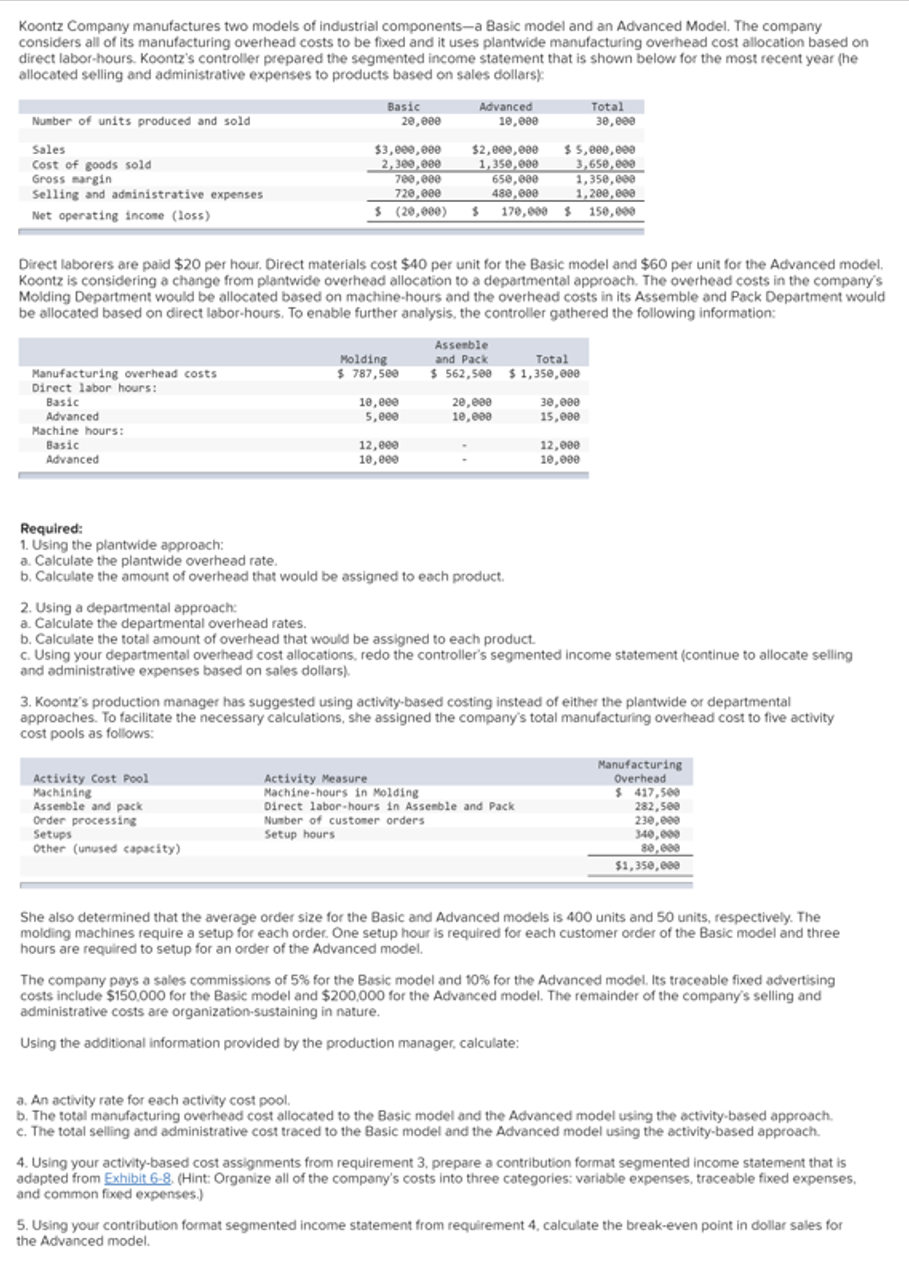

Koontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total 30, e00 Number of units produced and sold 20,000 10,e0e Sales Cost of goods sold Gross nargin Selling and administrative expenses $3,e00,e00 2,300, e00 700,000 720,e00 $2,e00,000 1,350,000 650,000 480,000 $ 170,000 $ 150,000 $ 5,000,009 3,650,000 1,350,e00 1,200,000 Net operating incone (loss) $ (20,000) Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's Molding Department would be allocated based on machine-hours and the overhead costs in its Assemble and Pack Department would be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information: Molding $ 787,5e0 Assenble and Pack $ 562,500 $1358,000 Total Manufacturing overhead costs Direct labor hours: Basic 10,e00 5,e00 20,000 10,e00 30,000 15,000 Advanced Machine hours: Basic Advanced 12,e00 10, e00 12,000 10,000 Required: 1. Using the plantwide approach: a. Calculate the plantwide overhead rate. b. Calculate the amount of overhead that would be assigned to each product. 2. Using a departmental approach: a. Calculate the departmental overhead rates. b. Calculate the total amount of overhead that would be assigned to each product. c. Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars). 3. Koontz's production manager has suggested using activity-based costing instead of either the plantwide or departmental approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to five activity cost pools as follows: Activity Cost Pool Machining Assenble and pack Order processing Setups Other (unused capacíty) Activity Measure Machine-hours in Molding Direct labor-hours in Assenble and Pack Number of customer orders Setup hours Manufacturing Overhead $ 417,500 282,se0 230,000 340,000 $1,350,000 She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is required for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model. The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising costs include $150,000 for the Basic model and $200,000 for the Advanced model. The remainder of the company's selling and administrative costs are organization-sustaining in nature. Using the additional information provided by the production manager, calculate: a. An activity rate for each activity cost pool. b. The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach. c. The total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach. 4. Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented income statement that is adapted from Exhibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common fixed expenses.) 5. Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model.

Koontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total 30, e00 Number of units produced and sold 20,000 10,e0e Sales Cost of goods sold Gross nargin Selling and administrative expenses $3,e00,e00 2,300, e00 700,000 720,e00 $2,e00,000 1,350,000 650,000 480,000 $ 170,000 $ 150,000 $ 5,000,009 3,650,000 1,350,e00 1,200,000 Net operating incone (loss) $ (20,000) Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's Molding Department would be allocated based on machine-hours and the overhead costs in its Assemble and Pack Department would be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information: Molding $ 787,5e0 Assenble and Pack $ 562,500 $1358,000 Total Manufacturing overhead costs Direct labor hours: Basic 10,e00 5,e00 20,000 10,e00 30,000 15,000 Advanced Machine hours: Basic Advanced 12,e00 10, e00 12,000 10,000 Required: 1. Using the plantwide approach: a. Calculate the plantwide overhead rate. b. Calculate the amount of overhead that would be assigned to each product. 2. Using a departmental approach: a. Calculate the departmental overhead rates. b. Calculate the total amount of overhead that would be assigned to each product. c. Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars). 3. Koontz's production manager has suggested using activity-based costing instead of either the plantwide or departmental approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to five activity cost pools as follows: Activity Cost Pool Machining Assenble and pack Order processing Setups Other (unused capacíty) Activity Measure Machine-hours in Molding Direct labor-hours in Assenble and Pack Number of customer orders Setup hours Manufacturing Overhead $ 417,500 282,se0 230,000 340,000 $1,350,000 She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is required for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model. The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising costs include $150,000 for the Basic model and $200,000 for the Advanced model. The remainder of the company's selling and administrative costs are organization-sustaining in nature. Using the additional information provided by the production manager, calculate: a. An activity rate for each activity cost pool. b. The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach. c. The total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach. 4. Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented income statement that is adapted from Exhibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common fixed expenses.) 5. Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model.

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

100%

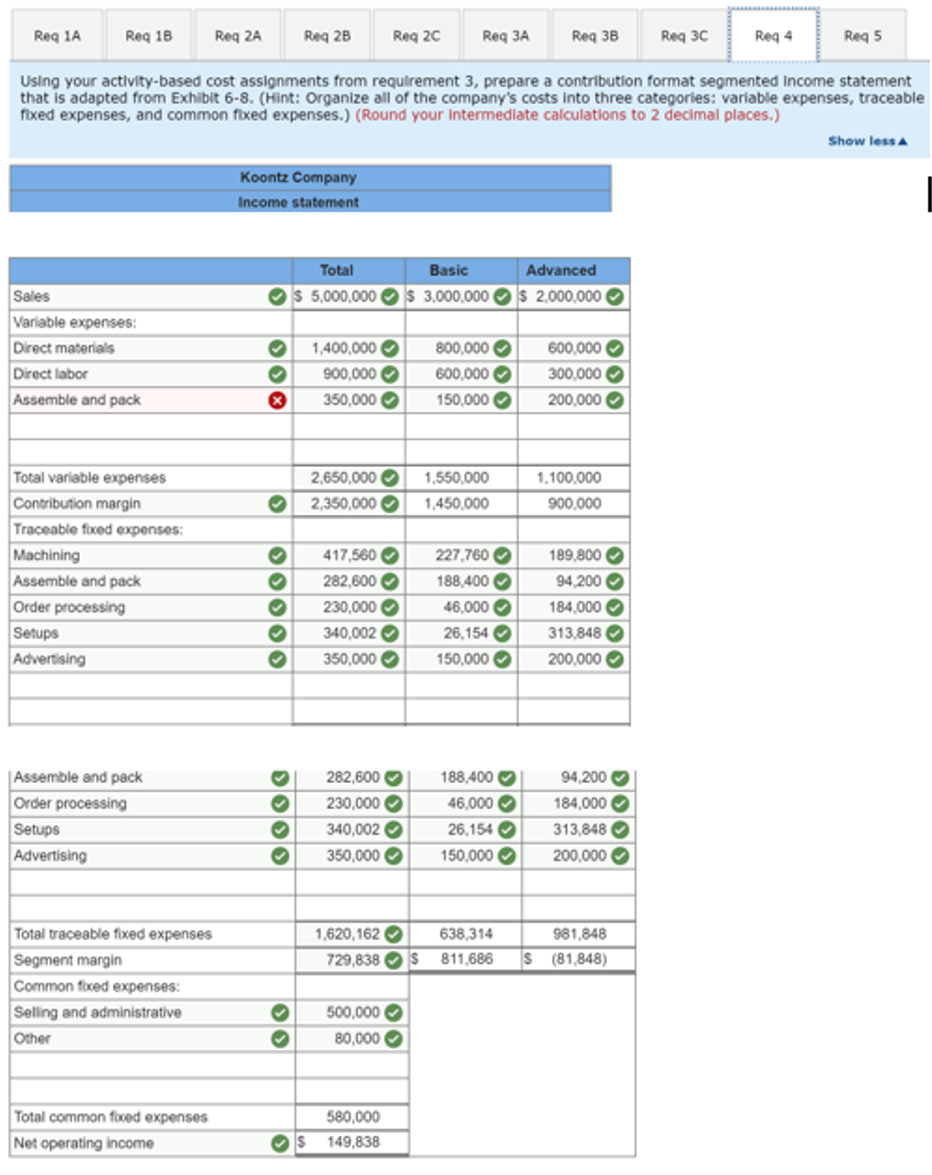

Please help me fix what "Assemble and Pack" should be that was marked incorrect. I think it may be "Sales Comissions" but I am unsure. I know it is not "Selling and Administrative." Thanks!

Transcribed Image Text:Reg 1A

Req 18

Req 2A

Req 28

Req 20

Req 3A

Req 38

Reg 30

Req 4

Req 5

Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented Income statement

that is adapted from Exhibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable

fixed expenses, and common fixed expenses.) (Round your Intermedlate calculations to 2 decimal places.)

Show less A

Koontz Company

Income statement

Total

Basic

Advanced

Sales

Os 5,000,000 Os 3,000,000 Os 2,000,000

Variable expenses:

1,400,000 O

900,000 O

800,000 O

600,000 O

600,000 O

300,000 O

200,000 O

Direct materials

Direct labor

Assemble and pack

350,000 O

150,000 O

Total variable expenses

2,650,000 O

1,550,000

1,100,000

Contribution margin

2,350,000 O

1,450,000

900,000

Traceable foxed expenses:

Machining

417,560 O

282,600 O

227,760 O

189,800 O

188,400 O

46,000 O

Assemble and pack

94,200 O

Order processing

230,000 O

184,000 O

Setups

Advertising

340,002 O

26,154 O

313,848 O

350,000 O

150,000 O

200,000

Assemble and pack

282,600 O

188,400 O

94,200 O

Order processing

230,000 O

340,002 O

46,000 O

26,154 O

184,000 O

Setups

313,848 O

Advertising

350,000 O

150,000 O

200,000 O

Total traceable fixed expenses

1,620,162 O

638,314

981,848

Segment margin

729,838 Os

811,686

(81,848)

Common foxed expenses:

500,000 O

80,000 O

Selling and administrative

Other

Total common foxed expenses

580,000

Net operating income

149,838

O 000

O 0000O

Transcribed Image Text:Koontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company

considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on

direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he

allocated selling and administrative expenses to products based on sales dollars):

Basic

20,000

Total

30,eee

Advanced

Number of units produced and sold

10,000

$3,e00,000

2,300, 000

700,000

720,000

$2,e00,000

1,350,000

65e,000

480,000

170,000 $ 150,000

$ 5,000, e0e

3,650,000

1,350,e00

1,200, eee

Sales

Cost of goods sold

Gross nargin

Selling and administrative expenses

Net operating income (loss)

$ (20,000)

Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model.

Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's

Molding Department would be allocated based on machine-hours and the overhead costs in its Assemble and Pack Department would

be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information:

Assenble

Molding

$ 787,5ee

and Pack

Total

$ 562,508 $ 1,350,000

Manufacturing overhead costs

Direct labor hours:

Basic

18,ee0

5,ee0

20,e00

10,e00

30,000

15,000

Advanced

Machine hours:

Basic

12,eee

10,eee

12,000

10,000

Advanced

Required:

1. Using the plantwide approach:

a. Calculate the plantwide overhead rate.

b. Calculate the amount of overhead that would be assigned to each product.

2. Using a departmental approach:

a. Calculate the departmental overhead rates.

b. Calculate the total amount of overhead that would be assigned to each product.

c. Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling

and administrative expenses based on sales dollars).

3. Koontz's production manager has suggested using activity-based costing instead of either the plantwide or departmental

approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to five activity

cost pools as follows:

Activity Cost Pool

Machining

Assemble and pack

Order processing

Setups

Other (unused capacity)

Activity Measure

Machine-hours in Molding

Direct labor-hours in Assemble and Pack

Number of customer orders

Setup hours

Manufacturing

Overhead

$ 417,500

282,500

230,000

340,000

80,000

$1,350,e00

She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The

molding machines require a setup for each order. One setup hour is required for each customer order of the Basic model and three

hours are required to setup for an order of the Advanced model.

The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising

costs include $150,000 for the Basic model and $200,000 for the Advanced model. The remainder of the company's selling and

administrative costs are organization-sustaining in nature.

Using the additional information provided by the production manager, calculate:

a. An activity rate for each activity cost pool.

b. The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach.

c. The total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach.

4. Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented income statement that is

adapted from Exhibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses,

and common fixed expenses.)

5. Using your contribution format segmented income statement from requirement 4, calcculate the break-even point in dollar sales for

the Advanced model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning