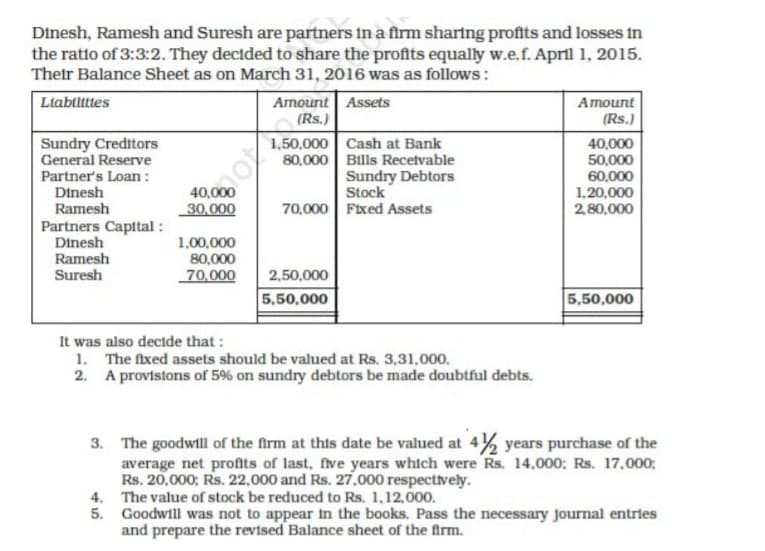

Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in the ratio of 3:3:2. They dectded to share the profits equally w.e.f. April 1, 2015. Thetr Balance Sheet as on March 31, 2016 was as follows: Ltabtltttes Arnount Assets (Rs.) Amount (Rs.) Sundry Creditors General Reserve Partner's Loan: Dinesh Ramesh Partners Capital : Dinesh Ramesh Suresh 1,50,000 Cash at Bank 80,000 Bills Recetvable Sundry Debtors Stock 70,000 Fixed Assets 40,000 50,000 60,000 40,000 _30,000 1,20,000 2,80,000 1,00,000 80,000 70,000 2,50,000 5,50,000 5,50,000 It was also decide that : 1. The fixed assets should be valued at Rs. 3,31,000. 2. A provisions of 5% on sundry debtors be made doubtful debts. 3. The goodwill of the firm at this date be valued at 4% years purchase of the average net profts of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22.000 and Rs. 27,000 respectively. 4. The value of stock be reduced to Rs. 1,12,000. 5. Goodwill was not to appear in the books. Pass the necessary journal entrtes and prepare the revised Balance sheet of the firm.

Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in the ratio of 3:3:2. They dectded to share the profits equally w.e.f. April 1, 2015. Thetr Balance Sheet as on March 31, 2016 was as follows: Ltabtltttes Arnount Assets (Rs.) Amount (Rs.) Sundry Creditors General Reserve Partner's Loan: Dinesh Ramesh Partners Capital : Dinesh Ramesh Suresh 1,50,000 Cash at Bank 80,000 Bills Recetvable Sundry Debtors Stock 70,000 Fixed Assets 40,000 50,000 60,000 40,000 _30,000 1,20,000 2,80,000 1,00,000 80,000 70,000 2,50,000 5,50,000 5,50,000 It was also decide that : 1. The fixed assets should be valued at Rs. 3,31,000. 2. A provisions of 5% on sundry debtors be made doubtful debts. 3. The goodwill of the firm at this date be valued at 4% years purchase of the average net profts of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22.000 and Rs. 27,000 respectively. 4. The value of stock be reduced to Rs. 1,12,000. 5. Goodwill was not to appear in the books. Pass the necessary journal entrtes and prepare the revised Balance sheet of the firm.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 35P

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in

the ratto of 3:3:2. They decided to share the profits equally w.e.f. April 1, 2015.

Their Balance Sheet as on March 31, 2016 was as follows :

Ltabtltttes

Amount Assets

(Rs.)

Amount

(Rs.)

1,50,000 Cash at Bank

80,000 Bills Recetvable

Sundry Debtors

Stock

70,000 Fixed Assets

Sundry Creditors

General Reserve

40,000

50,000

60,000

1,20,000

Partner's Loan:

Dinesh

40,000

_30,000

Ramesh

Partners Capital :

Dinesh

Ramesh

Suresh

2,80,000

1,00,000

80,000

70,000

2,50,000

5,50,000

5,50,000

It was also dectde that :

1. The fixed assets should be valued at Rs. 3,31,000.

2. A provisions of 5% on sundry debtors be made doubtful debts.

3. The goodwill of the firm at this date be valued at 4% years purchase of the

average net profts of last, five years whtch were Rs. 14,000; Rs. 17,000;

Rs. 20,000; Rs. 22,000 and Rs. 27,000 respectively.

4. The value of stock be reduced to Rs. 1,12,000.

5. Goodwill was not to appear tn the books. Pass the necessary journal entries

and prepare the revised Balance sheet of the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you