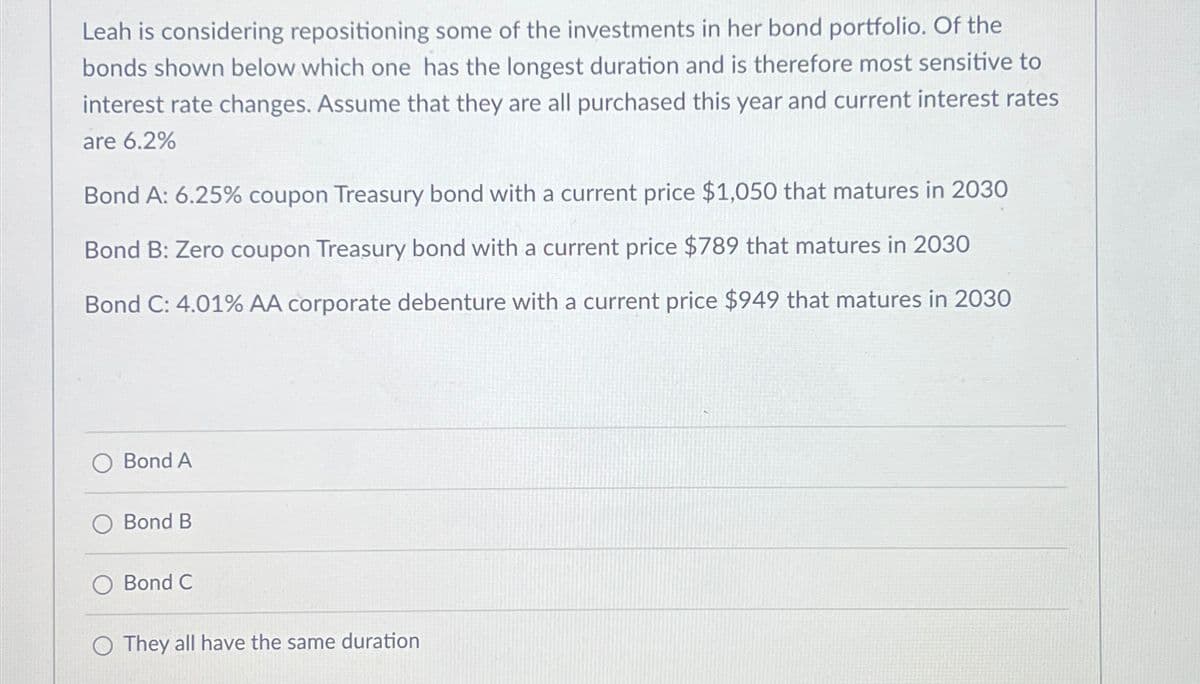

Leah is considering repositioning some of the investments in her bond portfolio. Of the bonds shown below which one has the longest duration and is therefore most sensitive to interest rate changes. Assume that they are all purchased this year and current interest rates are 6.2% Bond A: 6.25% coupon Treasury bond with a current price $1,050 that matures in 2030 Bond B: Zero coupon Treasury bond with a current price $789 that matures in 2030 Bond C: 4.01% AA corporate debenture with a current price $949 that matures in 2030 Bond A Bond B Bond C O They all have the same duration

Leah is considering repositioning some of the investments in her bond portfolio. Of the bonds shown below which one has the longest duration and is therefore most sensitive to interest rate changes. Assume that they are all purchased this year and current interest rates are 6.2% Bond A: 6.25% coupon Treasury bond with a current price $1,050 that matures in 2030 Bond B: Zero coupon Treasury bond with a current price $789 that matures in 2030 Bond C: 4.01% AA corporate debenture with a current price $949 that matures in 2030 Bond A Bond B Bond C O They all have the same duration

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Leah is considering repositioning some of the investments in her bond portfolio. Of the

bonds shown below which one has the longest duration and is therefore most sensitive to

interest rate changes. Assume that they are all purchased this year and current interest rates

are 6.2%

Bond A: 6.25% coupon Treasury bond with a current price $1,050 that matures in 2030

Bond B: Zero coupon Treasury bond with a current price $789 that matures in 2030

Bond C: 4.01% AA corporate debenture with a current price $949 that matures in 2030

Bond A

Bond B

Bond C

O They all have the same duration

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning