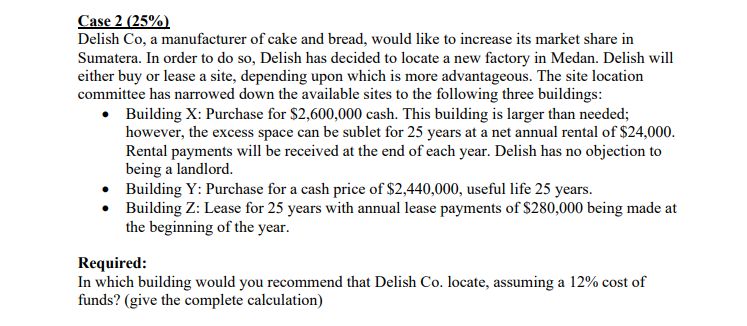

Delish Co, a manufacturer of cake and bread, would like to increase its market share in Sumatera. In order to do so, Delish has decided to locate a new factory in Medan. Delish will either buy or lease a site, depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings: • Building X: Purchase for $2,600,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $24,000. Rental payments will be received at the end of each year. Delish has no objection to being a landlord. • Building Y: Purchase for a cash price of $2,440,000, useful life 25 years. • Building Z: Lease for 25 years with annual lease payments of $280,000 being made at the beginning of the year. Required: In which building would you recommend that Delish Co. locate, assuming a 12% cost of funds?

Delish Co, a manufacturer of cake and bread, would like to increase its market share in

Sumatera. In order to do so, Delish has decided to locate a new factory in Medan. Delish will either buy or lease a site, depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings:

• Building X: Purchase for $2,600,000 cash. This building is larger than needed;

however, the excess space can be sublet for 25 years at a net annual rental of $24,000.

Rental payments will be received at the end of each year. Delish has no objection to

being a landlord.

• Building Y: Purchase for a cash price of $2,440,000, useful life 25 years.

• Building Z: Lease for 25 years with annual lease payments of $280,000 being made at

the beginning of the year.

Required:

In which building would you recommend that Delish Co. locate, assuming a 12% cost of

funds? (give the complete calculation)

Step by step

Solved in 2 steps