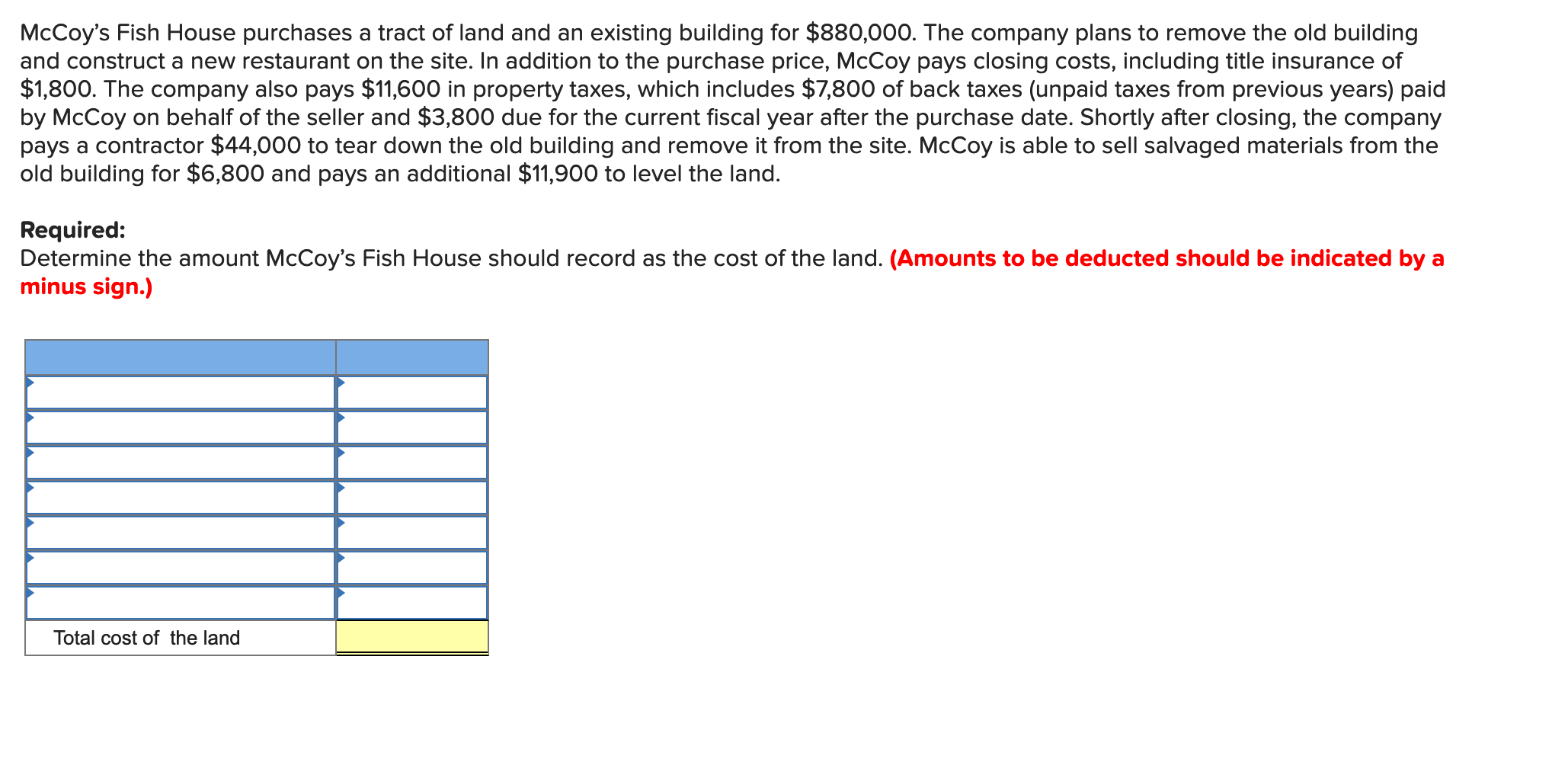

McCoy's Fish House purchases a tract of land and an existing building for $880,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of $1,800. The company also pays $11,600 in property taxes, which includes $7,800 of back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $3,800 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $44,000 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the old building for $6,800 and pays an additional $11,900 to level the land. Required: Determine the amount McCoy's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land

McCoy's Fish House purchases a tract of land and an existing building for $880,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of $1,800. The company also pays $11,600 in property taxes, which includes $7,800 of back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $3,800 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $44,000 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the old building for $6,800 and pays an additional $11,900 to level the land. Required: Determine the amount McCoy's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:McCoy's Fish House purchases a tract of land and an existing building for $880,000. The company plans to remove the old building

and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of

$1,800. The company also pays $11,600 in property taxes, which includes $7,800 of back taxes (unpaid taxes from previous years) paid

by McCoy on behalf of the seller and $3,800 due for the current fiscal year after the purchase date. Shortly after closing, the company

pays a contractor $44,000 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the

old building for $6,800 and pays an additional $11,900 to level the land.

Required:

Determine the amount McCoy's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a

minus sign.)

Total cost of the land

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College