Kramer Corp. began the current period with 4,030 units in process that were 100% complete as to materials and 60% complete as to conversion. Costs of $7,500 in direct materials and $4,720 in conversion costs were incurred in manufacturing those units in the previous period. Kramer ended the current period with 20,100 units completed and 5,010 units still in process. Work in process was 100% complete as to materials and 70% complete as to conversion costs. Kramer incurred $68,000 in direct materials costs, $7,190 in direct labor costs, and $40,100 in manufacturing overhead costs during the period. Required: a. Using the weighted average method, compute the equivalent units of production for materials. Equivalent Units b. Using the weighted average method, compute the equivalent units of production for conversion. Equivalent Units c. Using the weighted average method, compute the cost per equivalent unit for materials. (Round your answer to 2 decimal places.) Cost per Equivalent Unit

Kramer Corp. began the current period with 4,030 units in process that were 100% complete as to materials and 60% complete as to conversion. Costs of $7,500 in direct materials and $4,720 in conversion costs were incurred in manufacturing those units in the previous period. Kramer ended the current period with 20,100 units completed and 5,010 units still in process. Work in process was 100% complete as to materials and 70% complete as to conversion costs. Kramer incurred $68,000 in direct materials costs, $7,190 in direct labor costs, and $40,100 in manufacturing overhead costs during the period. Required: a. Using the weighted average method, compute the equivalent units of production for materials. Equivalent Units b. Using the weighted average method, compute the equivalent units of production for conversion. Equivalent Units c. Using the weighted average method, compute the cost per equivalent unit for materials. (Round your answer to 2 decimal places.) Cost per Equivalent Unit

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 16E: Heap Company manufactures a product that passes through two processes: Fabrication and Assembly. The...

Related questions

Question

Please answer all, it is all one question!

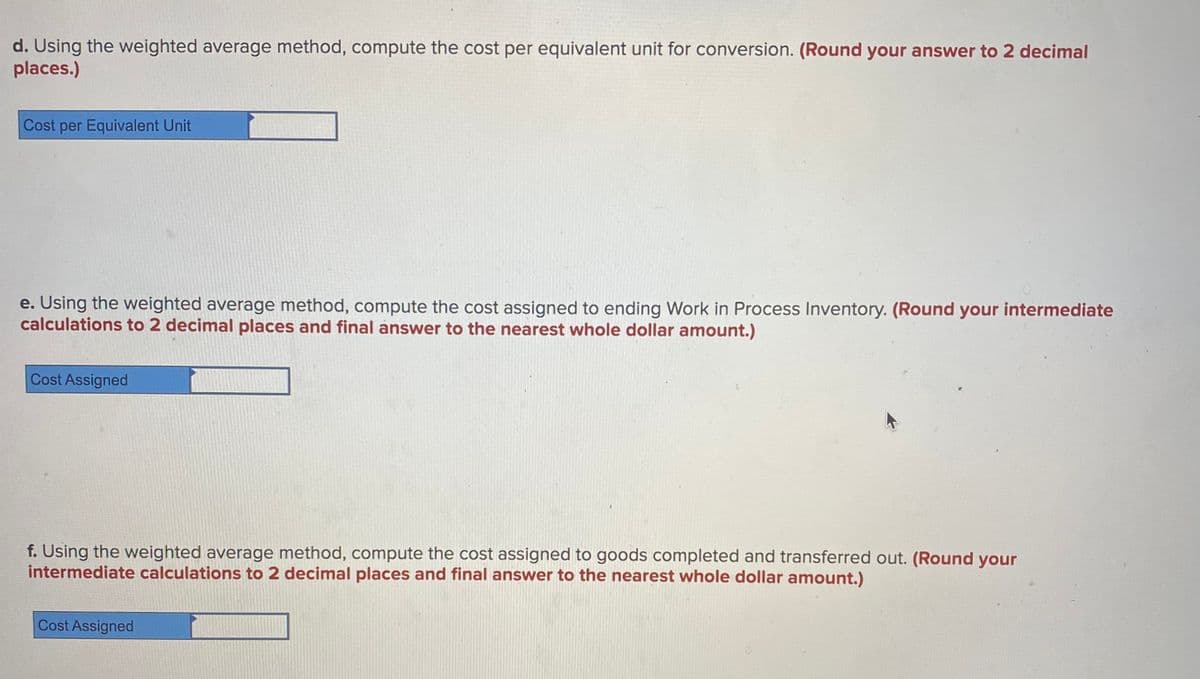

Transcribed Image Text:d. Using the weighted average method, compute the cost per equivalent unit for conversion. (Round your answer to 2 decimal

places.)

Cost per Equivalent Unit

e. Using the weighted average method, compute the cost assigned to ending Work in Process Inventory. (Round your intermediate

calculations to 2 decimal places and final answer to the nearest whole dollar amount.)

Cost Assigned

f. Using the weighted average method, compute the cost assigned to goods completed and transferred out. (Round your

intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.)

Cost Assigned

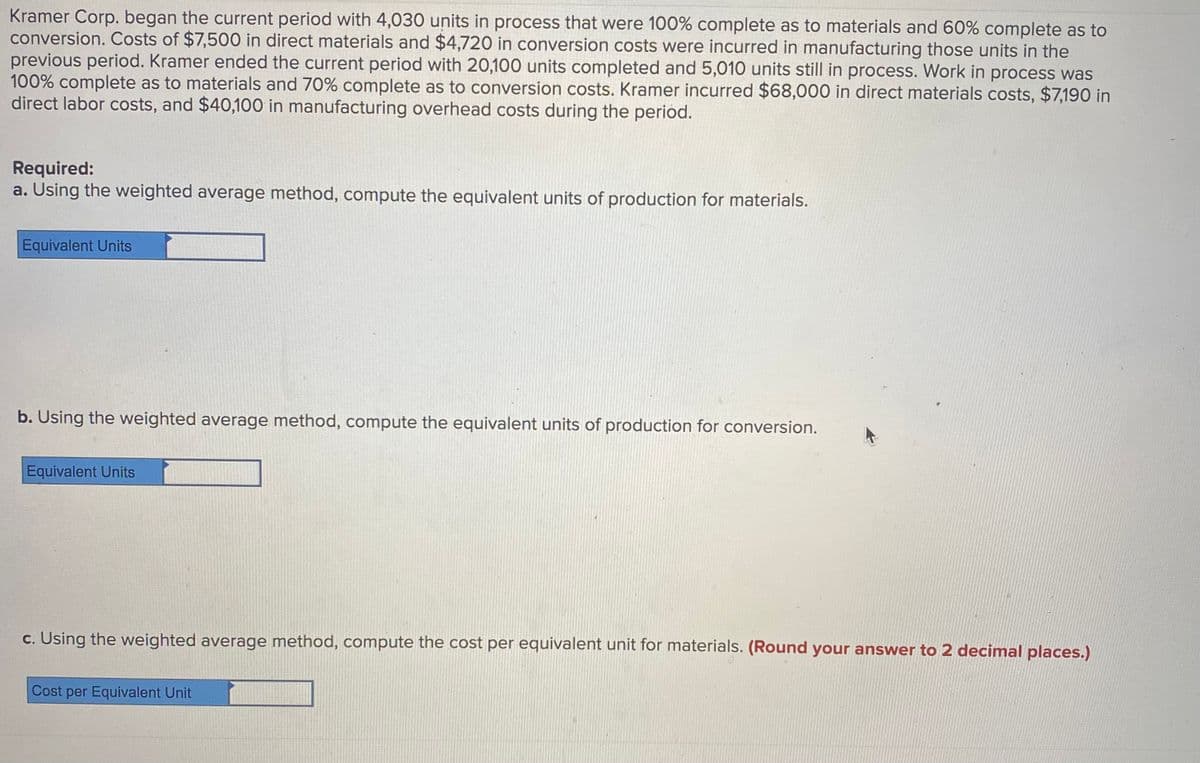

Transcribed Image Text:Kramer Corp. began the current period with 4,030 units in process that were 100% complete as to materials and 60% complete as to

conversion. Costs of $7,500 in direct materials and $4,720 in conversion costs were incurred in manufacturing those units in the

previous period. Kramer ended the current period with 20,100 units completed and 5,010 units still in process. Work in process was

100% complete as to materials and 70% complete as to conversion costs. Kramer incurred $68,000 in direct materials costs, $7,190 in

direct labor costs, and $40,100 in manufacturing overhead costs during the period.

Required:

a. Using the weighted average method, compute the equivalent units of production for materials.

Equivalent Units

b. Using the weighted average method, compute the equivalent units of production for conversion.

Equivalent Units

c. Using the weighted average method, compute the cost per equivalent unit for materials. (Round your answer to 2 decimal places.)

Cost per Equivalent Unit

Expert Solution

Step 1

Dear student as per guidelines we can answer only three first three interlinked subarts plelase post other parts separately.Thanku

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,