Lancaster Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 50, and it currently pays on the 5th day and takes discounts. Lancaster plans to expand, which will require additional financing. Assun 365 days in year for your calculations. If Lancaster decides to forgo discounts, how much additional credit could it obtain? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Rour your answer to the nearest cent. %24 What would be the nominal cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. What would be the effective cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. If the company could get the funds from a bank at a rate of 9%%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your ar to two decimal places. Should Lancaster use bank debt or additional trade credit? -Select-

Lancaster Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 50, and it currently pays on the 5th day and takes discounts. Lancaster plans to expand, which will require additional financing. Assun 365 days in year for your calculations. If Lancaster decides to forgo discounts, how much additional credit could it obtain? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Rour your answer to the nearest cent. %24 What would be the nominal cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. What would be the effective cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places. If the company could get the funds from a bank at a rate of 9%%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your ar to two decimal places. Should Lancaster use bank debt or additional trade credit? -Select-

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Practice Pack

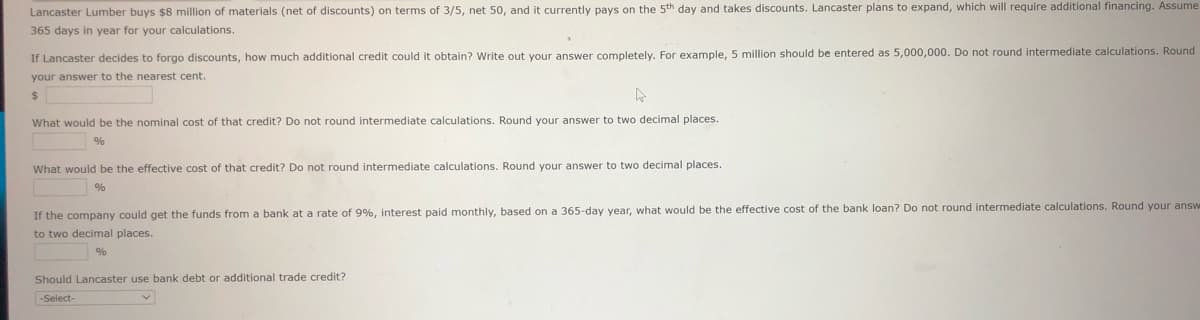

Transcribed Image Text:Lancaster Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 50, and it currently pays on the 5th day and takes discounts. Lancaster plans to expand, which will require additional financing. Assume

365 days in year for your calculations.

If Lancaster decides to forgo discounts, how much additional credit could it obtain? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Round

your answer to the nearest cent.

2$

What would be the nominal cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places.

%

What would be the effective cost of that credit? Do not round intermediate calculations. Round your answer to two decimal places.

%

If the company could get the funds from a bank at a rate of 9%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answ

to two decimal places.

%

Should Lancaster use bank debt or additional trade credit?

-Select-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College