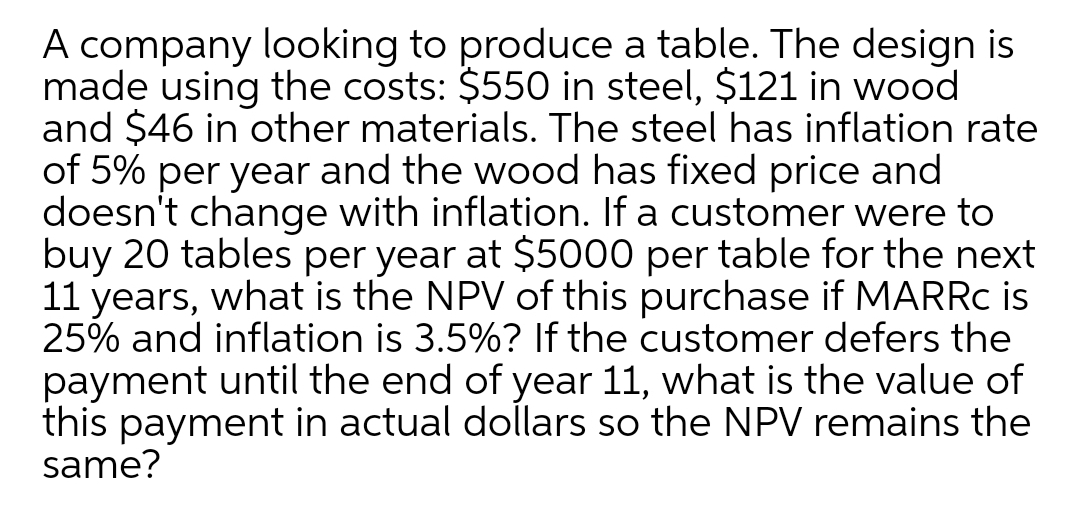

A company looking to produce a table. The design is made using the costs: $550 in steel, $121 in wood and $46 in other materials. The steel has inflation rate of 5% per year and the wood has fixed price and doesn't change with inflation. If a customer were to buy 20 tables per year at $5000 per table for the next 11 years, what is the NPV of this purchase if MARRC is 25% and inflation is 3.5%? If the customer defers the

A company looking to produce a table. The design is made using the costs: $550 in steel, $121 in wood and $46 in other materials. The steel has inflation rate of 5% per year and the wood has fixed price and doesn't change with inflation. If a customer were to buy 20 tables per year at $5000 per table for the next 11 years, what is the NPV of this purchase if MARRC is 25% and inflation is 3.5%? If the customer defers the

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 30P

Related questions

Question

Transcribed Image Text:A company looking to produce a table. The design is

made using the costs: $550 in steel, $121 in wood

and $46 in other materials. The steel has inflation rate

of 5% per year and the wood has fixed price and

doesn't change with inflation. If a customer were to

buy 20 tables per year at $5000 per table for the next

11 years, what is the NPV of this purchase if MARRC is

25% and inflation is 3.5%? If the customer defers the

payment until the end of year 11, what is the value of

this payment in actual dollars so the NPV remains the

same?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT