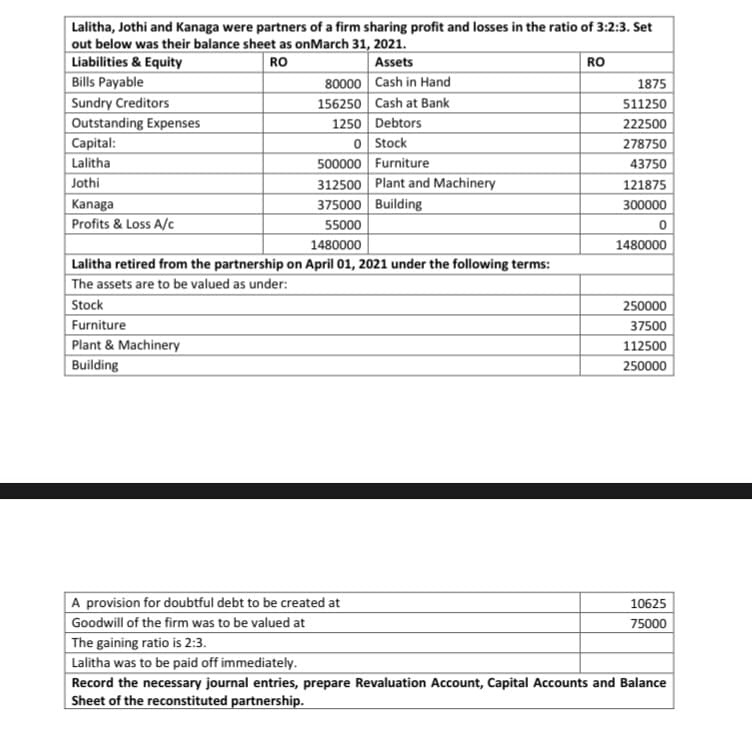

Lalitha, Jothi and Kanaga were partners of a firm sharing profit and losses in the ratio of 3:2:3. Set out below was their balance sheet as onMarch 31, 2021. Liabilities & Equity Bills Payable RO Assets RO 80000 Cash in Hand 156250 Cash at Bank 1250 Debtors 0 Stock 500000 Furniture 312500 Plant and Machinery 375000 Building 1875 Sundry Creditors 511250 Outstanding Expenses Capital: 222500 278750 Lalitha 43750 Jothi 121875 Kanaga Profits & Loss A/c 300000 55000

Q: In Sheridan Co. capital balances are Irey $40,000 and Pedigo $56.600. The partners share income…

A: Admission of the partner is the process where a new person is added into the business of partnership…

Q: The balance sheet for Coney, Honey, and Money partnership shows the following information as of…

A: Note: Since you have posted multiple questions, we will solve the first question. Please submit a…

Q: The following is the Balance Sheet of Tahani and Alaa sharing profit and losses in the ratio of 2 :…

A: Let's understand the basics Partnership is an agreement between two or more people to oversee…

Q: Prepare the opening journal entries in the books of the partnership.

A: Given that: On April 8, 2018, Tolentino who has her own retail business and Tan, decided to form a…

Q: Links Comments Header & Footer Lalitha, Jothi and Kanaga were partners of a firm sharing profit and…

A: Partners Old sharing Ratio is 3:2:3 New Sharing Ratio is 2:3 Gaining Ratio is also2:3

Q: The following is the trail Balance of X and Y Co. as on March 31, 2021. The partners sharing profits…

A: Appropriation of profit and loss defines the distribution of loss or profit of the entity between…

Q: Jo, Pat and Espie are partners in a marketing consultancy firm and share profits and losses in the…

A: Liquidation of partnership is done through the Realization account. All the assets and liabilities…

Q: X, Y and Z were partners sharing profits in the proportion of 3:2:1. Y Retires from the business.…

A: Journal Entries: Particulars Dr. Cr. 1. Revaluation A/c Dr 18300…

Q: Ali, Ben and Cathy have been in partnership for many years sharing profits and losses based on the…

A:

Q: Kareen Labor, Lalaine Dajao and Leah Magno were partners in a business engaged in printing and…

A: Journal entries (JE) refers to posting of the transactions into the books of the entity and it is…

Q: Ahmed and Wahid are partners sharing profits and losses in the ratio of 3:1. Their Balance sheet as…

A: NOTE : As per BARTLEBY guidelines, when multiple questions are given then first question is to be…

Q: appropriation account and the current account for

A: Paul and Carl are partner sharing profit in their capital ratio i e 4 : 1 In trial balance Capital…

Q: Blanche, Rose and Dorothy own and run a small hotel in partnership. They share profits and losses…

A: All amounts are in dollar ($).

Q: The accounts of Kelly, Loise, and Kyla, who share profits in a 5:3:2 ratio, are as follows on…

A: Liquidation of Partnership Firm: Dissolving a partnership firm entails ceasing to do business under…

Q: The accounts of Kelly, Loise, and Kyla, who share profits in a 5:3:2 ratio, are as follows on…

A: Given Profit-sharing Ratio 5 : 3 : 2 Kyla Received 27500 on her final settlement.

Q: Charles, Diana, William are partners in a family business, CDW Partners. Their abridged statement of…

A: Part (i) CDW Partners Journal Entry Particulars Amount (Dr) Amount (Cr) Land And…

Q: Ahmed and Wahid are partners sharing profits and losses in the ratio of 3:1. Their Balance sheet as…

A: Here we will first pass journal enntries for revaluarion and then we will prepare…

Q: Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of…

A: Given Information: Profit sharing ratio = 5:3:2 Non-cash assets sold for = P95,000

Q: Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of…

A: Statement of liquidation presents the manner in which, assets are realized, liabilities are settled,…

Q: X,Y,Z were partners in a firm whose Balance Sheet as on 31st March 2013 was as under: BALANCE SHEET…

A:

Q: Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000…

A: The Indian Partnership Act, 1932 defines Partnership in the following terms: “ Partnership is the…

Q: Abhay, Siddharth and Kusum are partners in a firm, sharing profits in theratio of 5:3:2. Kusum is…

A: Profit and loss Appropriation…

Q: A, B and C were partners sharing profits and losses in the proportion 5:3:2 respectively. Their…

A:

Q: 1. Nita and Bona entrepreneurs, agreed to invest cash to put up a business selling signature bags.…

A: A partnership seems to be a structure of two or more individuals who engage to conduct a legitimate…

Q: The balance sheet for Coney, Honey, and Money partnership shows the following information as of…

A: Partnership refers to the formal agreement between two or more person who agreed to carry out the…

Q: The partners of Blossom Company have decided to liquidate their business. Noncash assets were sold…

A: Partnership: This is the form of business entity that is formed by an agreement, owned and managed…

Q: Required: (a) The adjusted profit or loss for tax purposes for the year ended 31 December 2017.…

A: Njagi and Otieno are partners running a glass making plant and the profit and loss account is…

Q: Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in the ratio of 3:3:2.…

A: Partnership- Partnership refers to the form of organization that is incorporated with the mutual…

Q: Ahmed and Wahid are partners sharing profits and losses in the ratio of 3:1. Their Balance sheet as…

A: Revaluation of the account is mandatory when there is an admission of a new partner in the business.…

Q: Bedin, Ceyla and Deris have been in a partnership for a number of years, sharing profits in the…

A: Purpose of Preparation of Realization Account : Transferring all the assets except Cash or Bank…

Q: In Sandhill Co., capital balances are Irey $39,300 and Pedigo $56,900. The partners share income…

A: The question is based on the concept of Business Transaction Analysis.

Q: The following Information was obtained from the records of Alben Traders, a partnership business…

A: Here in this case, we are required to calculate net profit amount. We know that, partners share are…

Q: On May 1, 2022, Carlo has been in a trading business for five years as a sole proprietor. He needed…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: 1. Ben and Bob are partners in a business selling sports wear and equipment which the organized in…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: P,Q and R were carrying on a business in partnership, sharing profits and losses in the ratio of…

A:

Q: On June 1, 2022 Bedu, Budi, and Bobi were three friends who wanted to form a new firm which would be…

A: Partnership is one of type of business formation where two or more individuals come together and…

Q: Teoh, Meng and Chen are partners sharing profits and losses equally. The business performs has the…

A: Solution Ledger Account contains a record of business transaction . It is a separate record within…

Q: Teoh, Meng and Chen are partners sharing profits and losses equally. The business performs has the…

A: In the context of the given question, we can prepare the ledger accounts to close the books of the…

Q: The balance sheet for Coney, Honey, and Money partnership shows the following information as of…

A: Asset is an item which can be converted into near future and have then ownership by the individual…

Q: The balance sheet for Coney, Honey, and Money partnership shows the following information as of…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: The following are balances of a partnership between Shoe and Lace as at 2021 December 31: DR CR…

A: Partnership Account - Partnership Account includes two or more individual form together for the…

Q: CABLES General Professional Partnership, a business formed by Carlo and Jamie, have the following…

A: The average capital of partners is calculated on the basis of time period for the capital balance…

Q: Tim and Ray are partners in Double Good Trading. They share the profits and losses equally. The…

A: Profit and Loss Appropriation Account is next step after Profit and Loss Account.

Q: In Indigo Co., capital balances are Adrienne $61,000 and Dino $79,000. The partners share income…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: A Devine and Vicky are partners dealing in cosmetics and other assorted goods. They share profit and…

A: A) Income Statement of the partnership firm for the year ended 31st December, 2020 Particulars…

Q: Mhustration 12 Raesh, Kanesh and Suresh are partners of a firm sharing profits and losses in 3:2:1…

A: “Since you have asked multiple question, we will solve the first question for you( Illustration 12)…

Q: Teoh, Meng and Chen are partners sharing profits and losses equally. The business performs has the…

A: Revaluation account Particulars Amount (RM) Particulars Amount (RM) To Partner's capital…

Q: The information given below was extracted from the accounting records of Veco Traders, a partnership…

A: SOLUTION- PARTNER CURRENT ACCOUNT BALANCE AS ON 1 MARCH 20Y1 BOBBY -R 82600 (CREDIT) VINCENT -…

Q: The balance sheet for Coney, Honey, and Money partnership shows the following information as of…

A: Partnership means where two or more person comes together to do some common business activity and…

Step by step

Solved in 2 steps with 1 images

- The information given below was extracted from the accounting records of Veco Traders, a partnershipbusiness with Bobby and Vincent.Required:Prepare the Statement of Changes in Equity as at: 28 February 2021.INFORMATIONBalances in the ledger 28 February 2019Debit CreditCapital: Bobby 500 000Capital: Vincent 300 000Current account: Bobby (1 Mar 2020) 20 000Current account: Vincent (1 Mar 2020) 15 000Drawings: Bobby 250 000Drawings: Vincent 200 000Additional information1.The net profit according to the Profit and Loss account amounted to R500 000 on 28February 2021.2.The partnership agreement made provision for the following:1.Interest on capital must be provided at 15% per annum on the balances in the capitalAccounts from 1 March 2020 to 31 August 2020. With effect from 1 September 2019 theinterest rate on capital increases to 18% per annum.2.The partners are entitled to the following monthly salaries: Bobby R11 000Vincent R10 0003.Bobby is entitled to a bonus of 15% of the net profit…Tim and Ray are partners in Double Good Trading. They share the profits and losses equally. The balances extracted from their books as at 31 December 2020 are shown below: $ $ Capital Accounts: Tim 60000 Ray 60000 Current Accounts: Tim 3000 Ray 5000 Drawings: Tim 10000 Ray 10000 Closing inventory 26000 Motor vehicles 80500 Cash 3250 Bank 7460 Trade Debtors 25860 Trade Creditors 28220 Profit & Loss Account for 2020 16850 168070 168070 Additional information: i. After the Profit and Loss Account was prepared, Tim realised that there was an accrued utilities charge amounting to $1,200 that was not recorded. ii. The interest on capital is at 6% per annum. iii. The interest on drawings is at 8% per annum. iv. Tim is to be paid a salary of $24,000 per annum Required: Prepare the Profit and Loss Appropriation Account for the year ended 31 December 2020, and the…The following is the balance sheet of P, Q and R who were sharing profits and losses in the proportion of 4:3:2 as on 31st March 2009 Liabilities RO Assets RO Capitals P Q R P’s Loan Provision for taxation Accounts Payables 80,000 45,000 35,000 7,000 3,000 56,000 226,000 Premises Fixtures and fittings Joint life policy Stock Accounts receivables Cash 85,000 20,000 10,000 68,000 40,000 3,000 226,000 Q decides to retire from the business due to her marriage. It is agreed that Commission accrued but not received RO 6,000 be brought into accounts Provision for taxation need not be maintained as there is no liability attached to it The surrender value of the joint life policy is RO 8,000 Premises is appreciated by RO 12,000 Fixtures and fitting and stock to be depreciated by 10% Goodwill of the entire firm be fixed at RO 21,600 and Q’s share if it be adjusted through the capital accounts of P and R…

- The information given below was extracted from the accounting records of Ndlove Traders, a partnership business with Brian and Taryn as partners. REQUIRED Use the information provided to prepare the Statement of Changes in Equity for the year ended 29 February 2020. INFORMATION Extract from the ledger of Britar Traders as at 29 February 2020 Debit Credit R R Capital: Brian 900 000 Capital: Taryn 600 000 Current a/c: Brian (01 March 2019) 50 000 Current a/c: Taryn (01 March 2019) 30 000 Drawings: Brian 350 000 Drawings: Taryn 250 000 The following must be taken into account: 1. On 29 February 2020 the Statement of Comprehensive Incomec reflected, amongst others, the following: Sales R1 200 000 Sales returns R50 000 Net profit R700 000 2. The partners earn interest at 12% p.a. on their capital balances. Note: Brian increased his capital…Prepare the Statement of Changes in Equity of Camray Traders for the year ended 28 February 2021. The information given below was extracted from the accounting records of Camray Traders, a partnership business with Camy and Raymond as partners. The financial year ends on the last day of February each year. Balances in the ledger on 28 February 2021 Debit Credit R R Capital: Camy 1 200 000 Capital: Raymond 800 000 Current a/c: Camy (01 March 2020) 50 000 Current a/c: Raymond (01 March 2020) 60 000 Drawings: Camy 360 000 Drawings: Raymond 320 000 The following must be taken into account: (a) The net profit according to the statement of comprehensive income amounted to R1 400 000 on 28 February 2021. (b) The partnership agreement made provision for the following: ¦ Interest on capital must be provided at 18% per annum on the balances in the capital accounts. Note: Camy increased her capital by R240 000 on 01 September 2020. Raymond decreased his capital by R120 000 on the same date. The…Kareen Labor, Lalaine Dajao and Leah Magno were partners in a business engaged in printingand publishing. The statement of financial position reveals that their business has no obligationto outside creditors. The partners share profit or loss 30%, 20%, and 50%, respectively. ASSETS PARTNER'S EQUITYCash 120,000 Labor, Capital 400,000Accounts receivable 150,000 Dajao, Capital 280,000Inventory 260,000 Magno, Capital 150,000Equipment 300,000Total 830,000 Total 830,000 On January 1, 2021, the partners agree to admit Jimwell Acenas as a new partner afterconsidering the following revaluation and adjustments:1. Allowance for doubtful accounts of P20,000 is to be established for possible uncollectibleaccount.2. Inventories should be recorded at their net realizable value of P240,000.3. The net book value of the equipment should be adjusted at…

- Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000 respectively. Doy has a loan balance of P 4,000. Profits and losses are shared 40%; 30%; 20%; 10% by Doy, Rey, May, and Fay respectively. Assuming assets were sold and liabilities paid and the balance of cash showed P 24,000. Prepare a schedule showing how the P 24,000 will be distributed to the partners.Simmi and Sonu are partners in a firm, sharing profits and losses in the ratioof 3:1. The profit and loss account of the firm for the year ending March 31, 2017 shows a net profit of Rs. 1,50,000. Prepare the Profit and LossAppropriation Account by taking into consideration the following information:(i) Partners capital on April 1, 2016;Simmi, Rs. 30,000; Sonu, Rs. 60,000; (ii) Current accounts balances on April 1, 2016; Simmi, Rs. 30,000 (cr.); Sonu, Rs. 15,000 (cr.);(iii) Partners drawings during the year amounted to Simmi, Rs. 20,000; Sonu, Rs. 15,000;(iv) Interest on capital was allowed @ 5% p.a.;(v) Interest on drawing was to be charged @ 6% p.a. at an average of six months;(vi) Partners’ salaries : Simmi Rs. 12,000 and Sonu Rs. 9,000. Also show the partners’ current accounts.Chan, Tan and Eric were in partnership sharing profits and losses in the ratio Chan 2/3, Tan 1/4 and Eric 1/12. Their summarized Balance Sheet as at 31 October 2019 was as follows: $$$ $ $ $ $$$ Fixed Assets (at Book Value) Premises 120 000 Machinery 60 000 Motor Vehicle 9 000 189 000 Current Assets Stock 14 200 Debtors 18 000 less Provision for Doubtful Debts 360 17 640 Bank 16 160 48 000 237 000 Capital Accounts Chan…

- Chan, Tan and Eric were in partnership sharing profits and losses in the ratio Chan 2/3, Tan 1/4 and Eric 1/12. Their summarized Balance Sheet as at 31 October 2019 was as follows: $$$ $ $ $ $$$ Fixed Assets (at Book Value) Premises 120 000 Machinery 60 000 Motor Vehicle 9 000 189 000 Current Assets Stock 14 200 Debtors 18 000 less Provision for Doubtful Debts 360 17 640 Bank 16 160 48 000 237 000 Capital Accounts Chan…Chan, Tan and Eric were in partnership sharing profits and losses in the ratio Chan 2/3, Tan 1/4 and Eric 1/12. Their summarized Balance Sheet as at 31 October 2019 was as follows: $$$ $ $ $ $$$ Fixed Assets (at Book Value) Premises 120 000 Machinery 60 000 Motor Vehicle 9 000 189 000 Current Assets Stock 14 200 Debtors 18 000 less Provision for Doubtful Debts 360 17 640 Bank 16 160 48 000 237 000 Capital Accounts Chan…Chan, Tan and Eric were in partnership sharing profits and losses in the ratio Chan 2/3, Tan 1/4 and Eric 1/12. Their summarized Balance Sheet as at 31 October 2019 was as follows: $$$ $ $ $ $$$ Fixed Assets (at Book Value) Premises 120 000 Machinery 60 000 Motor Vehicle 9 000 189 000 Current Assets Stock 14 200 Debtors 18 000 less Provision for Doubtful Debts 360 17 640 Bank 16 160 48 000 237 000 Capital Accounts…