Required: If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing total costs? Note: Do not round intermediate calculations. Maximum amount

Required: If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing total costs? Note: Do not round intermediate calculations. Maximum amount

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 1CMA

Related questions

Question

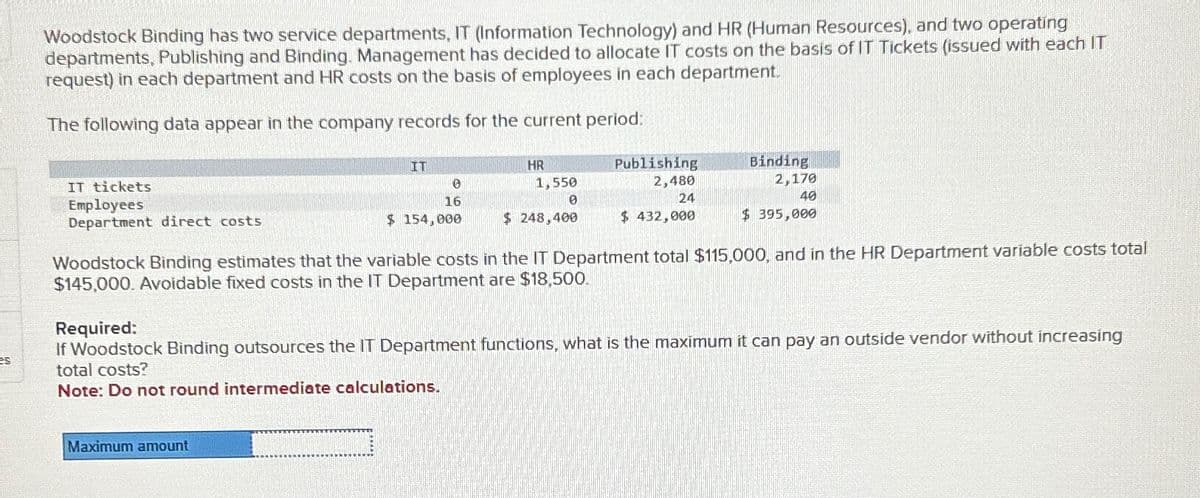

Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: \table[[,IT,HR,Publishing,Binding],[,0,1,550,2,480,2,170],[IT tickets,16,0,24,40],[\table[[Employees],[Department direct costs]],$154,000,$248,400,$432,000,$395,000

Transcribed Image Text:Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating

departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT

request) in each department and HR costs on the basis of employees in each department.

The following data appear in the company records for the current period:

IT tickets

Employees

Department direct costs.

IT

HR

1,550

Publishing

2,480

Binding

2,170

16

0

24

40

$ 154,000

$ 248,400

$ 432,000

$395,000

es

Woodstock Binding estimates that the variable costs in the IT Department total $115,000, and in the HR Department variable costs total

$145,000. Avoidable fixed costs in the IT Department are $18,500.

Required:

If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing

total costs?

Note: Do not round intermediate calculations.

Maximum amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT