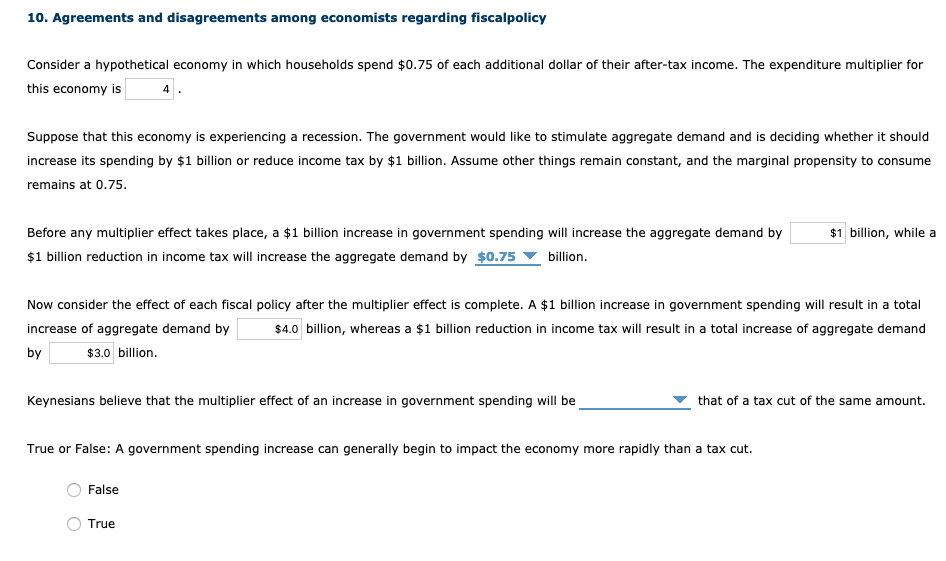

Transcribed Image Text:10. Agreements and disagreements among economists regarding fiscalpolicy

Consider a hypothetical economy in which households spend $0.75 of each additional dollar of their after-tax income. The expenditure multiplier for

this economy is

Suppose that this economy is experiencing a recession. The government would like to stimulate aggregate demand and is deciding whether it should

increase its spending by $1 billion or reduce income tax by $1 billion. Assume other things remain constant, and the marginal propensity to consume

remains at 0.75.

Before any multiplier effect takes place, a $1 billion increase in government spending will increase the aggregate demand by

$1 billion, while a

$1 billion reduction in income tax will increase the aggregate demand by $0.75

billion.

Now consider the effect of each fiscal policy after the multiplier effect is complete. A $1 billion increase in government spending will result in a total

increase of aggregate demand by

$4.0 billion, whereas a $1 billion reduction in income tax will result in a total increase of aggregate demand

by

$3.0 billion.

Keynesians believe that the multiplier effect of an increase in government spending will be

that of a tax cut of the same amount.

True or False: A government spending increase can generally begin to impact the economy more rapidly than a tax cut.

False

True

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning