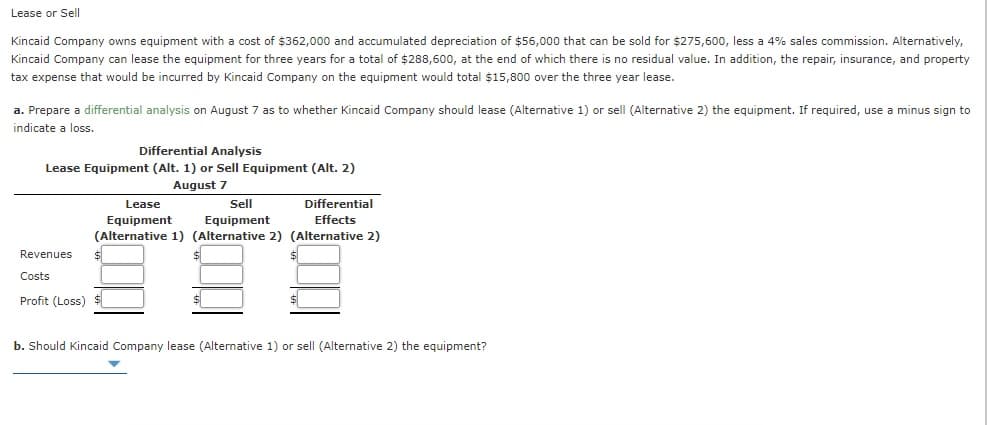

Kincaid Company owns equipment with a cost of $362,000 and accumulated depreciation of $56,000 that can be sold for $275,600, less a 4% sales commission. Alternatively, Kincaid Company can lease the equipment for three years for a total of $288,600, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Kincaid Company on the equipment would total $15,800 over the three year lease. a. Prepare a differential analysis on August 7 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. If required, use a minus sign to indicate a loss. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) August 7 Lease Sell Differential Effects Equipment (Alternative 1) (Alternative 2) (Alternative 2) Equipment Revenues Costs Profit (Loss) b. Should Kincaid Company lease (Alternative 1) or sell (Alternative 2) the equipment?

Kincaid Company owns equipment with a cost of $362,000 and accumulated depreciation of $56,000 that can be sold for $275,600, less a 4% sales commission. Alternatively, Kincaid Company can lease the equipment for three years for a total of $288,600, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Kincaid Company on the equipment would total $15,800 over the three year lease. a. Prepare a differential analysis on August 7 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. If required, use a minus sign to indicate a loss. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) August 7 Lease Sell Differential Effects Equipment (Alternative 1) (Alternative 2) (Alternative 2) Equipment Revenues Costs Profit (Loss) b. Should Kincaid Company lease (Alternative 1) or sell (Alternative 2) the equipment?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 1BE: Lease or sell Plymouth Company owns equipment with a cost of 600,000 and accumulated depreciation of...

Related questions

Question

Transcribed Image Text:Lease or Sell

Kincaid Company owns equipment with a cost of $362,000 and accumulated depreciation of $56,000 that can be sold for $275,600, less a 4% sales commission. Alternatively,

Kincaid Company can lease the equipment for three years for a total of $288,600, at the end of which there is no residual value. In addition, the repair, insurance, and property

tax expense that would be incurred by Kincaid Company on the equipment would total $15,800 over the three year lease.

a. Prepare a differential analysis on August 7 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. If required, use a minus sign to

indicate a loss.

Differential Analysis

Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2)

August 7

Lease

Sell

Differential

Equipment

(Alternative 1) (Alternative 2) (Alternative 2)

Equipment

Effects

Revenues

Costs

Profit (Loss)

b. Should Kincaid Company lease (Alternative 1) or sell (Alternative 2) the equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning