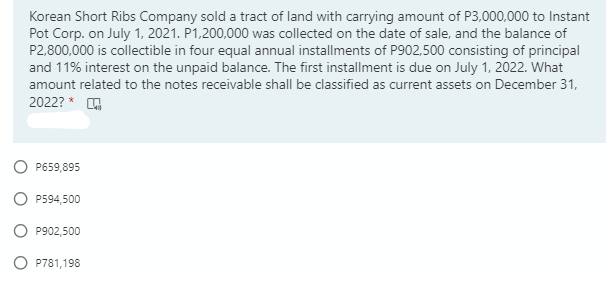

Korean Short Ribs Company sold a tract of land with carrying amount of P3,000,000 to Instant Pot Corp. on July 1, 2021. P1,200,000 was collected on the date of sale, and the balance of P2,800,000 is collectible in four equal annual installments of P902,500 consisting of principal and 11% interest on the unpaid balance. The first installment is due on July 1, 2022. What amount related to the notes receivable shall be classified as current assets on December 31, 2022? *

Korean Short Ribs Company sold a tract of land with carrying amount of P3,000,000 to Instant Pot Corp. on July 1, 2021. P1,200,000 was collected on the date of sale, and the balance of P2,800,000 is collectible in four equal annual installments of P902,500 consisting of principal and 11% interest on the unpaid balance. The first installment is due on July 1, 2022. What amount related to the notes receivable shall be classified as current assets on December 31, 2022? *

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 29CE

Related questions

Question

Question 54

Choose the correct answer from the choices.

Transcribed Image Text:Korean Short Ribs Company sold a tract of land with carrying amount of P3,000,000 to Instant

Pot Corp. on July 1, 2021. P1,200,000 was collected on the date of sale, and the balance of

P2,800,000 is collectible in four equal annual installments of P902,500 consisting of principal

and 11% interest on the unpaid balance. The first installment is due on July 1, 2022. What

amount related to the notes receivable shall be classified as current assets on December 31,

2022? * O

P659,895

P594,500

O P902,500

P781,198

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning