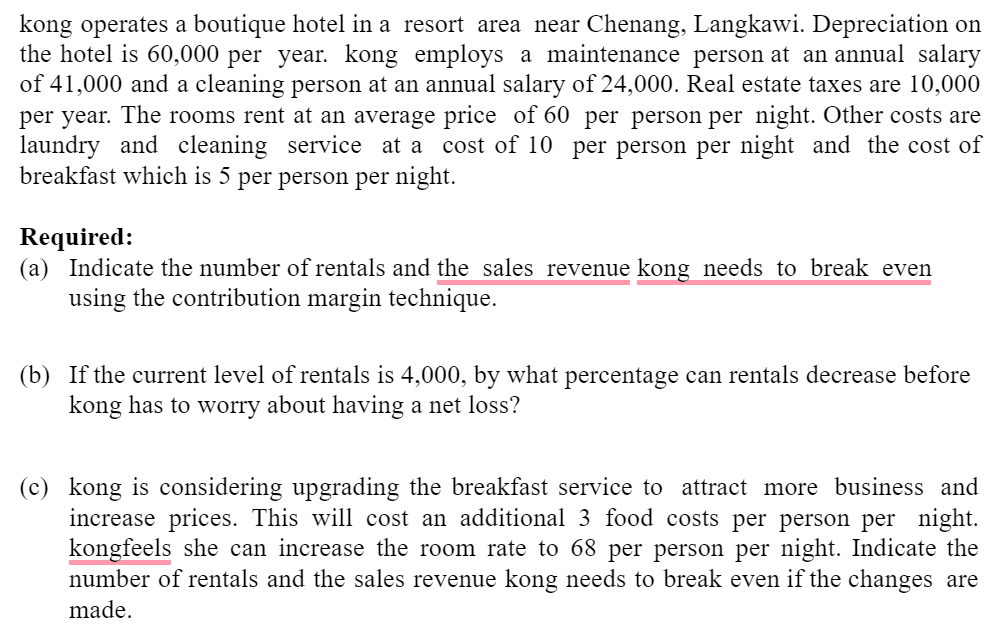

kong operates a boutique hotel in a resort area near Chenang, Langkawi. Depreciation on the hotel is 60,000 per year. kong employs a maintenance person at an annual salary of 41,000 and a cleaning person at an annual salary of 24,000. Real estate taxes are 10,000 per year. The rooms rent at an average price of 60 per person per night. Other costs are laundry and cleaning service at a cost of 10 per person per night and the cost of breakfast which is 5 per person per night. Required: (a) Indicate the number of rentals and the sales revenue kong needs to break even using the contribution margin technique. (b) If the current level of rentals is 4,000, by what percentage can rentals decrease before kong has to worry about having a net loss? (c) kong is considering upgrading the breakfast service to attract more business and increase prices. This will cost an additional 3 food costs per person per night. kongfeels she can increase the room rate to 68 per person per night. Indicate the number of rentals and the sales revenue kong needs to break even if the changes are

kong operates a boutique hotel in a resort area near Chenang, Langkawi. Depreciation on the hotel is 60,000 per year. kong employs a maintenance person at an annual salary of 41,000 and a cleaning person at an annual salary of 24,000. Real estate taxes are 10,000 per year. The rooms rent at an average price of 60 per person per night. Other costs are laundry and cleaning service at a cost of 10 per person per night and the cost of breakfast which is 5 per person per night. Required: (a) Indicate the number of rentals and the sales revenue kong needs to break even using the contribution margin technique. (b) If the current level of rentals is 4,000, by what percentage can rentals decrease before kong has to worry about having a net loss? (c) kong is considering upgrading the breakfast service to attract more business and increase prices. This will cost an additional 3 food costs per person per night. kongfeels she can increase the room rate to 68 per person per night. Indicate the number of rentals and the sales revenue kong needs to break even if the changes are

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 56P: Hassad owns a rental house on Lake Tahoe. He uses a real estate firm to screen prospective renters,...

Related questions

Question

Transcribed Image Text:kong operates a boutique hotel in a resort area near Chenang, Langkawi. Depreciation on

the hotel is 60,000 per year. kong employs a maintenance person at an annual salary

of 41,000 and a cleaning person at an annual salary of 24,000. Real estate taxes are 10,000

per year. The rooms rent at an average price of 60 per person per night. Other costs are

laundry and cleaning service at a cost of 10 per person per night and the cost of

breakfast which is 5 per person per night.

Required:

(a) Indicate the number of rentals and the sales revenue kong needs to break even

using the contribution margin technique.

(b) If the current level of rentals is 4,000, by what percentage can rentals decrease before

kong has to worry about having a net loss?

(c) kong is considering upgrading the breakfast service to attract more business and

increase prices. This will cost an additional 3 food costs per person per night.

kongfeels she can increase the room rate to 68 per person per night. Indicate the

number of rentals and the sales revenue kong needs to break even if the changes are

made.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT