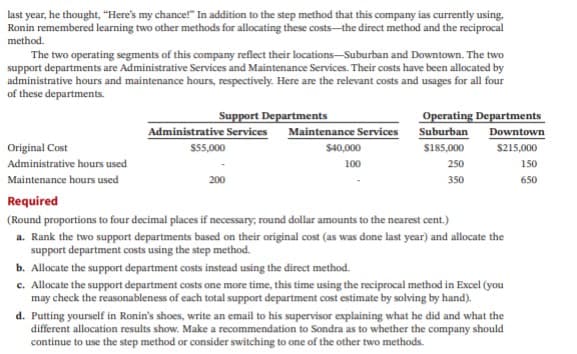

last year, he thought, "Here's my chance!" In addition to the step method that this company ias currently using. Ronin remembered learning two other methods for allocating these costs-the direct method and the reciprocal method. The two operating segments of this company reflect their locations-Suburban and Downtown. The two support departments are Administrative Services and Maintenance Services. Their costs have been allocated by administrative hours and maintenance hours, respectively. Here are the relevant costs and usages for all four of these departments. Support Departments Administrative Services Maintenance Services Operating Departments Suburban Downtown Original Cost S55,000 $40,000 S185,000 $215,000 Administrative hours used 100 250 150 Maintenance hours used 200 350 650 Required (Round proportions to four decimal places if necessary, round dollar amounts to the nearest cent.) a. Rank the two support departments based on their original cost (as was done last year) and allocate the support department costs using the step method. b. Allocate the support department costs instead using the direct method. c. Allocate the support department costs one more time, this time using the reciprocal method in Excel (you may check the reasonableness of each total support department cost estimate by solving by hand). d. Putting yourself in Ronin's shoes, write an email to his supervisor explaining what he did and what the different allocation results show. Make a recommendation to Sondra as to whether the company should continue to use the step method or consider switching to one of the other two methods.

last year, he thought, "Here's my chance!" In addition to the step method that this company ias currently using. Ronin remembered learning two other methods for allocating these costs-the direct method and the reciprocal method. The two operating segments of this company reflect their locations-Suburban and Downtown. The two support departments are Administrative Services and Maintenance Services. Their costs have been allocated by administrative hours and maintenance hours, respectively. Here are the relevant costs and usages for all four of these departments. Support Departments Administrative Services Maintenance Services Operating Departments Suburban Downtown Original Cost S55,000 $40,000 S185,000 $215,000 Administrative hours used 100 250 150 Maintenance hours used 200 350 650 Required (Round proportions to four decimal places if necessary, round dollar amounts to the nearest cent.) a. Rank the two support departments based on their original cost (as was done last year) and allocate the support department costs using the step method. b. Allocate the support department costs instead using the direct method. c. Allocate the support department costs one more time, this time using the reciprocal method in Excel (you may check the reasonableness of each total support department cost estimate by solving by hand). d. Putting yourself in Ronin's shoes, write an email to his supervisor explaining what he did and what the different allocation results show. Make a recommendation to Sondra as to whether the company should continue to use the step method or consider switching to one of the other two methods.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BD

Related questions

Question

Transcribed Image Text:last year, he thought, "Here's my chance!" In addition to the step method that this company ias currently using,

Ronin remembered learning two other methods for allocating these costs-the direct method and the reciprocal

method.

The two operating segments of this company reflect their locations-Suburban and Downtown. The two

support departments are Administrative Services and Maintenance Services. Their costs have been allocated by

administrative hours and maintenance hours, respectively. Here are the relevant costs and usages for all four

of these departments.

Support Departments

Administrative Services Maintenance Services Suburban

Operating Departments

Downtown

Original Cost

$55,000

$40,000

S185,000

S215,000

Administrative hours used

100

250

150

Maintenance hours used

200

350

650

Required

(Round proportions to four decimal places if necessary, round dollar amounts to the nearest cent.)

a. Rank the two support departments based on their original cost (as was done last year) and allocate the

support department costs using the step method.

b. Allocate the support department costs instead using the direct method.

c. Allocate the support department costs one more time, this time using the reciprocal method in Excel (you

may check the reasonableness of each total support department cost estimate by solving by hand).

d. Putting yourself in Ronin's shoes, write an email to his supervisor explaining what he did and what the

different allocation results show. Make a recommendation to Sondra as to whether the company should

continue to use the step method or consider switching to one of the other two methods.

Transcribed Image Text:P14.1 (LO 1, 2), AP Excel Business Writing After starting his first full-time position for a private com-

pany, Ronin was anxious to go above and beyond the expectations of his supervisor. So when Sondra asked him

to complete the support department cost allocations for all departments using the same method as they used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning