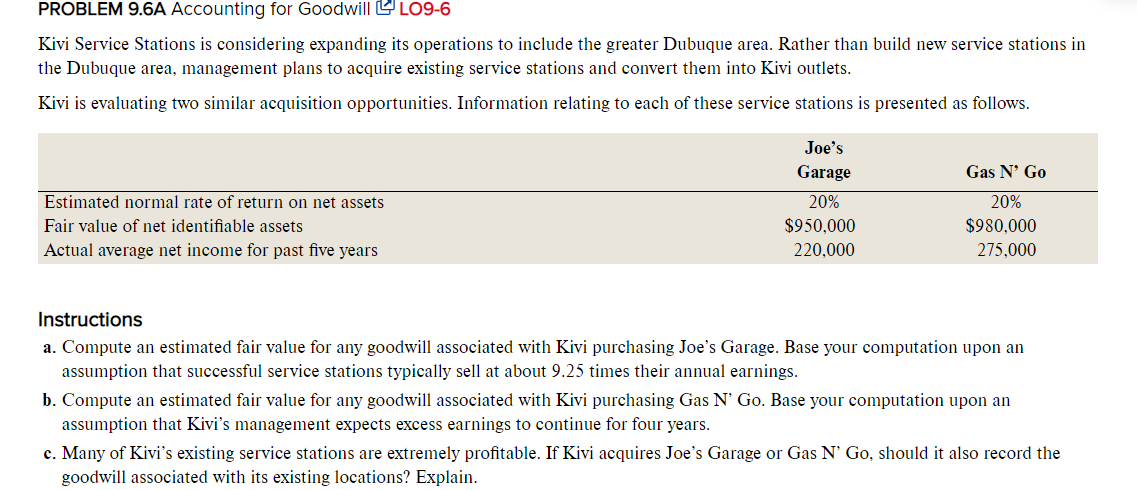

Kivi Service Stations is considering expanding its operations to include the greater Dubuque area. Rather than build new service stations in the Dubuque area, management plans to acquire existing service stations and convert them into Kivi outlets. Kivi is evaluating two similar acquisition opportunities. Information relating to each of these service stations is presented as follows. Joe's Garage Gas N’ Go Estimated normal rate of return on net assets 20% 20% Fair value of net identifiable assets $950,000 $980,000 Actual average net income for past five years 220,000 275,000 Instructions a. Compute an estimated fair value for any goodwill associated with Kivi purchasing Joe's Garage. Base your computation upon an assumption that successful service stations typically sell at about 9.25 times their annual earnings. b. Compute an estimated fair value for any goodwill associated with Kivi purchasing Gas N' Go. Base your computation upon an assumption that Kivi's management expects excess earnings to continue for four years. c. Many of Kivi's existing service stations are extremely profitable. If Kivi acquires Joe's Garage or Gas N' Go, should it also record the goodwill associated with its existing locations? Explain.

Kivi Service Stations is considering expanding its operations to include the greater Dubuque area. Rather than build new service stations in the Dubuque area, management plans to acquire existing service stations and convert them into Kivi outlets. Kivi is evaluating two similar acquisition opportunities. Information relating to each of these service stations is presented as follows. Joe's Garage Gas N’ Go Estimated normal rate of return on net assets 20% 20% Fair value of net identifiable assets $950,000 $980,000 Actual average net income for past five years 220,000 275,000 Instructions a. Compute an estimated fair value for any goodwill associated with Kivi purchasing Joe's Garage. Base your computation upon an assumption that successful service stations typically sell at about 9.25 times their annual earnings. b. Compute an estimated fair value for any goodwill associated with Kivi purchasing Gas N' Go. Base your computation upon an assumption that Kivi's management expects excess earnings to continue for four years. c. Many of Kivi's existing service stations are extremely profitable. If Kivi acquires Joe's Garage or Gas N' Go, should it also record the goodwill associated with its existing locations? Explain.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 5CE

Related questions

Question

Transcribed Image Text:PROBLEM 9.6A Accounting for Goodwill L LO9-6

Kivi Service Stations is considering expanding its operations to include the greater Dubuque area. Rather than build new service stations in

the Dubuque area, management plans to acquire existing service stations and convert them into Kivi outlets.

Kivi is evaluating two similar acquisition opportunities. Information relating to each of these service stations is presented as follows.

Joe's

Garage

Gas N' Go

Estimated normal rate of return on net assets

20%

20%

Fair value of net identifiable assets

$950,000

$980,000

Actual average net income for past five years

220,000

275,000

Instructions

a. Compute an estimated fair value for any goodwill associated with Kivi purchasing Joe's Garage. Base your computation upon an

assumption that successful service stations typically sell at about 9.25 times their annual earnings.

b. Compute an estimated fair value for any goodwill associated with Kivi purchasing Gas N' Go. Base your computation upon an

assumption that Kivi's management expects excess earnings to continue for four years.

c. Many of Kivi's existing service stations are extremely profitable. If Kivi acquires Joe's Garage or Gas N' Go, should it also record the

goodwill associated with its existing locations? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning